Answered step by step

Verified Expert Solution

Question

1 Approved Answer

David Wright used to work as an associate recruitment consultant in a top-tier human resource consulting firm in Toronto, Ontario but got laid off

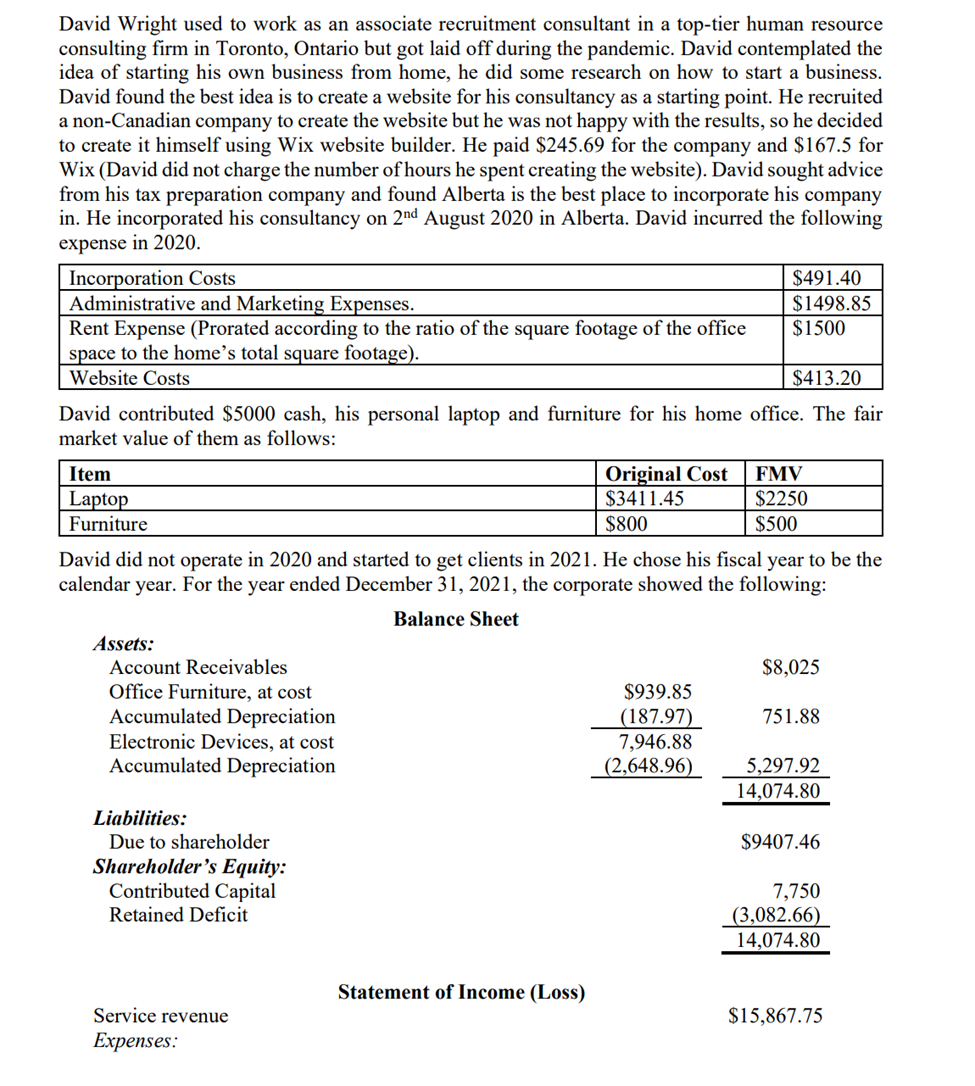

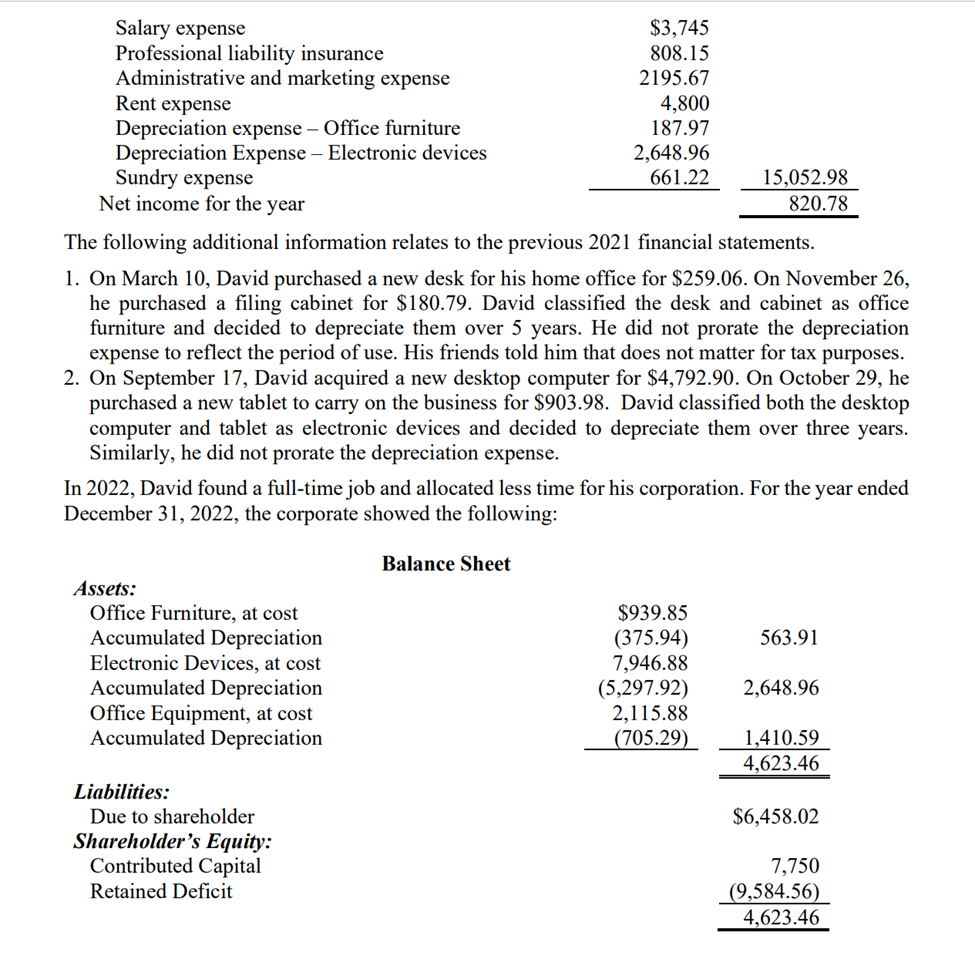

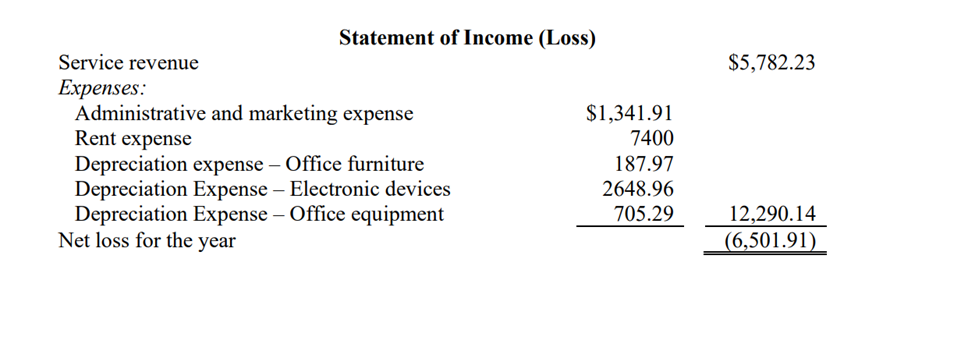

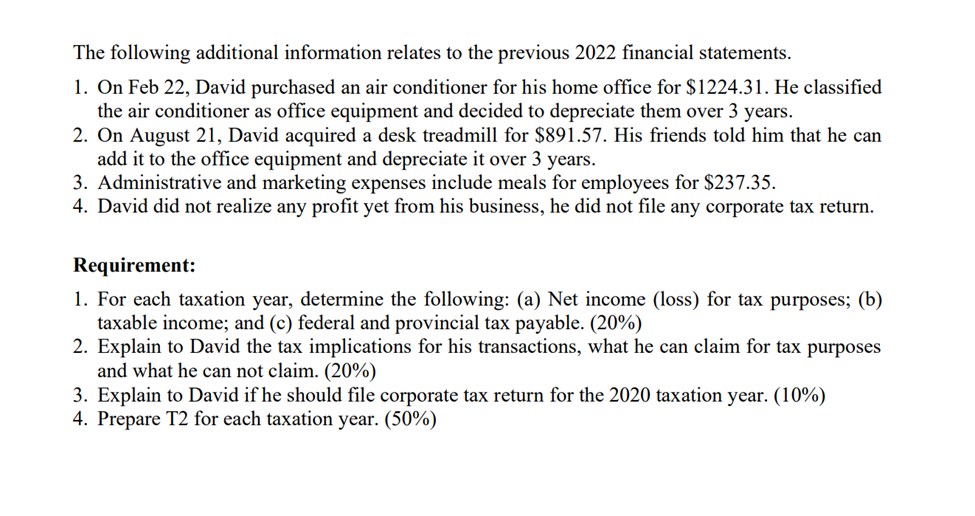

David Wright used to work as an associate recruitment consultant in a top-tier human resource consulting firm in Toronto, Ontario but got laid off during the pandemic. David contemplated the idea of starting his own business from home, he did some research on how to start a business. David found the best idea is to create a website for his consultancy as a starting point. He recruited a non-Canadian company to create the website but he was not happy with the results, so he decided to create it himself using Wix website builder. He paid $245.69 for the company and $167.5 for Wix (David did not charge the number of hours he spent creating the website). David sought advice from his tax preparation company and found Alberta is the best place to incorporate his company in. He incorporated his consultancy on 2nd August 2020 in Alberta. David incurred the following expense in 2020. Incorporation Costs Administrative and Marketing Expenses. Rent Expense (Prorated according to the ratio of the square footage of the office space to the home's total square footage). Website Costs $491.40 $1498.85 $1500 $413.20 David contributed $5000 cash, his personal laptop and furniture for his home office. The fair market value of them as follows: Item Laptop Furniture Original Cost FMV $3411.45 $2250 $800 $500 David did not operate in 2020 and started to get clients in 2021. He chose his fiscal year to be the calendar year. For the year ended December 31, 2021, the corporate showed the following: Balance Sheet Assets: Account Receivables $8,025 Office Furniture, at cost Accumulated Depreciation Electronic Devices, at cost Accumulated Depreciation Liabilities: Due to shareholder $939.85 (187.97) 751.88 7,946.88 (2,648.96) 5,297.92 14,074.80 $9407.46 Shareholder's Equity: Contributed Capital Retained Deficit 7,750 (3,082.66) 14,074.80 Statement of Income (Loss) Service revenue $15,867.75 Expenses: Salary expense Professional liability insurance Administrative and marketing expense Rent expense Depreciation expense - Office furniture Depreciation Expense - Electronic devices Sundry expense Net income for the year $3,745 808.15 2195.67 4,800 187.97 2,648.96 661.22 15,052.98 820.78 The following additional information relates to the previous 2021 financial statements. 1. On March 10, David purchased a new desk for his home office for $259.06. On November 26, he purchased a filing cabinet for $180.79. David classified the desk and cabinet as office furniture and decided to depreciate them over 5 years. He did not prorate the depreciation expense to reflect the period of use. His friends told him that does not matter for tax purposes. 2. On September 17, David acquired a new desktop computer for $4,792.90. On October 29, he purchased a new tablet to carry on the business for $903.98. David classified both the desktop computer and tablet as electronic devices and decided to depreciate them over three years. Similarly, he did not prorate the depreciation expense. In 2022, David found a full-time job and allocated less time for his corporation. For the year ended December 31, 2022, the corporate showed the following: Assets: Office Furniture, at cost Accumulated Depreciation Electronic Devices, at cost Accumulated Depreciation Office Equipment, at cost Accumulated Depreciation Liabilities: Due to shareholder Shareholder's Equity: Contributed Capital Retained Deficit Balance Sheet $939.85 (375.94) 563.91 7,946.88 (5,297.92) 2,648.96 2,115.88 (705.29) 1,410.59 4,623.46 $6,458.02 7,750 (9,584.56) 4,623.46 Statement of Income (Loss) Service revenue Expenses: Administrative and marketing expense Rent expense Depreciation expense - Office furniture Depreciation Expense - Electronic devices Depreciation Expense - Office equipment Net loss for the year $5,782.23 $1,341.91 7400 187.97 2648.96 705.29 12,290.14 (6,501.91) The following additional information relates to the previous 2022 financial statements. 1. On Feb 22, David purchased an air conditioner for his home office for $1224.31. He classified the air conditioner as office equipment and decided to depreciate them over 3 years. 2. On August 21, David acquired a desk treadmill for $891.57. His friends told him that he can add it to the office equipment and depreciate it over 3 years. 3. Administrative and marketing expenses include meals for employees for $237.35. 4. David did not realize any profit yet from his business, he did not file any corporate tax return. Requirement: 1. For each taxation year, determine the following: (a) Net income (loss) for tax purposes; (b) taxable income; and (c) federal and provincial tax payable. (20%) 2. Explain to David the tax implications for his transactions, what he can claim for tax purposes and what he can not claim. (20%) 3. Explain to David if he should file corporate tax return for the 2020 taxation year. (10%) 4. Prepare T2 for each taxation year. (50%)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started