Answered step by step

Verified Expert Solution

Question

1 Approved Answer

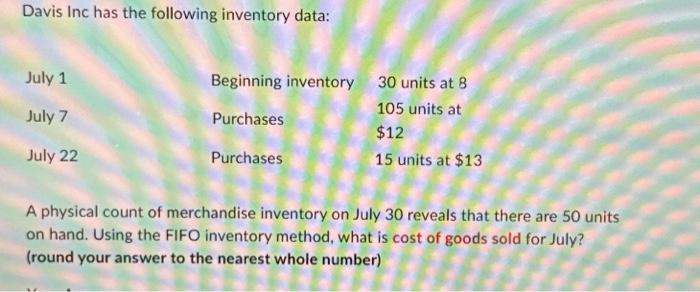

Davis Inc has the following inventory data: July 1 July 7 July 22 Beginning inventory 30 units at 8 105 units at Purchases $12

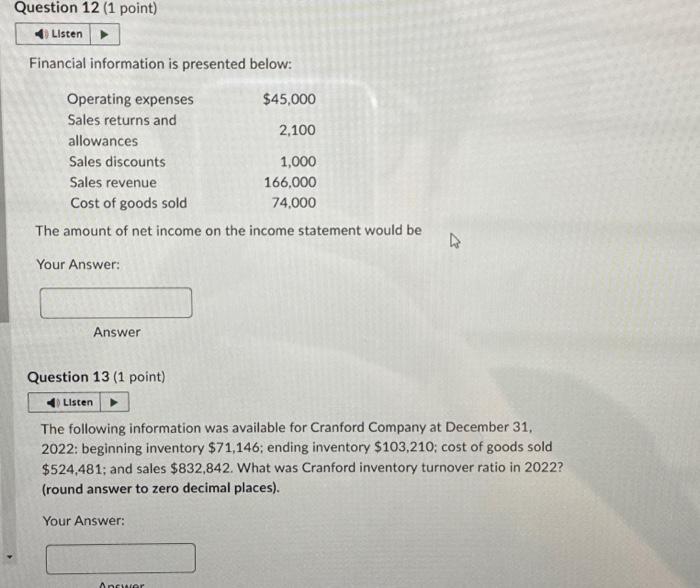

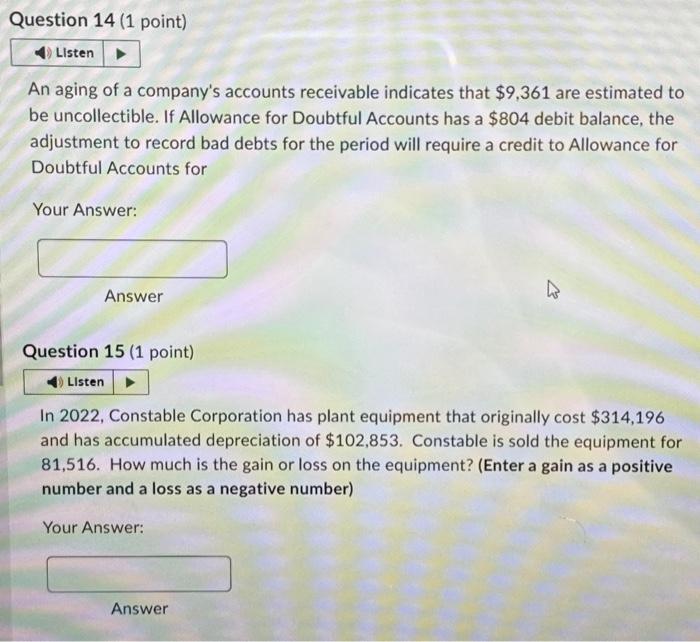

Davis Inc has the following inventory data: July 1 July 7 July 22 Beginning inventory 30 units at 8 105 units at Purchases $12 Purchases 15 units at $13 A physical count of merchandise inventory on July 30 reveals that there are 50 units on hand. Using the FIFO inventory method, what is cost of goods sold for July? (round your answer to the nearest whole number) Question 12 (1 point) Listen Financial information is presented below: Operating expenses Sales returns and allowances Sales discounts Sales revenue Cost of goods sold The amount of net income on the income statement would be Your Answer: Answer Question 13 (1 point) $45,000 2,100 1,000 166,000 74,000 Answer 4 Listen. The following information was available for Cranford Company at December 31, 2022: beginning inventory $71,146; ending inventory $103,210; cost of goods sold $524,481; and sales $832,842. What was Cranford inventory turnover ratio in 2022? (round answer to zero decimal places). Your Answer: Question 14 (1 point) 4) Listen An aging of a company's accounts receivable indicates that $9,361 are estimated to be uncollectible. If Allowance for Doubtful Accounts has a $804 debit balance, the adjustment to record bad debts for the period will require a credit to Allowance for Doubtful Accounts for Your Answer: Answer Question 15 (1 point) Listen 27 In 2022, Constable Corporation has plant equipment that originally cost $314,196 and has accumulated depreciation of $102,853. Constable is sold the equipment for 81,516. How much is the gain or loss on the equipment? (Enter a gain as a positive number and a loss as a negative number) Your Answer: Answer

Step by Step Solution

★★★★★

3.32 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Calculate the cost of goods sold COGS for July using the firstin firstout FIFO method Calculate the cost of goods available for sale Beginning Invento...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started