Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Davis Inc. purchased $1000 CHK bond at par. CHK bond pays 5% interest. Davis intends to hold the bonds until maturity, and has classified

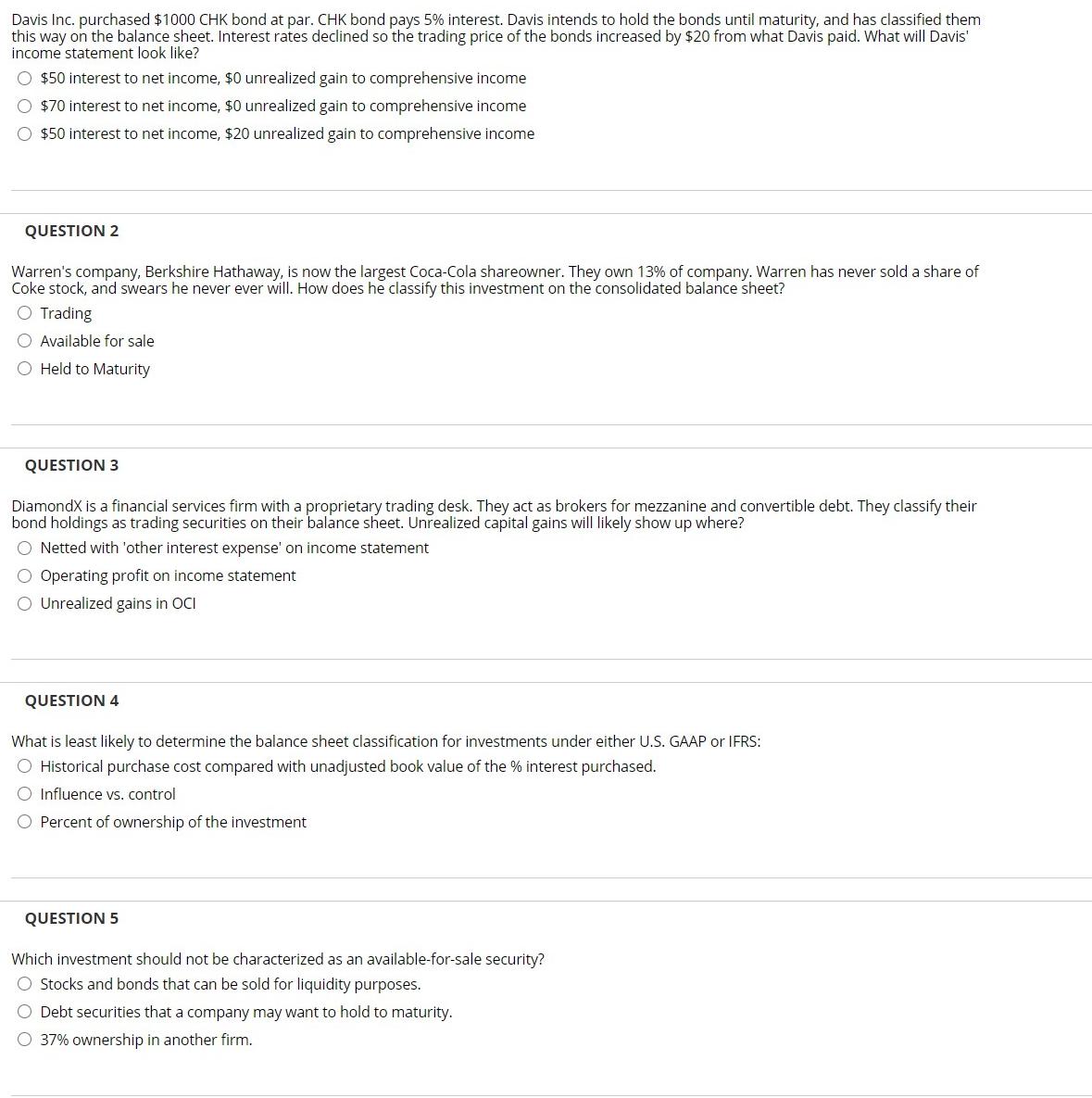

Davis Inc. purchased $1000 CHK bond at par. CHK bond pays 5% interest. Davis intends to hold the bonds until maturity, and has classified them this way on the balance sheet. Interest rates declined so the trading price of the bonds increased by $20 from what Davis paid. What will Davis' income statement look like? O $50 interest to net income, $0 unrealized gain to comprehensive income O $70 interest to net income, $0 unrealized gain to comprehensive income $50 interest to net income, $20 unrealized gain to comprehensive income QUESTION 2 Warren's company, Berkshire Hathaway, is now the largest Coca-Cola shareowner. They own 13% of company. Warren has never sold a share of Coke stock, and swears he never ever will. How does he classify this investment on the consolidated balance sheet? O Trading O Available for sale O Held to Maturity QUESTION 3 DiamondX is a financial services firm with a proprietary trading desk. They act as brokers for mezzanine and convertible debt. They classify their bond holdings as trading securities on their balance sheet. Unrealized capital gains will likely show up where? O Netted with other interest expense' on income statement O Operating profit on income statement O Unrealized gains in OCI QUESTION 4 What is least likely to determine the balance sheet classification for investments under either U.S. GAAP or IFRS: O Historical purchase cost compared with unadjusted book value of the % interest purchased. O Influence vs. control O Percent of ownership of the investment QUESTION 5 Which investment should not be characterized as an available-for-sale security? O Stocks and bonds that can be sold for liquidity purposes. O Debt securities that a company may want to hold to maturity. O 37% ownership in another firm.

Step by Step Solution

★★★★★

3.50 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Question 1 What will Davis income state...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started