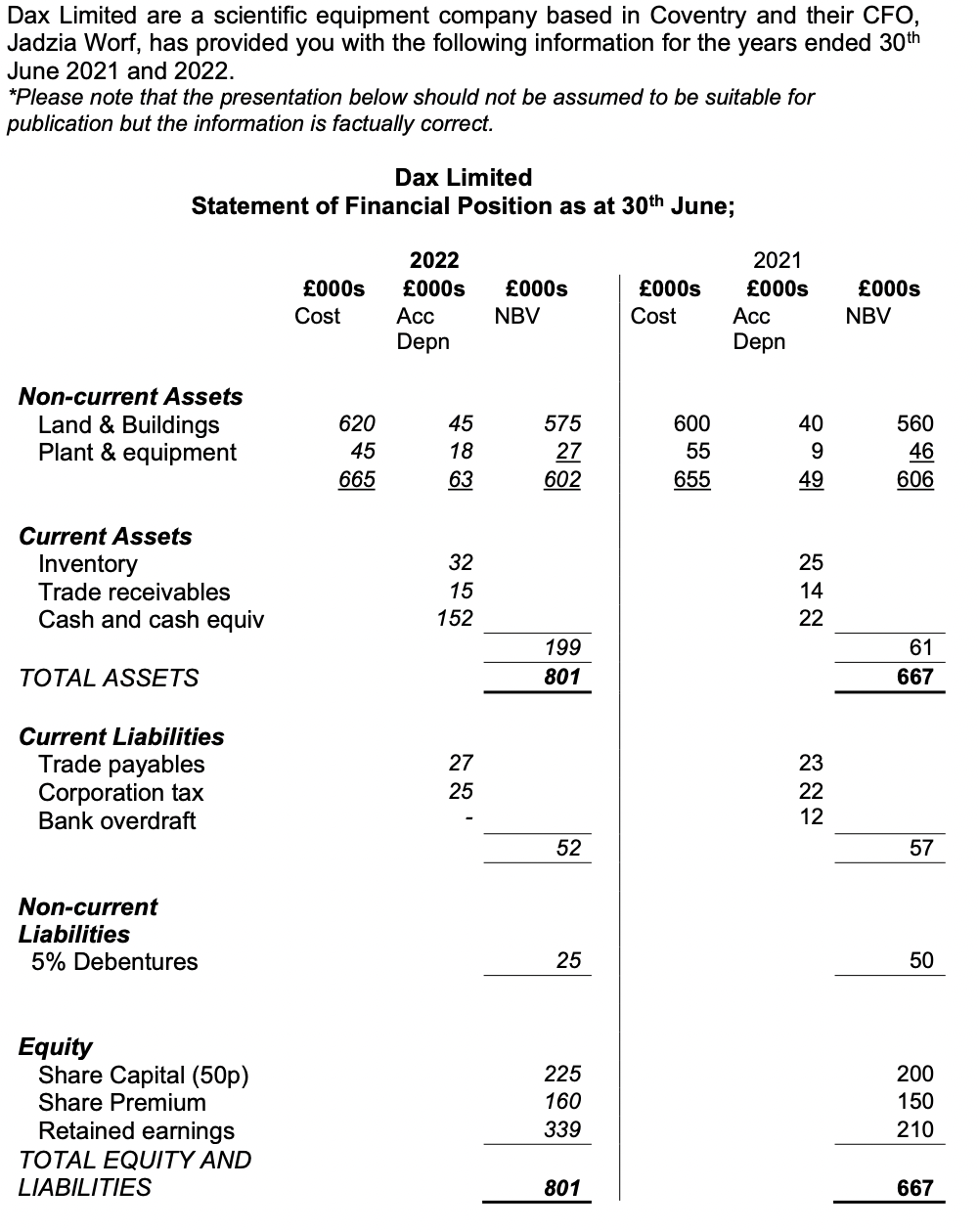

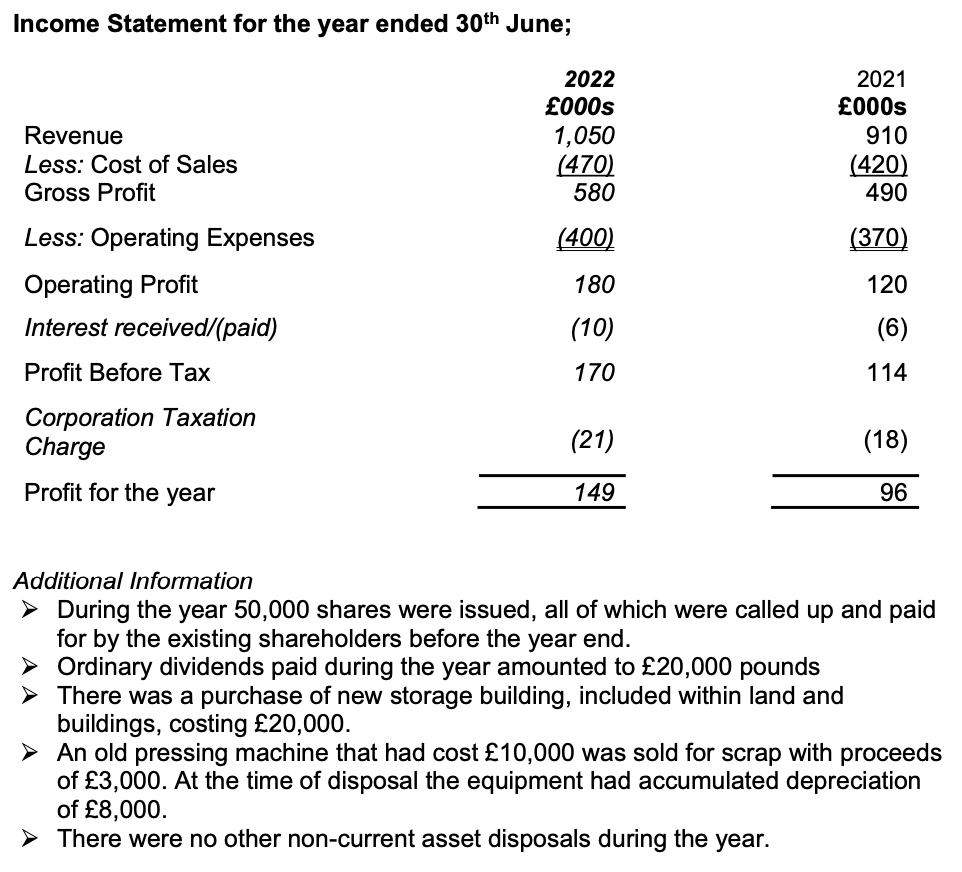

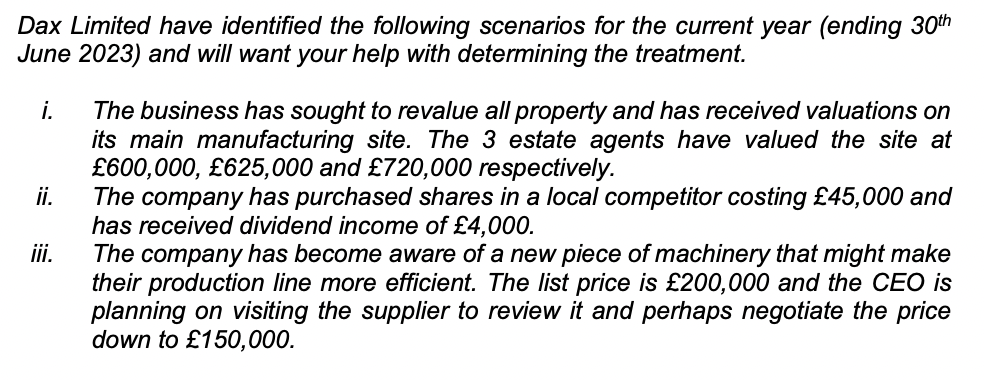

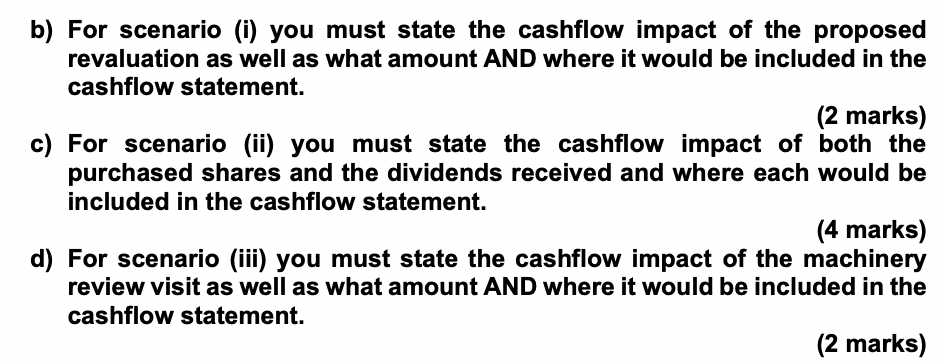

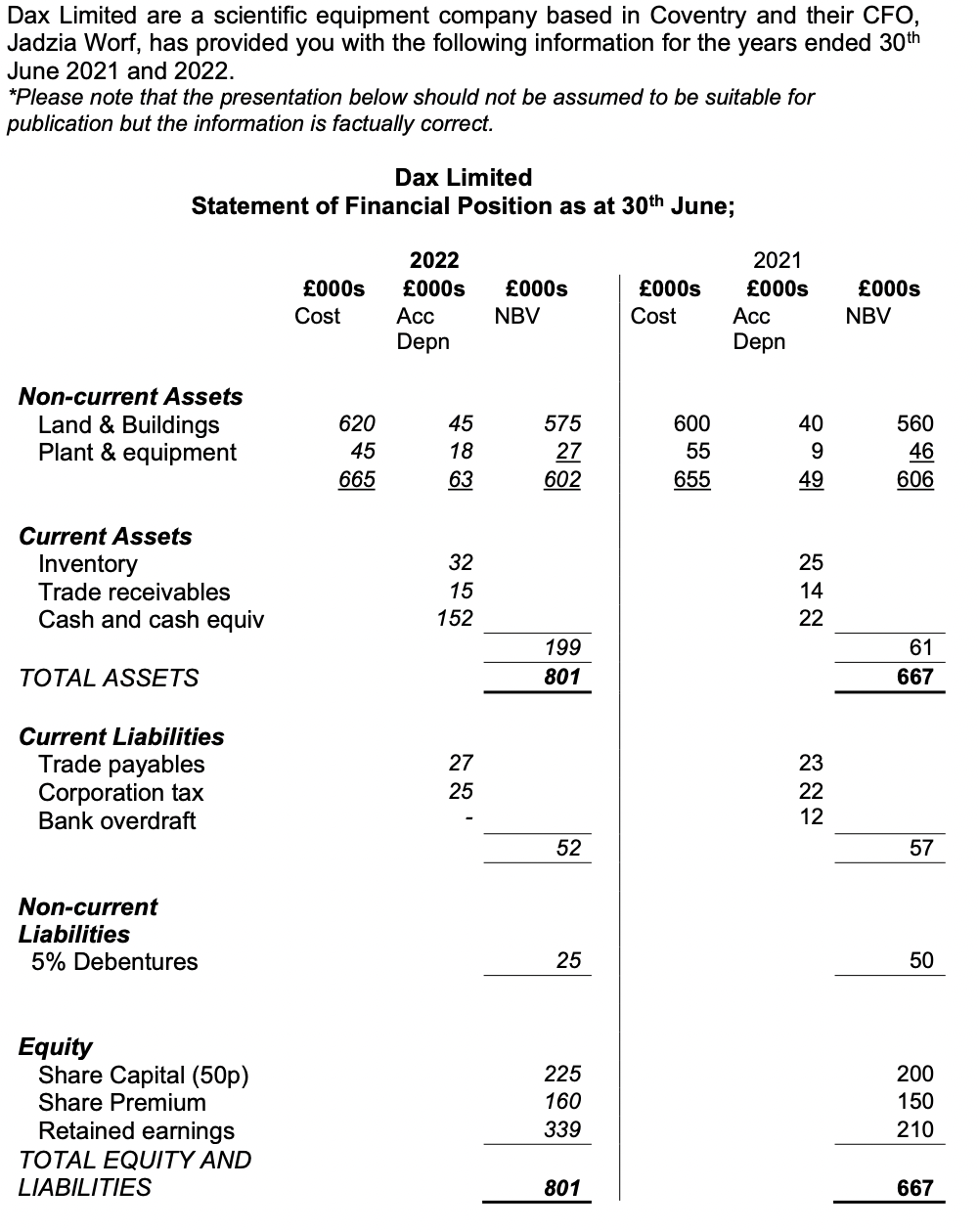

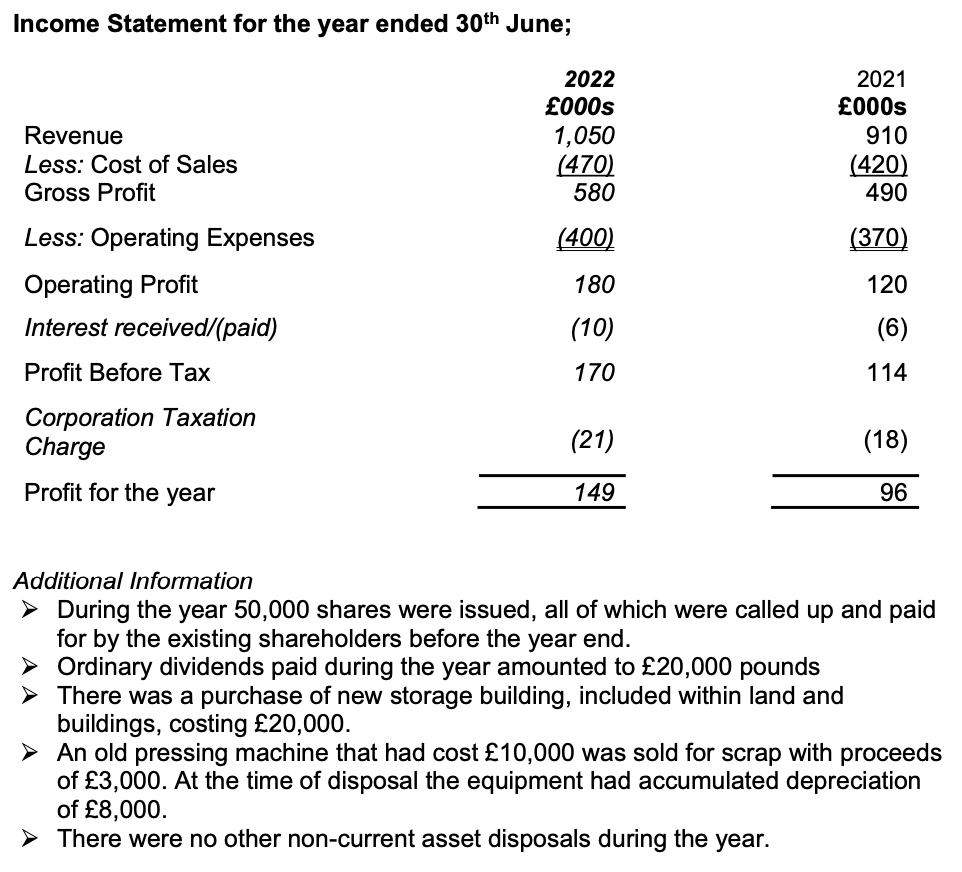

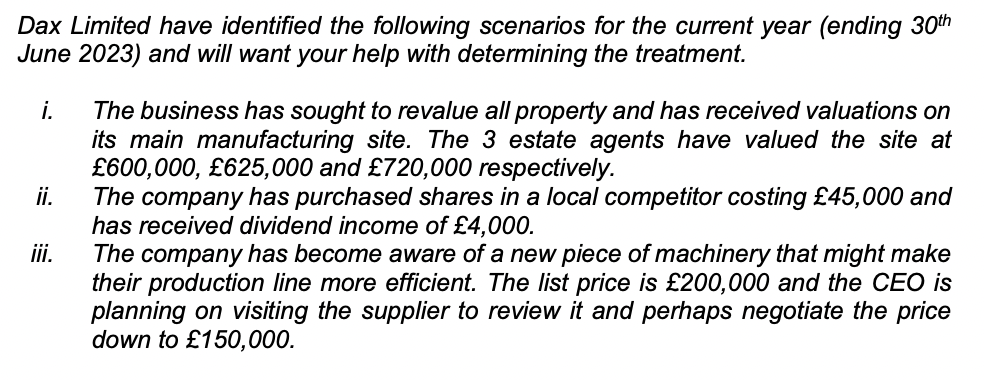

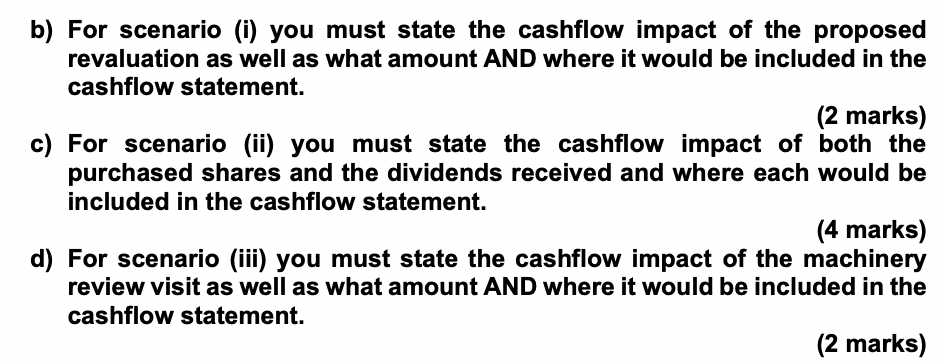

Dax Limited are a scientific equipment company based in Coventry and their CFO, Jadzia Worf, has provided you with the following information for the years ended 30th June 2021 and 2022. *Please note that the presentation below should not be assumed to be suitable for publication but the information is factually correct. Dax Limited Statement of Financial Position as at 30th June; Non-current Assets Land & Buildings Plant & equipment Current Assets Inventory Trade receivables Cash and cash equiv TOTAL ASSETS Current Liabilities Trade payables Corporation tax Bank overdraft Non-current Liabilities 5% Debentures Equity Share Capital (50p) Share Premium Retained earnings TOTAL EQUITY AND LIABILITIES 000s Cost 620 45 665 2022 000s Acc Depn 45 18 63 32 15 152 27 25 000s NBV 575 27 602 199 801 52 25 225 160 339 801 000s Cost 600 55 655 2021 000s Acc Depn 40 9 49 25 14 22 222 23 12 000s NBV 560 46 606 61 667 57 50 200 150 210 667 Income Statement for the year ended 30th June; Revenue Less: Cost of Sales Gross Profit Less: Operating Expenses Operating Profit Interest received/(paid) Profit Before Tax Corporation Taxation Charge Profit for the year 2022 000s 1,050 (470) 580 (400) 180 (10) 170 (21) 149 2021 000s 910 (420) 490 (370) 120 (6) 114 (18) 96 Additional Information During the year 50,000 shares were issued, all of which were called up and paid for by the existing shareholders before the year end. Ordinary dividends paid during the year amounted to 20,000 pounds There was a purchase of new storage building, included within land and buildings, costing 20,000. An old pressing machine that had cost 10,000 was sold for scrap with proceeds of 3,000. At the time of disposal the equipment had accumulated depreciation of 8,000. > There were no other non-current asset disposals during the year. Dax Limited have identified the following scenarios for the current year (ending 30th June 2023) and will want your help with determining the treatment. i. ii. iii. The business has sought to revalue all property and has received valuations on its main manufacturing site. The 3 estate agents have valued the site at 600,000, 625,000 and 720,000 respectively. The company has purchased shares in a local competitor costing 45,000 and has received dividend income of 4,000. The company has become aware of a new piece of machinery that might make their production line more efficient. The list price is 200,000 and the CEO is planning on visiting the supplier to review it and perhaps negotiate the price down to 150,000. b) For scenario (i) you must state the cashflow impact of the proposed revaluation as well as what amount AND where it would be included in the cashflow statement. (2 marks) c) For scenario (ii) you must state the cashflow impact of both the purchased shares and the dividends received and where each would be included in the cashflow statement. (4 marks) d) For scenario (iii) you must state the cashflow impact of the machinery review visit as well as what amount AND where it would be included in the cashflow statement. (2 marks) Dax Limited are a scientific equipment company based in Coventry and their CFO, Jadzia Worf, has provided you with the following information for the years ended 30th June 2021 and 2022. *Please note that the presentation below should not be assumed to be suitable for publication but the information is factually correct. Dax Limited Statement of Financial Position as at 30th June; Non-current Assets Land & Buildings Plant & equipment Current Assets Inventory Trade receivables Cash and cash equiv TOTAL ASSETS Current Liabilities Trade payables Corporation tax Bank overdraft Non-current Liabilities 5% Debentures Equity Share Capital (50p) Share Premium Retained earnings TOTAL EQUITY AND LIABILITIES 000s Cost 620 45 665 2022 000s Acc Depn 45 18 63 32 15 152 27 25 000s NBV 575 27 602 199 801 52 25 225 160 339 801 000s Cost 600 55 655 2021 000s Acc Depn 40 9 49 25 14 22 222 23 12 000s NBV 560 46 606 61 667 57 50 200 150 210 667 Income Statement for the year ended 30th June; Revenue Less: Cost of Sales Gross Profit Less: Operating Expenses Operating Profit Interest received/(paid) Profit Before Tax Corporation Taxation Charge Profit for the year 2022 000s 1,050 (470) 580 (400) 180 (10) 170 (21) 149 2021 000s 910 (420) 490 (370) 120 (6) 114 (18) 96 Additional Information During the year 50,000 shares were issued, all of which were called up and paid for by the existing shareholders before the year end. Ordinary dividends paid during the year amounted to 20,000 pounds There was a purchase of new storage building, included within land and buildings, costing 20,000. An old pressing machine that had cost 10,000 was sold for scrap with proceeds of 3,000. At the time of disposal the equipment had accumulated depreciation of 8,000. > There were no other non-current asset disposals during the year. Dax Limited have identified the following scenarios for the current year (ending 30th June 2023) and will want your help with determining the treatment. i. ii. iii. The business has sought to revalue all property and has received valuations on its main manufacturing site. The 3 estate agents have valued the site at 600,000, 625,000 and 720,000 respectively. The company has purchased shares in a local competitor costing 45,000 and has received dividend income of 4,000. The company has become aware of a new piece of machinery that might make their production line more efficient. The list price is 200,000 and the CEO is planning on visiting the supplier to review it and perhaps negotiate the price down to 150,000. b) For scenario (i) you must state the cashflow impact of the proposed revaluation as well as what amount AND where it would be included in the cashflow statement. (2 marks) c) For scenario (ii) you must state the cashflow impact of both the purchased shares and the dividends received and where each would be included in the cashflow statement. (4 marks) d) For scenario (iii) you must state the cashflow impact of the machinery review visit as well as what amount AND where it would be included in the cashflow statement. (2 marks)