DAY Limited is an engineering company which uses job costing to attribute costs to individual products and services provided to its customers. It has

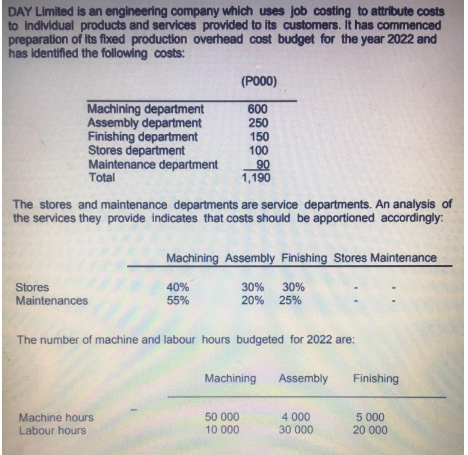

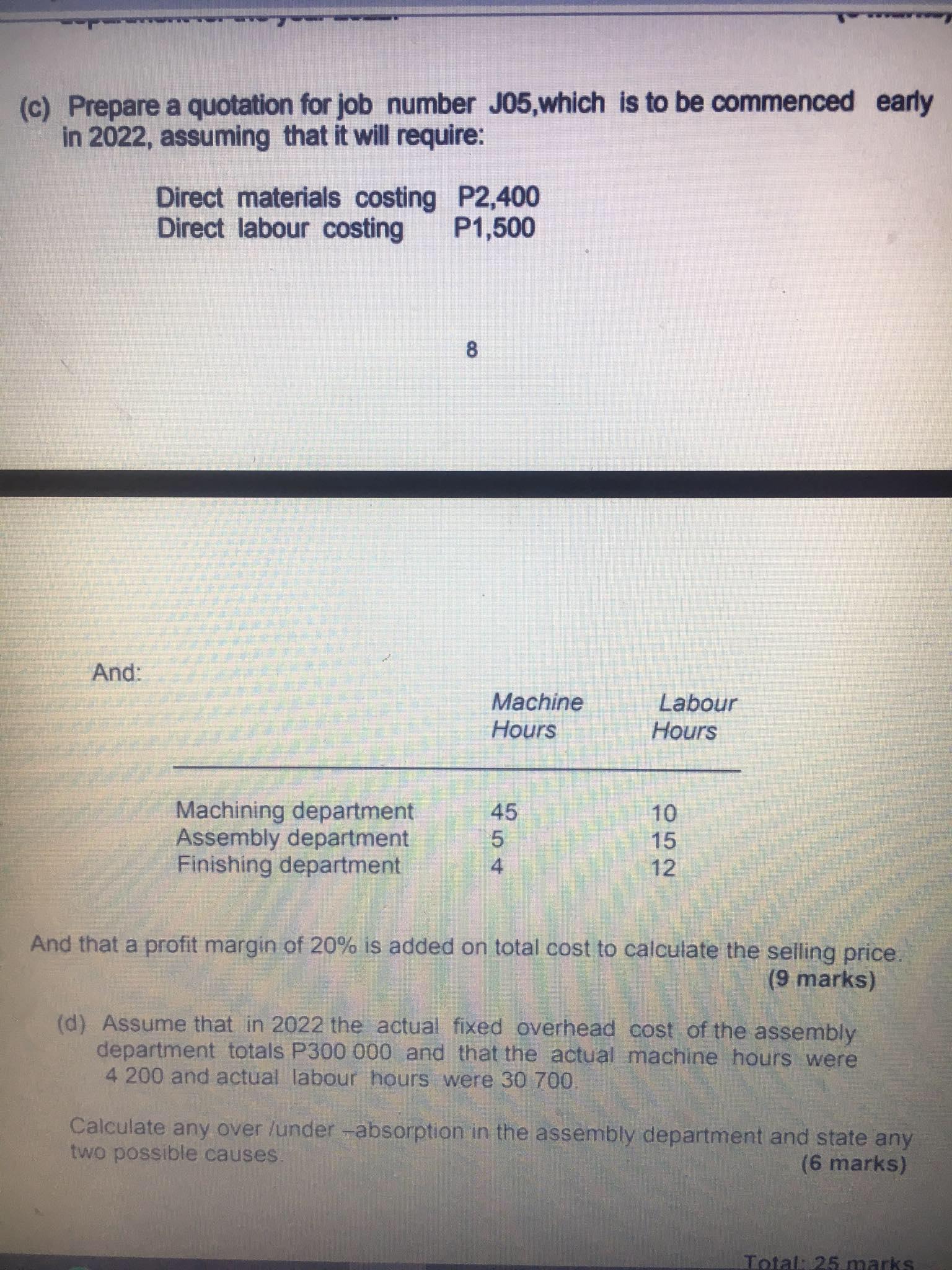

DAY Limited is an engineering company which uses job costing to attribute costs to individual products and services provided to its customers. It has commenced preparation of its fixed production overhead cost budget for the year 2022 and has identified the following costs: (P000) Machining department 600 Assembly department 250 Finishing department 150 Stores department 100 Maintenance department 90 Total 1,190 The stores and maintenance departments are service departments. An analysis of the services they provide indicates that costs should be apportioned accordingly: Stores Maintenances Machining Assembly Finishing Stores Maintenance 40% 30% 30% 55% 20% 25% The number of machine and labour hours budgeted for 2022 are: Machining Assembly Finishing Machine hours Labour hours 50 000 10 000 4 000 30 000 5 000 20 000 (c) Prepare a quotation for job number J05, which is to be commenced early in 2022, assuming that it will require: Direct materials costing P2,400 Direct labour costing P1,500 And: 8 CO Machine Hours Labour Hours Machining department Assembly department Finishing department 052 454 And that a profit margin of 20% is added on total cost to calculate the selling price. (9 marks) (d) Assume that in 2022 the actual fixed overhead cost of the assembly department totals P300 000 and that the actual machine hours were 4 200 and actual labour hours were 30 700. Calculate any over/under -absorption in the assembly department and state any two possible causes. (6 marks) Total: 25 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started