Answered step by step

Verified Expert Solution

Question

1 Approved Answer

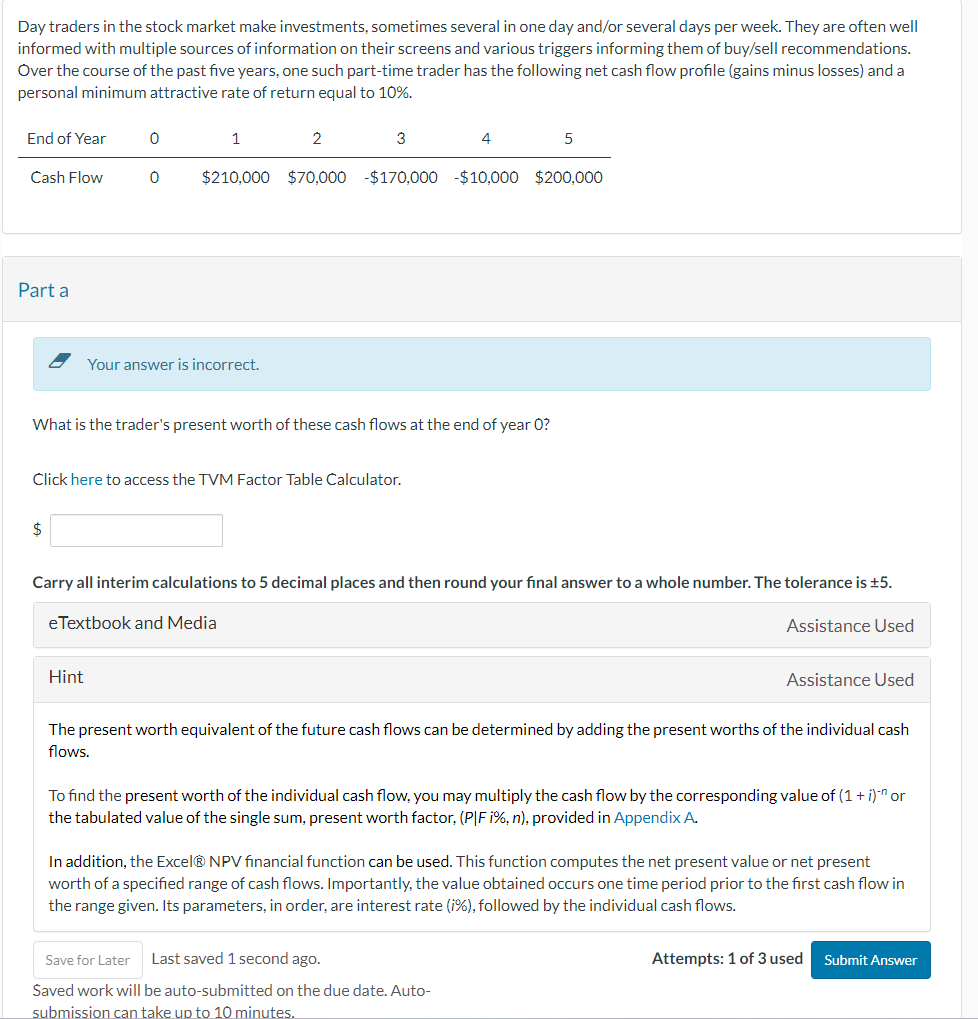

Day traders in the stock market make investments, sometimes several in one day and / or several days per week. They are often well informed

Day traders in the stock market make investments, sometimes several in one day andor several days per week. They are often well

informed with multiple sources of information on their screens and various triggers informing them of buysell recommendations.

Over the course of the past five years, one such parttime trader has the following net cash flow profile gains minus losses and a

personal minimum attractive rate of return equal to

Part a

Your answer is incorrect.

What is the trader's present worth of these cash flows at the end of year

Click here to access the TVM Factor Table Calculator.

$

Carry all interim calculations to decimal places and then round your final answer to a whole number. The tolerance is

Hint

Assistance Used

The present worth equivalent of the future cash flows can be determined by adding the present worths of the individual cash

flows.

To find the present worth of the individual cash flow, you may multiply the cash flow by the corresponding value of or

the tabulated value of the single sum, present worth factor, PFin provided in Appendix A

In addition, the Excel NPV financial function can be used. This function computes the net present value or net present

worth of a specified range of cash flows. Importantly, the value obtained occurs one time period prior to the first cash flow in

the range given. Its parameters, in order, are interest rate followed by the individual cash flows.

Last saved second ago.

Attempts: of used

Saved work will be autosubmitted on the due date. Auto

submission can take un to minutes.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started