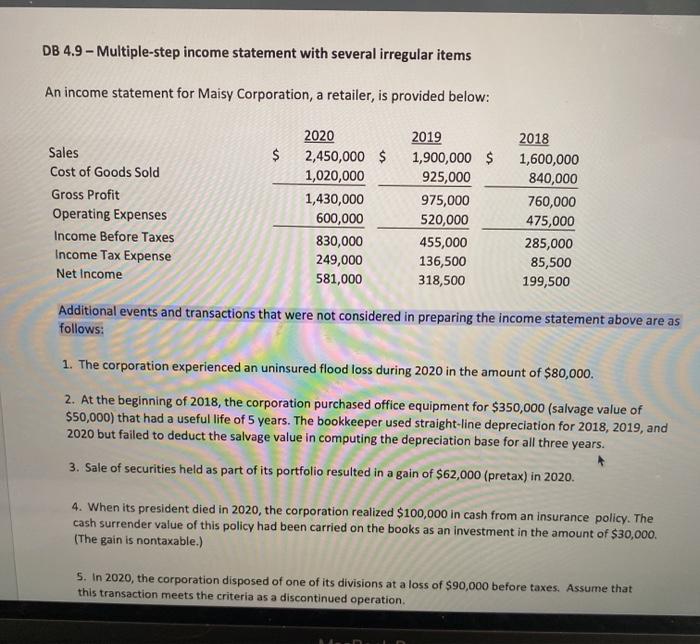

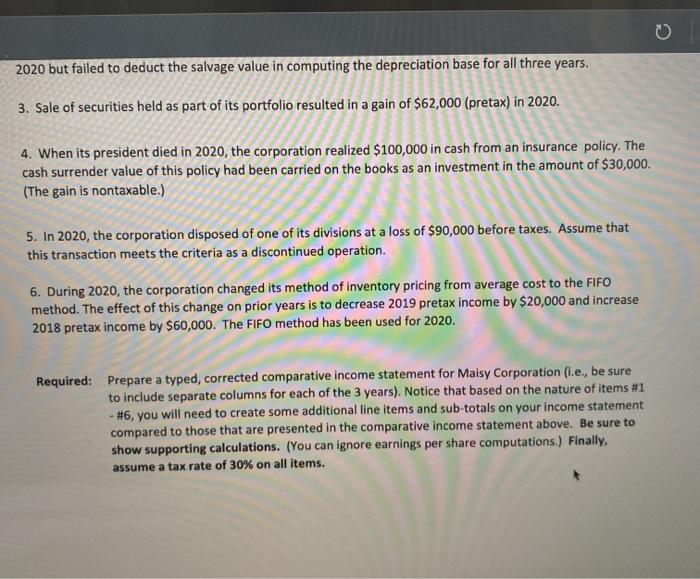

DB 4.9 - Multiple-step income statement with several irregular items An income statement for Maisy Corporation, a retailer, is provided below: $ Sales Cost of Goods Sold Gross Profit Operating Expenses Income Before Taxes Income Tax Expense Net Income 2020 2,450,000 $ 1,020,000 1,430,000 600,000 830,000 249,000 581,000 2019 1,900,000 $ 925,000 975,000 520,000 455,000 136,500 318,500 2018 1,600,000 840,000 760,000 475,000 285,000 85,500 199,500 Additional events and transactions that were not considered in preparing the income statement above are as follows: 1. The corporation experienced an uninsured flood loss during 2020 in the amount of $80,000. 2. At the beginning of 2018, the corporation purchased office equipment for $350,000 (salvage value of $50,000) that had a useful life of 5 years. The bookkeeper used straight-line depreciation for 2018, 2019, and 2020 but failed to deduct the salvage value in computing the depreciation base for all three years. 3. Sale of securities held as part of its portfolio resulted in a gain of $62,000 (pretax) in 2020 4. When its president died in 2020, the corporation realized $100,000 in cash from an insurance policy. The cash surrender value of this policy had been carried on the books as an investment in the amount of $30,000. (The gain is nontaxable.) 5. In 2020, the corporation disposed of one of its divisions at a loss of $90,000 before taxes. Assume that this transaction meets the criteria as a discontinued operation. 2020 but failed to deduct the salvage value in computing the depreciation base for all three years. 3. Sale of securities held as part of its portfolio resulted in a gain of $62,000 (pretax) in 2020. 4. When its president died in 2020, the corporation realized $100,000 in cash from an insurance policy. The cash surrender value of this policy had been carried on the books as an investment in the amount of $30,000. (The gain is nontaxable.) 5. In 2020, the corporation disposed of one of its divisions at a loss of $90,000 before taxes. Assume that this transaction meets the criteria as a discontinued operation. 6. During 2020, the corporation changed its method of inventory pricing from average cost to the FIFO method. The effect of this change on prior years is to decrease 2019 pretax income by $20,000 and increase 2018 pretax income by $60,000. The FIFO method has been used for 2020. Required: Prepare a typed, corrected comparative income statement for Maisy Corporation (.e., be sure to include separate columns for each of the 3 years). Notice that based on the nature of items #1 - #6, you will need to create some additional line items and sub-totals on your income statement compared to those that are presented in the comparative income statement above. Be sure to show supporting calculations. (You can ignore earnings per share computations.) Finally, assume a tax rate of 30% on all items