Answered step by step

Verified Expert Solution

Question

1 Approved Answer

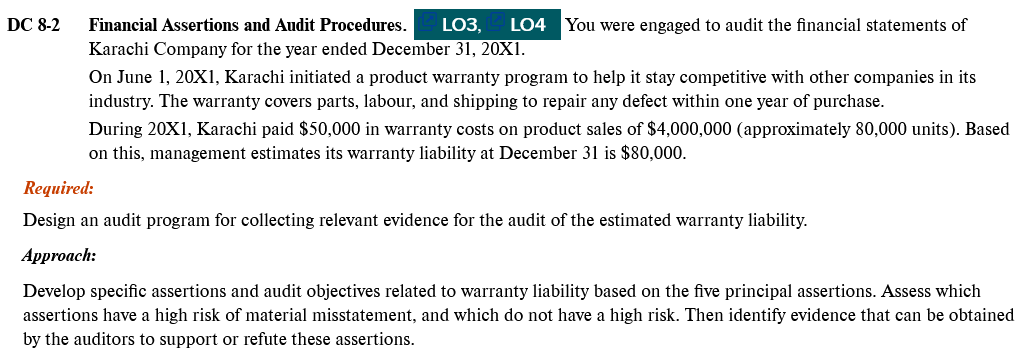

DC 8-2 Financial Assertions and Audit Procedures. LO3, LO4 You were engaged to audit the financial statements of Karachi Company for the year ended

DC 8-2 Financial Assertions and Audit Procedures. LO3, LO4 You were engaged to audit the financial statements of Karachi Company for the year ended December 31, 20X1. Required: On June 1, 20X1, Karachi initiated a product warranty program to help it stay competitive with other companies in its industry. The warranty covers parts, labour, and shipping to repair any defect within one year of purchase. During 20X1, Karachi paid $50,000 in warranty costs on product sales of $4,000,000 (approximately 80,000 units). Based on this, management estimates its warranty liability at December 31 is $80,000. Design an audit program for collecting relevant evidence for the audit of the estimated warranty liability. Approach: Develop specific assertions and audit objectives related to warranty liability based on the five principal assertions. Assess which assertions have a high risk of material misstatement, and which do not have a high risk. Then identify evidence that can be obtained by the auditors to support or refute these assertions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started