Question

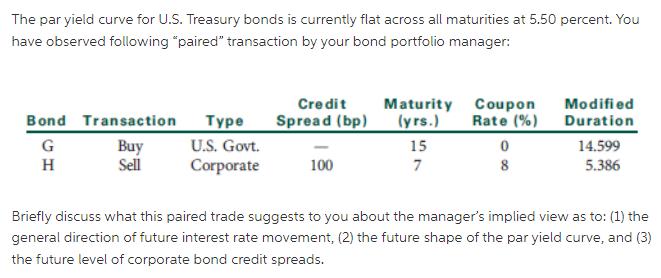

The par yield curve for U.S. Treasury bonds is currently flat across all maturities at 5.50 percent. You have observed following paired transaction by

The par yield curve for U.S. Treasury bonds is currently flat across all maturities at 5.50 percent. You have observed following "paired" transaction by your bond portfolio manager: Bond G H Transaction Buy Sell Type U.S. Govt. Corporate Credit Spread (bp) 100 Maturity Coupon (yrs.) Rate (%) 15 7 0 8 Modified Duration 14.599 5.386 Briefly discuss what this paired trade suggests to you about the manager's implied view as to: (1) the general direction of future interest rate movement, (2) the future shape of the par yield curve, and (3) the future level of corporate bond credit spreads.

Step by Step Solution

3.37 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Step 13 1 Future Interest rate movement The transactions undertaken by bond portfolio manager sugges...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Finance

Authors: Scott Besley, Eugene F. Brigham

6th edition

9781305178045, 1285429648, 1305178041, 978-1285429649

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App