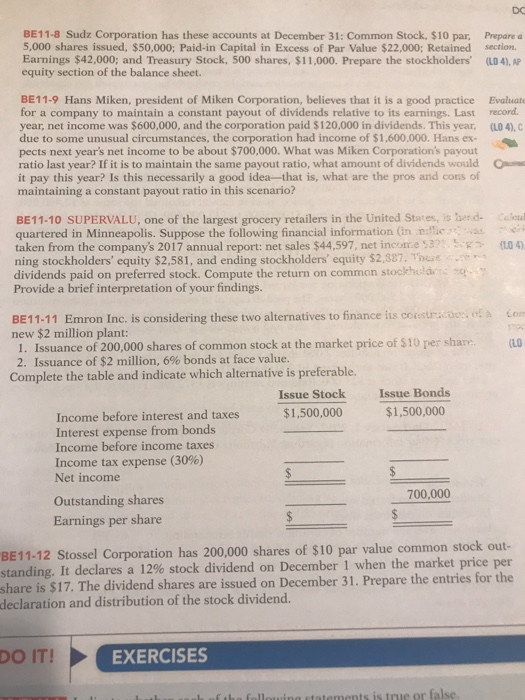

DC BE11-8 Sudz Corporation has these accounts at December 31: Common Stock, $10 par, Prepare a 5,000 shares issued, $50,000; Paid-in Capital in Excess of Par Value $22,000; Retained section Earnings $42,000; and Treasury Stock, 500 shares, $11,000. Prepare the stockholders' (LO 4), AP equity section of the balance sheet. BE11-9 Hans Miken, president of Miken Corporation, believes that it is a good practice Evaluat for a company to maintain a constant payout of dividends relative to its earnings. Last record. year, net income was $600,000, and the corporation paid $120,000 in dividends. This year, (LO 4),c due to some unusual circumstances, the corporation had income of $1,600,000. Hans ex- pects next year's net income to be about $700,000. What was Miken Corporation's payout ratio last year? If it is to maintain the same payout ratio, what amount of dividends would it pay this year? Is this necessarily a good idea-that is, what are the pros and cons of maintaining a constant payout ratio in this scenario? BE11-10 SUPERVALU, one of the largest grocery retailers in the United States, is e d- quartered in Minneapolis. Suppose the following financial information (in nie taken from the company's 2017 annual report: net sales $44,597, net income s3(0 4) ning stockholders' equity $2,581, and ending stockholders' equity $2,387. Thue dividends paid on preferred stock. Compute the return on common stockh Provide a brief interpretation of your findings. BE11-11 Emron Inc. is considering these two alternatives to finance is coistra:0e new $2 million plant 1. Issuance of 200,000 shares of common stock at the market price of $10 per sha 2. Issuance of $2 million, 6% bonds at face value. (LO Complete the table and indicate which alternative is preferable. Issue Bonds $1,500,000 Issue Stock $1,500,000 Income before interest and taxes Interest expense from bonds Income before income taxes Income tax expense (30%) Net income 700,000 Outstanding shares Earnings per share l Corporation has 200,000 shares of $10 par value common stock out- BE11-12 Stosse standing. It declares a l 2% stock dividend on December 1 when the market price per share is $17. T declaration and distribution of the stock dividend. he dividend shares are issued on December 31. Prepare the entries for the DO IT! EXERCISES