Answered step by step

Verified Expert Solution

Question

1 Approved Answer

DC Company purchased 100% of the outstanding common shares of FA Company on December 31, 20X3 for $570,000. At that date, FA had $260,000

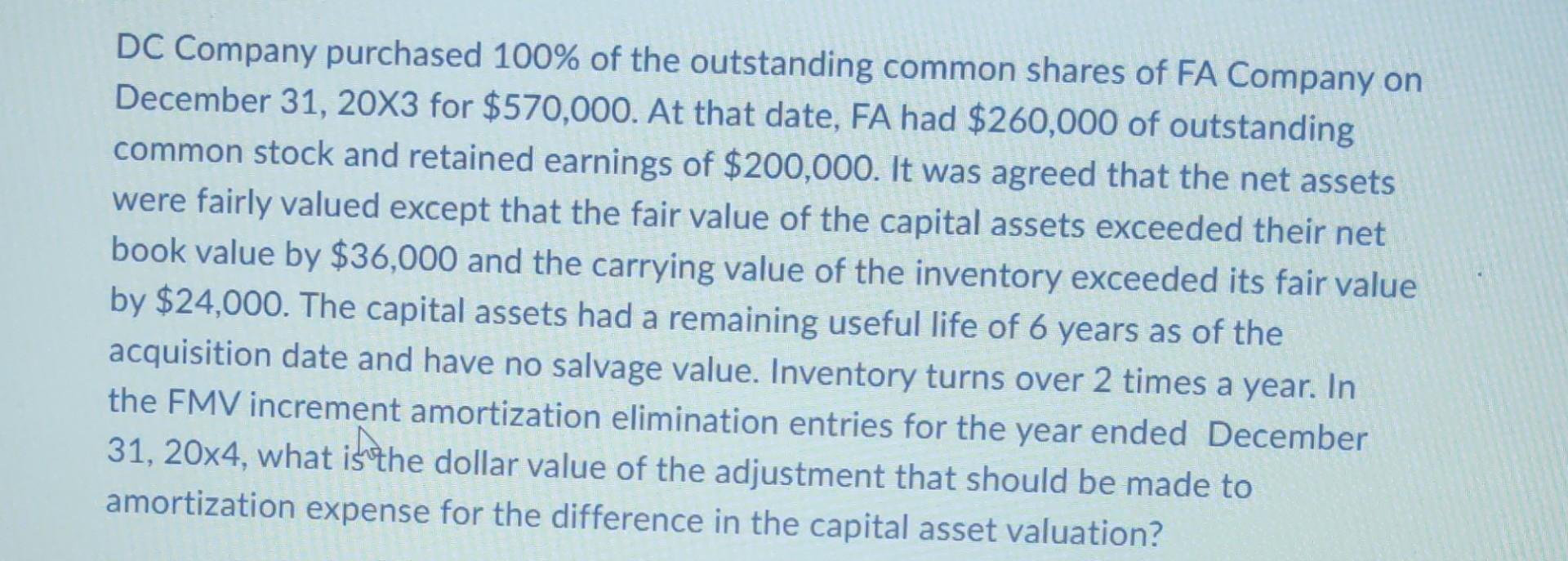

DC Company purchased 100% of the outstanding common shares of FA Company on December 31, 20X3 for $570,000. At that date, FA had $260,000 of outstanding common stock and retained earnings of $200,000. It was agreed that the net assets were fairly valued except that the fair value of the capital assets exceeded their net book value by $36,000 and the carrying value of the inventory exceeded its fair value by $24,000. The capital assets had a remaining useful life of 6 years as of the acquisition date and have no salvage value. Inventory turns over 2 times a year. In the FMV increment amortization elimination entries for the year ended December 31, 20x4, what is the dollar value of the adjustment that should be made to amortization expense for the difference in the capital asset valuation?

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

The calculation for the adjustment to amortization expense for the differen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started