Question

DCF and Market Multiples a. Compare the calculated values (DCF & Market multiples) below to the current market value of the subject company below: 276.17B

DCF and Market Multiples a. Compare the calculated values (DCF & Market multiples) below to the current market value of the subject company below:

| 276.17B |

. b. Explain why this projection is accurate.

Recommendation a. Make a recommendation as to Buy, Sell, or Hold the security. b. Justify your recommendation with support and reason, citing course materials or additional research, as appropriate.

Considerations a. Consider your valuation and identify three inherent risks of the valuation process. b. Describe each risk. c. Explain how each risk impacts valuing the company.

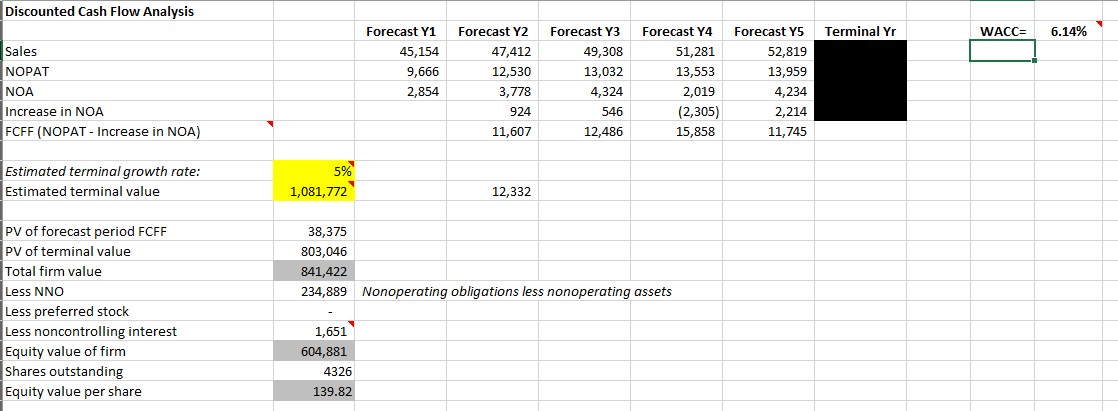

Calculated DCF:

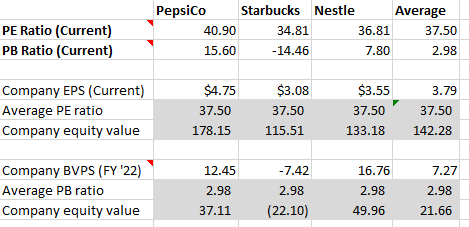

Market Multiples:

Market Value:

\begin{tabular}{|l|r|r|r|r|} \hline & PepsiCo & Starbucks & \multicolumn{1}{l|}{ Nestle } & \multicolumn{1}{l|}{ Average } \\ \hline PE Ratio (Current) & 40.90 & 34.81 & 36.81 & 37.50 \\ \hline PB Ratio (Current) & 15.60 & -14.46 & 7.80 & 2.98 \\ \hline Company EPS (Current) & & & & \\ \hline Average PE ratio & $4.75 & $3.08 & $3.55 & 3.79 \\ \hline Company equity value & 178.50 & 37.50 & 37.50 & 37.50 \\ & & 115.51 & 133.18 & 142.28 \\ \hline Company BVPS (FY '22) & 12.45 & & & \\ \hline Average PB ratio & 2.98 & 2.98 & 16.76 & 7.27 \\ \hline Company equity value & 37.11 & (22.10) & 49.96 & 2.98 \\ \hline \end{tabular} Market Summary > Coca-Cola Co 63.62 uso +0.12(0.18%)+ today May 11, 2:13 PM EDT - Disel aimer 10 50 1M 6M YTD \begin{tabular}{l|l} 1Y & 5Y \end{tabular} Max 63.8 \begin{tabular}{|l|r|r|r|r|} \hline & PepsiCo & Starbucks & \multicolumn{1}{l|}{ Nestle } & \multicolumn{1}{l|}{ Average } \\ \hline PE Ratio (Current) & 40.90 & 34.81 & 36.81 & 37.50 \\ \hline PB Ratio (Current) & 15.60 & -14.46 & 7.80 & 2.98 \\ \hline Company EPS (Current) & & & & \\ \hline Average PE ratio & $4.75 & $3.08 & $3.55 & 3.79 \\ \hline Company equity value & 178.50 & 37.50 & 37.50 & 37.50 \\ & & 115.51 & 133.18 & 142.28 \\ \hline Company BVPS (FY '22) & 12.45 & & & \\ \hline Average PB ratio & 2.98 & 2.98 & 16.76 & 7.27 \\ \hline Company equity value & 37.11 & (22.10) & 49.96 & 2.98 \\ \hline \end{tabular} Market Summary > Coca-Cola Co 63.62 uso +0.12(0.18%)+ today May 11, 2:13 PM EDT - Disel aimer 10 50 1M 6M YTD \begin{tabular}{l|l} 1Y & 5Y \end{tabular} Max 63.8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started