DCF Model:

Data needs to be from Thomson Reuters or Bloomberg.

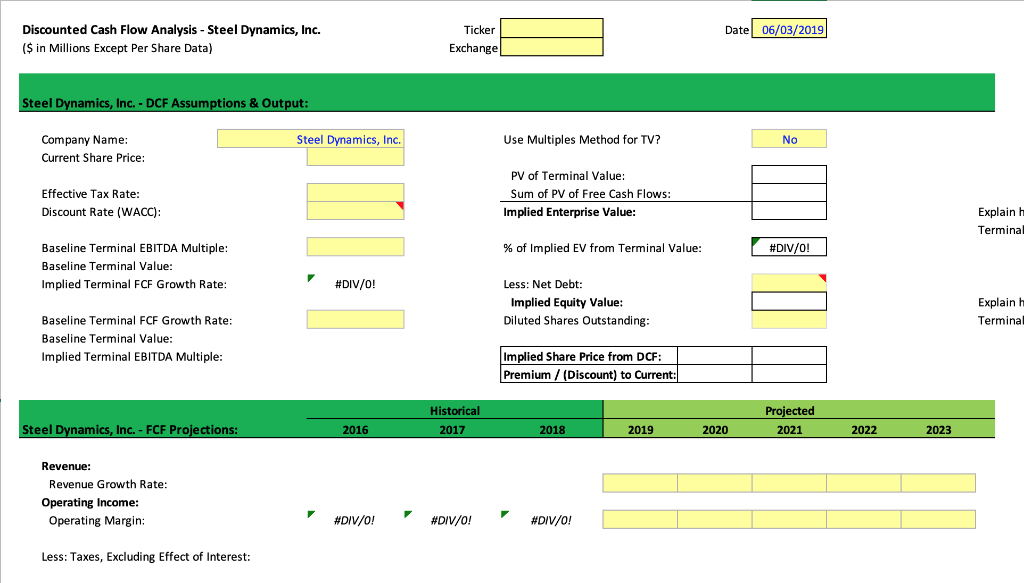

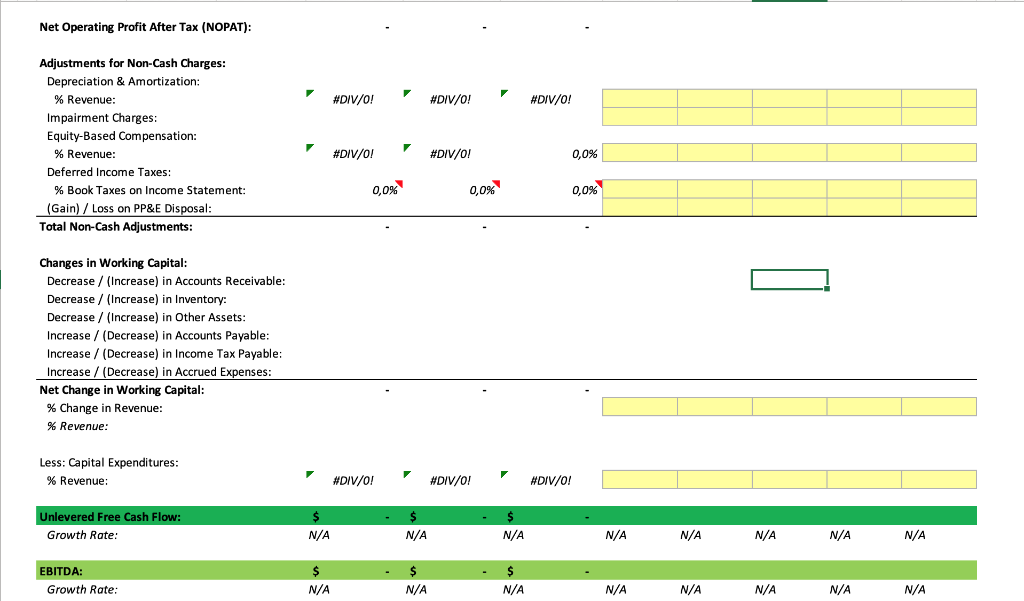

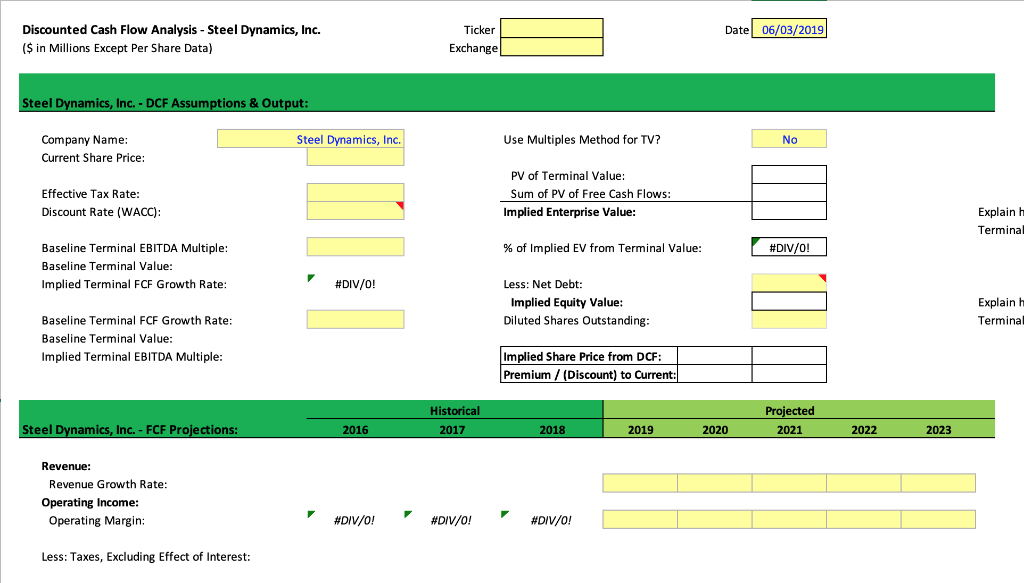

Discounted Cash Flow Analysis - Steel Dynamics, Inc. ($ in Millions Except Per Share Data) Ticker Date 06/03/2019 Exchange Steel Dynamics, Inc.-DCF Assumptions& Output: Steel Dynamics, Inc. Company Name Current Share Price Use Multiples Method for TV? No PV of Terminal Value: Sum of PV of Free Cash Flows: Effective Tax Rate Discount Rate (WACC): Implied Enterprise Value: Explain h Termina Baseline Terminal EBITDA Multiple: Baseline Terminal Value: Implied Terminal FCF Growth Rate: % of Implied EV from Terminal Value #DIV/0! #DIV/0! Less: Net Debt: Implied Equity Value Diluted Shares Outstanding Explain h Termina Baseline Terminal FCF Growth Rate: Baseline Terminal Value: Implied Terminal EBITDA Multiple Implied Share Price from DCF Premium/(Discount) to Current: Historical 01 Projected Steel Dynamics, Inc.-FCF Projections: 2019 2020 2021 2022 2023 Revenue: Revenue Growth Rate Operating Income Operating Margin: #Div/0! #DIV/0! #ON /01 Less: Taxes, Excluding Effect of Interest Net Operating Profit After Tax (NOPAT): Adjustments for Non-Cash Charges: Depreciation & Amortization: #DIV /01 #DIV/0! #DIV/0! % Revenue: Impairment Charges Equity-Based Compensation: #DIV/01 #Div/01 % Revenue Deferred Income Taxes 0,0% % Book Taxes on Income Statement: 0,0% 0,0% 0,0% (Gain) Loss on PP&E Disposal Total Non-Cash Adjustments: Changes in Working Capital Decrease (Increase) in Accounts Receivable: Decrease/ (Increase) in Inventory: Decrease (Increase) in Other Assets Increase/ (Decrease) in Accounts Payable Increase/ (Decrease) in Income Tax Payable Increase /(Decrease) in Accrued Expenses Net Change in Working Capital: % Change in Revenue: % Revenue: Less: Capital Expenditures % Revenue: #DIV /01 #DIV/0! #DIV/0! Growth Rate N/A N/A N/A N/A N/A N/A N/A N/A EBITDA: Growth Rate N/A N/A N/A N/A N/A N/A N/A N/A Sensitivity Implied Share Price from DCF Analysis Sensitivity - Implied Share Price from DCF Analysis -: Discounted Cash Flow Analysis - Steel Dynamics, Inc. ($ in Millions Except Per Share Data) Ticker Date 06/03/2019 Exchange Steel Dynamics, Inc.-DCF Assumptions& Output: Steel Dynamics, Inc. Company Name Current Share Price Use Multiples Method for TV? No PV of Terminal Value: Sum of PV of Free Cash Flows: Effective Tax Rate Discount Rate (WACC): Implied Enterprise Value: Explain h Termina Baseline Terminal EBITDA Multiple: Baseline Terminal Value: Implied Terminal FCF Growth Rate: % of Implied EV from Terminal Value #DIV/0! #DIV/0! Less: Net Debt: Implied Equity Value Diluted Shares Outstanding Explain h Termina Baseline Terminal FCF Growth Rate: Baseline Terminal Value: Implied Terminal EBITDA Multiple Implied Share Price from DCF Premium/(Discount) to Current: Historical 01 Projected Steel Dynamics, Inc.-FCF Projections: 2019 2020 2021 2022 2023 Revenue: Revenue Growth Rate Operating Income Operating Margin: #Div/0! #DIV/0! #ON /01 Less: Taxes, Excluding Effect of Interest Net Operating Profit After Tax (NOPAT): Adjustments for Non-Cash Charges: Depreciation & Amortization: #DIV /01 #DIV/0! #DIV/0! % Revenue: Impairment Charges Equity-Based Compensation: #DIV/01 #Div/01 % Revenue Deferred Income Taxes 0,0% % Book Taxes on Income Statement: 0,0% 0,0% 0,0% (Gain) Loss on PP&E Disposal Total Non-Cash Adjustments: Changes in Working Capital Decrease (Increase) in Accounts Receivable: Decrease/ (Increase) in Inventory: Decrease (Increase) in Other Assets Increase/ (Decrease) in Accounts Payable Increase/ (Decrease) in Income Tax Payable Increase /(Decrease) in Accrued Expenses Net Change in Working Capital: % Change in Revenue: % Revenue: Less: Capital Expenditures % Revenue: #DIV /01 #DIV/0! #DIV/0! Growth Rate N/A N/A N/A N/A N/A N/A N/A N/A EBITDA: Growth Rate N/A N/A N/A N/A N/A N/A N/A N/A Sensitivity Implied Share Price from DCF Analysis Sensitivity - Implied Share Price from DCF Analysis