Answered step by step

Verified Expert Solution

Question

1 Approved Answer

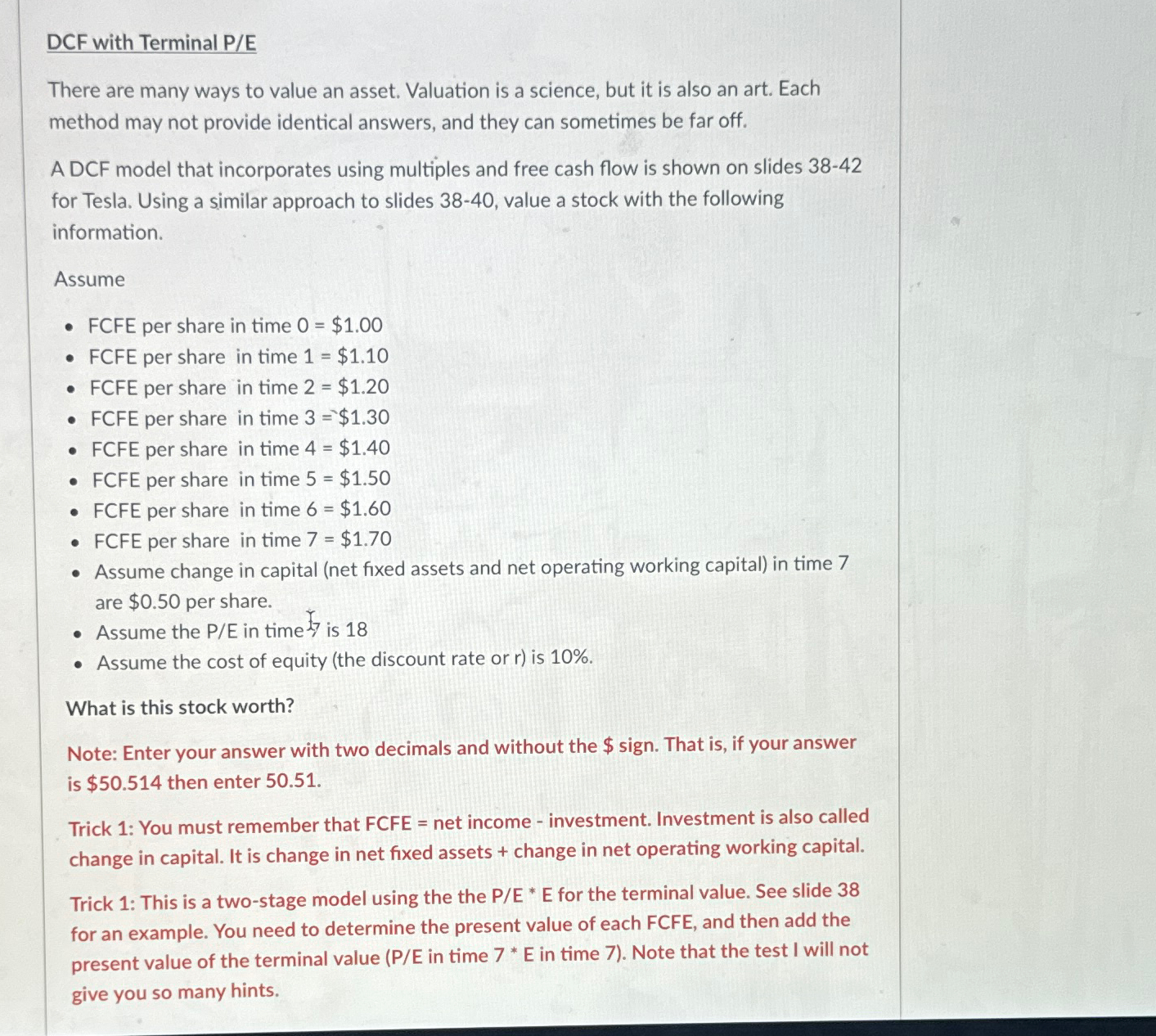

DCF with Terminal P / E There are many ways to value an asset. Valuation is a science, but it is also an art. Each

DCF with Terminal PE

There are many ways to value an asset. Valuation is a science, but it is also an art. Each method may not provide identical answers, and they can sometimes be far off.

A DCF model that incorporates using multiples and free cash flow is shown on slides for Tesla. Using a similar approach to slides value a stock with the following information.

Assume

FCFE per share in time $

FCFE per share in time $

FCFE per share in time $

FCFE per share in time $

FCFE per share in time $

FCFE per share in time $

FCFE per share in time $

FCFE per share in time $

Assume change in capital net fixed assets and net operating working capital in time are $ per share.

Assume the PE in time X is

Assume the cost of equity the discount rate or is

What is this stock worth?

Note: Enter your answer with two decimals and without the $ sign. That is if your answer is $ then enter

Trick : You must remember that FCFE net income investment. Investment is also called change in capital. It is change in net fixed assets change in net operating working capital.

Trick : This is a twostage model using the the PE E for the terminal value. See slide for an example. You need to determine the present value of each FCFE, and then add the present value of the terminal value PE in time in time Note that the test I will not give you so many hints.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started