Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Imagine a VC firm that had $300M committed capital and PICC of 100%. The venture capitalists (GPs) promised an annualized return of 20% to

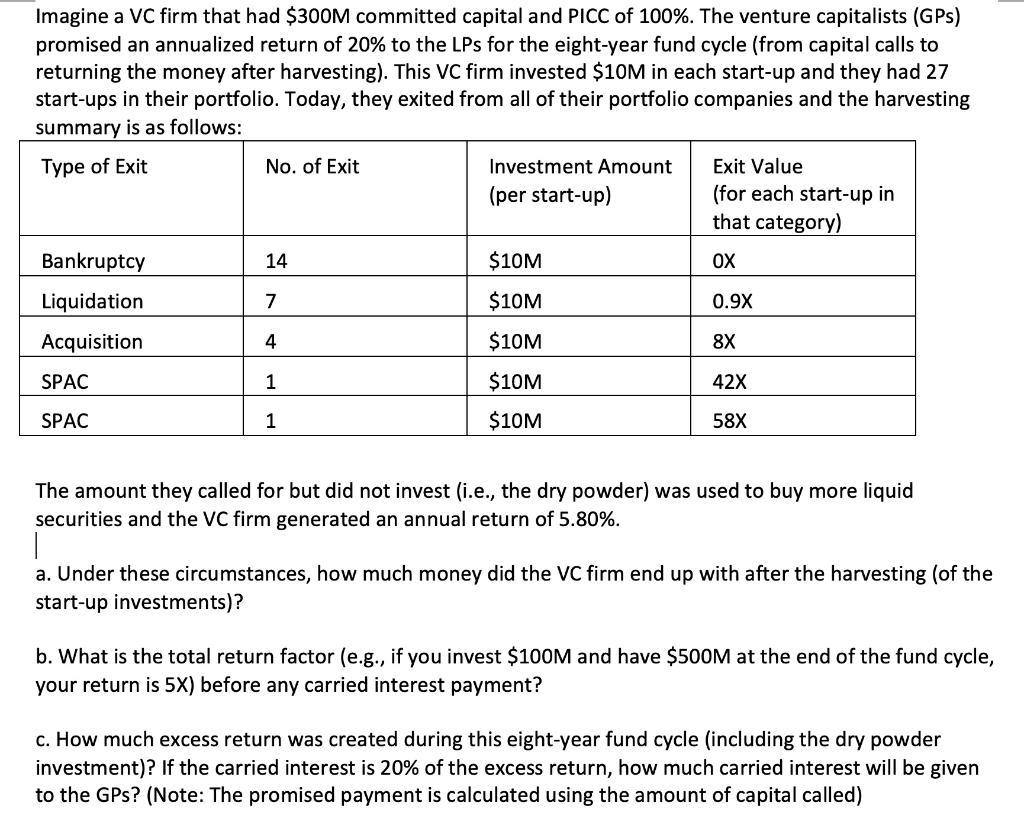

Imagine a VC firm that had $300M committed capital and PICC of 100%. The venture capitalists (GPs) promised an annualized return of 20% to the LPs for the eight-year fund cycle (from capital calls to returning the money after harvesting). This VC firm invested $10M in each start-up and they had 27 start-ups in their portfolio. Today, they exited from all of their portfolio companies and the harvesting summary is as follows: Type of Exit Bankruptcy Liquidation Acquisition SPAC SPAC No. of Exit 14 7 4 1 1 Investment Amount (per start-up) $10M $10M $10M $10M $10M Exit Value (for each start-up in that category) OX 0.9X 8X 42X 58X The amount they called for but did not invest (i.e., the dry powder) was used to buy more liquid securities and the VC firm generated an annual return of 5.80%. 1 a. Under these circumstances, how much money did the VC firm end up with after the harvesting (of the start-up investments)? b. What is the total return factor (e.g., if you invest $100M and have $500M at the end of the fund cycle, your return is 5X) before any carried interest payment? c. How much excess return was created during this eight-year fund cycle (including the dry powder investment)? If the carried interest is 20% of the excess return, how much carried interest will be given to the GPs? (Note: The promised payment is calculated using the amount of capital called)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The total amount of money the VC firm ended up with after harv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started