Answered step by step

Verified Expert Solution

Question

1 Approved Answer

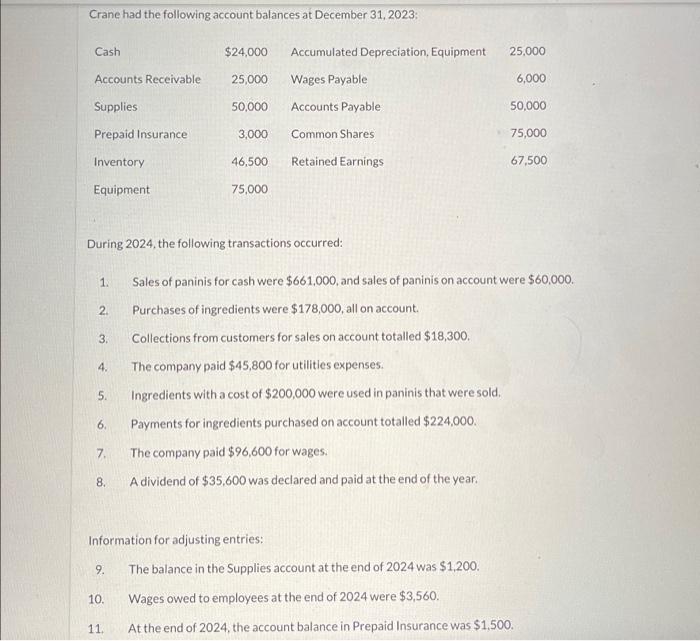

dCrane had the following account balances at December 31, 2023: Cash Accounts Receivable Supplies Prepaid Insurance Inventory Equipment 1. 2. 3. 4. 5. During 2024,

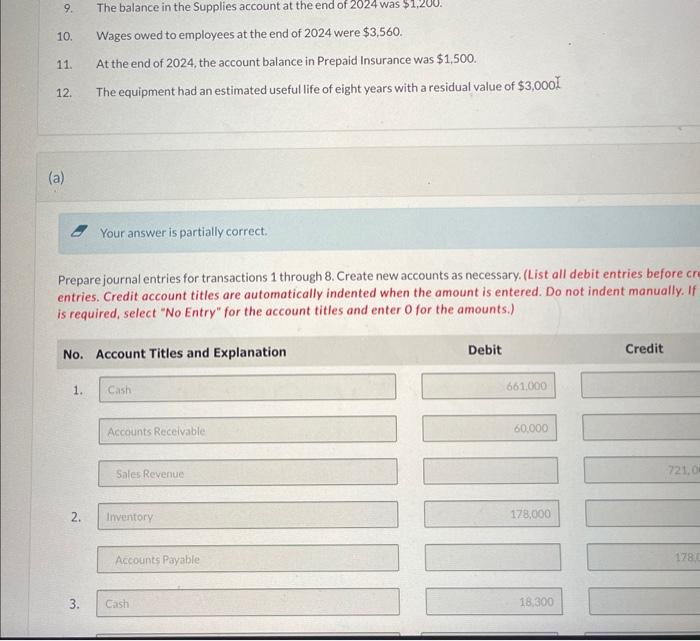

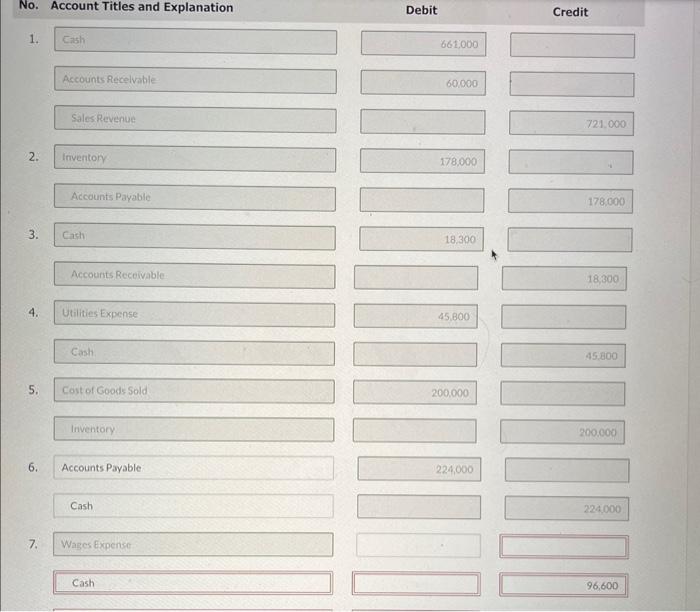

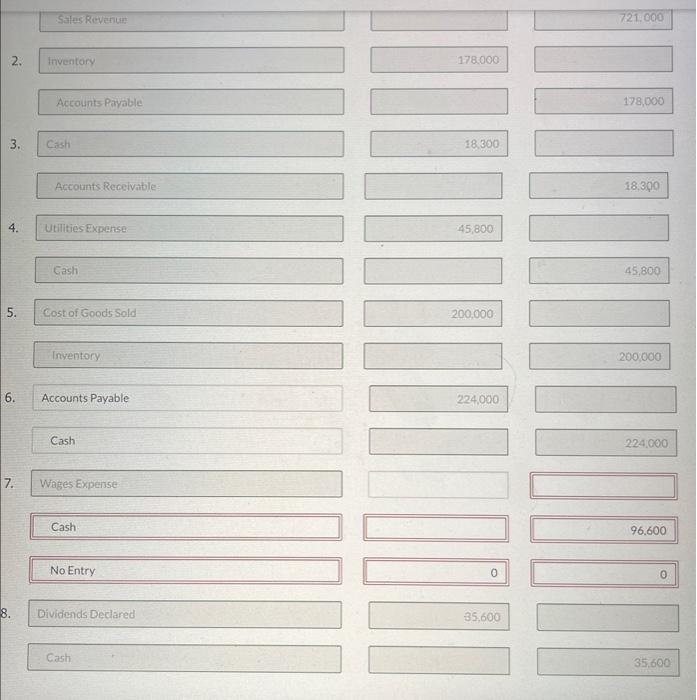

dCrane had the following account balances at December 31, 2023: Cash Accounts Receivable Supplies Prepaid Insurance Inventory Equipment 1. 2. 3. 4. 5. During 2024, the following transactions occurred: 6. 7. 8. 9. $24,000 Accumulated Depreciation, Equipment 10. Wages Payable 50,000 Accounts Payable Common Shares Retained Earnings 11. 25,000 3,000 46,500 75,000 Information for adjusting entries: 25,000 6,000 50,000 75,000 67,500 Sales of paninis for cash were $661,000, and sales of paninis on account were $60,000. Purchases of ingredients were $178,000, all on account. Collections from customers for sales on account totalled $18,300. The company paid $45,800 for utilities expenses. Ingredients with a cost of $200,000 were used in paninis that were sold. Payments for ingredients purchased on account totalled $224,000. The company paid $96,600 for wages. A dividend of $35,600 was declared and paid at the end of the year. The balance in the Supplies account at the end of 2024 was $1,200. Wages owed to employees at the end of 2024 were $3,560. At the end of 2024, the account balance in Prepaid Insurance was $1,500.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started