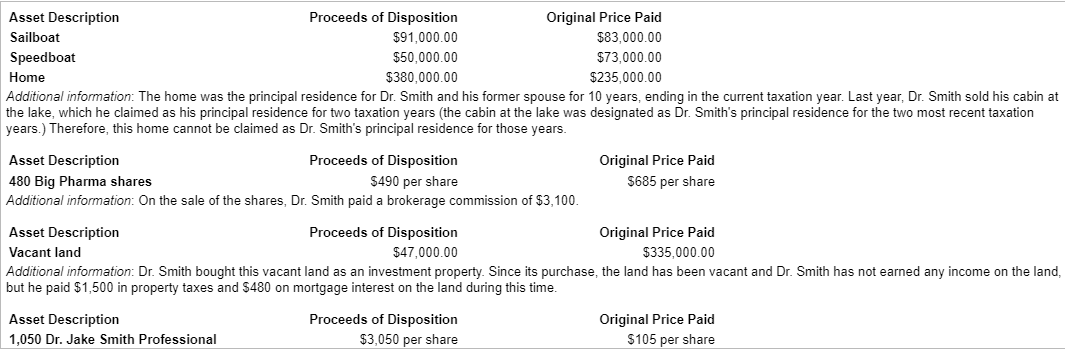

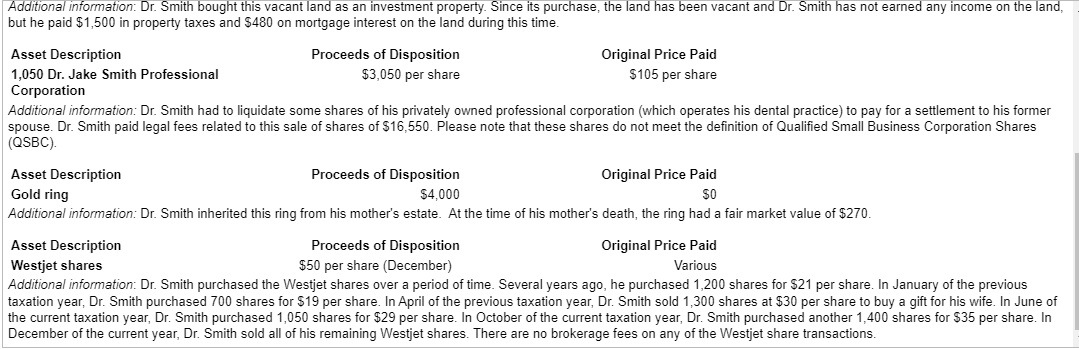

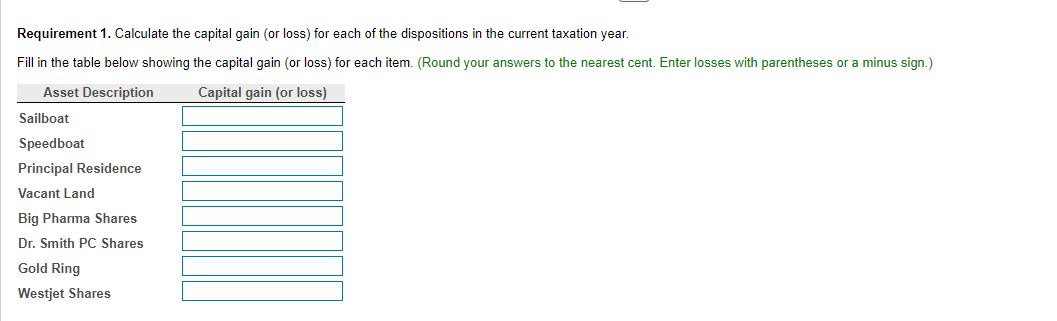

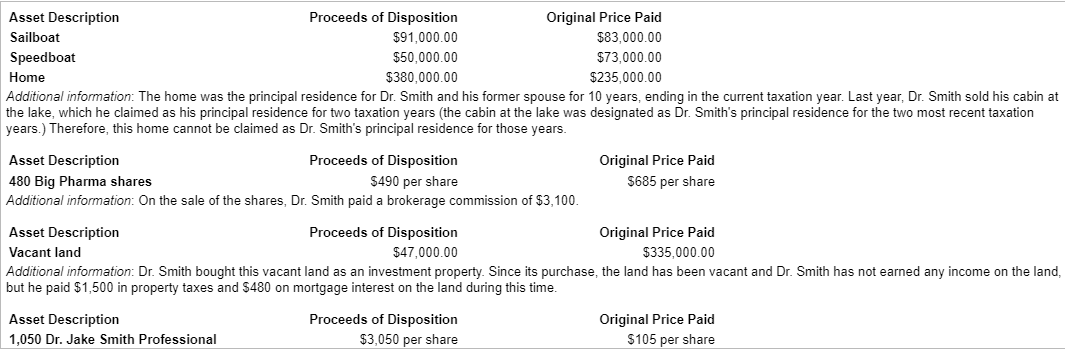

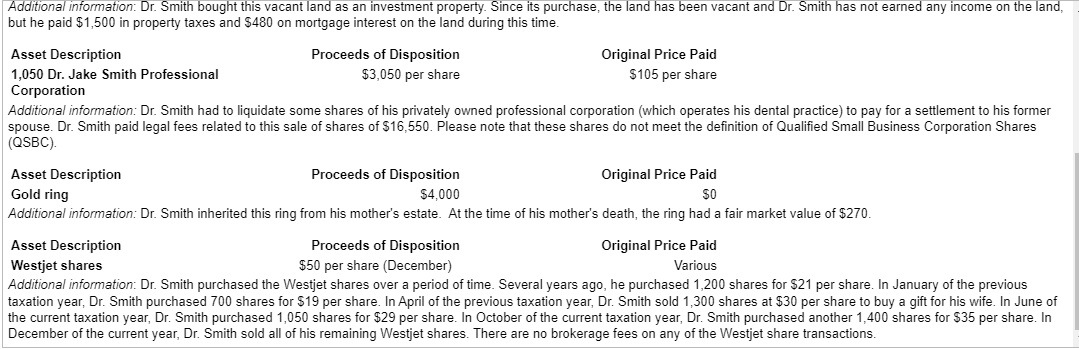

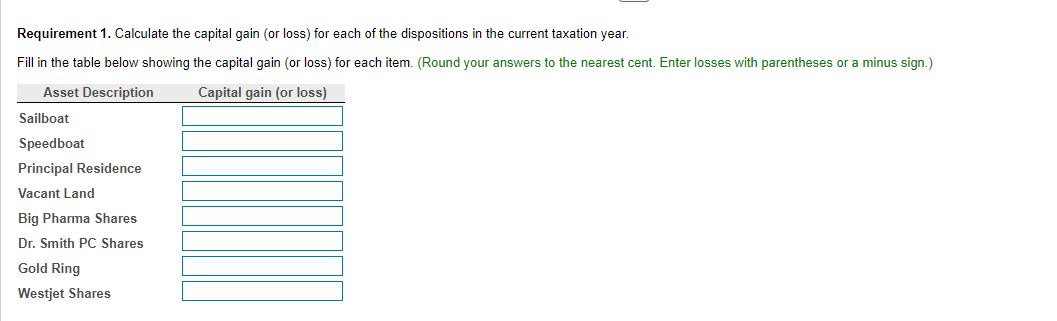

dditional information: The home was the principal residence for Dr. Smith and his former spouse for 10 years, ending in the current taxation year. Last year, Dr. Smith sold his cabin a e lake, which he claimed as his principal residence for two taxation years (the cabin at the lake was designated as Dr. Smith's principal residence for the two most recent taxation ears.) Therefore, this home cannot be claimed as Dr. Smith's principal residence for those years. Additional information: Dr. Smith had to liquidate some shares of his privately owned professional corporation (which operates his dental practice) to pay for a settlement to his former spouse. Dr. Smith paid legal fees related to this sale of shares of $16,550. Please note that these shares do not meet the definition of Qualified Small Business Corporation Shares (QSBC) Requirement 1. Calculate the capital gain (or loss) for each of the dispositions in the current taxation year. Fill in the table below showing the capital gain (or loss) for each item. (Round your answers to the nearest cent. Enter losses with parentheses or a minus sign.) dditional information: The home was the principal residence for Dr. Smith and his former spouse for 10 years, ending in the current taxation year. Last year, Dr. Smith sold his cabin a e lake, which he claimed as his principal residence for two taxation years (the cabin at the lake was designated as Dr. Smith's principal residence for the two most recent taxation ears.) Therefore, this home cannot be claimed as Dr. Smith's principal residence for those years. Additional information: Dr. Smith had to liquidate some shares of his privately owned professional corporation (which operates his dental practice) to pay for a settlement to his former spouse. Dr. Smith paid legal fees related to this sale of shares of $16,550. Please note that these shares do not meet the definition of Qualified Small Business Corporation Shares (QSBC) Requirement 1. Calculate the capital gain (or loss) for each of the dispositions in the current taxation year. Fill in the table below showing the capital gain (or loss) for each item. (Round your answers to the nearest cent. Enter losses with parentheses or a minus sign.)