dditional instructions: Prepare the return as if you were preparing it for an actual client. All necessary forms and schedules should be attached to the return and properly and neatly completed. Schedules 1, 2, 3 A, B, C, D, SE, Form 2441, Form 8867 and Form 8283 must be completed and attached to the

return in the proper order. Required forms are posted to D2L. Download the required forms and save them under a new name before completing. The pdf forms can be filled in and edited as necessary. A pdf version of the return is required. A handwritten return that is neat and professional will be accepted with a 5-point subtraction for not submitting in pdf format. A handwritten return that is not neat and professional will not be accepted. Interview Information Helen Hanson is an unmarried, calendar year, cash basis taxpayer. Helen provides the majority of support for her two children (Hillary and Hank), who live with her. Hillary is a full-time student at Middle Tennessee State University and earned $5,000 in wages in 2021. Hank had no income in 2021. Helen did not receive any advance child tax credit payments in 2021. 1Helens mother, Heather Johnson, also lives with Helen. Helen provides 80% of Heathers support. Heather provides the other 20%. Heather received $14,000 in social security benefits and $1,400 in interest from a savings account in 2021. The social security numbers and dates of birth for members of the family are as follows: Social Security Number Date of Birth Helen 471-11-1111 9/30/1974 Hillary 471-22-2222 2/12/1999 Hank 471-33-3333 8/19/2015 Heather 471-44-4444 9/27/1930 The Hanson family resides at 280 Happy Street, Murfreesboro, Tennessee 37132. An in-depth interview with Helen, coupled with a review of all her documentation, reveals the following information for the current year: 1. Helen owns and operates a computer consulting business specializing in computer systems design (doing business as Helens Computer Solutions) as a sole proprietorship. Helens Computer Solutions specializes in computer system design and related services. Helens office is located at 125 Blackberry Boulevard, Murfreesboro, Tennessee 37132. The employer identification number of the company is 41-5474678. The company uses the cash method of accounting for keeping its books. This is a service business, so Helen has no cost of goods sold.

Helen collected revenue of $301,120 (all reported to the Company on Form 1099-NEC), and paid the following expenses (all of these expenses pass the 12-month rule test for tax recognition in 2021): Repairs and maintenance, $500. Rent on office, $30,000. Employee salaries (wages), $100,000. Office expense, $2,720. Payroll Taxes, $7,650. Advertising, $2,500. Fine paid to the state of Tennessee for unfair trade practices, $2,000. Legal and professional fees, $2,000. Business meals, $4,000. The entire $4,000 of the business meals were paid to restaurants. Business entertainment, $800 Utilities, $3,740. Supplies, $1,500 Property, casualty and liability insurance, $3,500. Health insurance premiums on a policy Helen purchased to cover her and her two children, $20,000. The coverage was in place for the entire year and Helen does not qualify for the premium tax credit. Helen used a 2015 Cadillac (purchased on January 1, 2015) for both business and personal purposes. Helen drove the car 5,594 miles for business in 2021. She also drove it 16,176 miles for personal reasons (3,206 of those miles were for commuting). Helen uses the standard mileage rate to account for her business transportation expenses rather than her actual costs. Helen has another vehicle that she uses for personal purposes. Helen has written records to substantiate her business use of the new car. 2. You previously advised Helen to make estimated tax payments on Form 1040-ES totaling $26,000 ($6,500 per quarter) to prepay an estimate of her 2021 self- employment and income tax liability. Helen followed your advice and made timely estimated tax payments. Helen would like her 2021 federal income tax refund, if any, applied to her 2021 estimated tax payments. Helen had a $1,065 refund on her 2020 federal income tax return, which she applied to her 2021 estimate tax payments. 3. In addition to her sole proprietorship, Helen worked part-time as a computer technician for Big Computer Store, located at 100 Computer Street, Murfreesboro, TN 37132. Helens W-2 indicates gross wages of $18,000 and federal income tax withholding of $1,800. (You may omit the requirement to attach a copy of the W-2 to the tax return). The appropriate amount of social security tax ($1116) and Medicare tax ($261) was withheld from her paychecks.

4. Helen paid Kinder Care, Inc. a total of $6,200 to take care of Hank while she was at work. Kinder Care, Inc. is located at 1200 Child Care Street, Murfreesboro, TN 37132. Kinder Cares tax identification number is 46-3456789. 5. Helen received a Form 1099-INT from State Street Bank and Trust indicating she earned a total of $2,000 of interest income from her bank account. Helen has no interest in any foreign accounts or trusts. 6. Helen received a Form 1099-DIV from ABC Corporation indicating she received a total of $1,000 of dividend income from the corporation. The Form 1099-DIV indicated that the entire $1,000 was qualified dividend income (eligible for the preferential maximum tax rate). 7. On April 14, 2021 Helen won a jackpot of $9,000 at the Lucky Lady Casino. The casino withheld federal income taxes of $1,800 from Helens jackpot and gave Helen a check for $7,200. Helen received a W-2 from the casino showing the gambling winnings of $9,000 and the Federal income tax withholding of $1,800. In addition to her gambling winnings, Helen had properly documented gambling losses totaling $10,000 in 2021. 8. Helen sold 500 shares of XYZ Corporation stock for $33.00 per share on October 1, 2021. She paid an additional $20 commission to her broker to transact the sale. She originally paid $22.00 per share when she purchased the stock on January 15, 2009. She paid an additional $20 commission to her broker to make the purchase. This information (including basis information) was reported to Helen on Form 1099-B. 9. Helen sold 100 shares of ABC Corporation stock for $10 per share on December 1, 2021. She paid an additional $10 commission to her broker to transact the sale. She originally paid $9 per share when they purchased the stock on January 2, 2021. She paid an additional $5 commission to her broker to make the purchase. This information (including basis information) was reported to Helen on Form 1099-B. 10. Helen received $800 in interest on a state of Tennessee bond in 2021. This information was reported to them on Form 1099-INT. 11. Helen received a Form 1098 from Regions Bank indicating she paid a total of $11,800 in home mortgage interest. The mortgage origination date was January 1, 2016 and the current balance on the mortgage is $290,000. She also paid $3,240 in property taxes on her home and $900 interest on personal debt (i.e., a car loan and credit cards). 12. Helen contributed $4,800 to her local church, an organization officially recognized by the IRS as a nonprofit, tax exempt entity. Helen has proper documentation for this contribution. 13. On October 1, 2021, Helen contributed 50 shares of ZZZ Corporation stock to the Red Cross, an organization officially recognized by the IRS as a nonprofit, tax-exempt

entity. Helen purchased the 50 shares on February 5, 2008 for a total of $2,000. The fair market value of the stock on the date of contribution was $5,000. 14. 324012030302Helen paid $12,000 in tuition to Middle Tennessee State University in 2021. The tuition was paid on behalf of Hillary, who was a full-time student at State University in 2021. Hillary is a Sophomore at MTSU and Helen claimed the American Opportunity Tax Credit for expenses paid on behalf of Hillary for the first time in 2019. Hillary received a Form 1099-T from MTSU indicating the $12,000 of tuition paid in 2021. 15. Helen has no liability for Tennessee income tax, but they paid sales tax on all applicable, personal purchases. Search for the sales tax deduction calculator on the IRS website, and use it to simplify the calculation of their deductible sales tax. Assume that Helen had no additional large purchases that were subject to sales tax in 2021. 16. Helen paid $13,832 in out-of-pocket medical expenses (documented hospital, doctor and dental bills) in 2021. She also drove a total of 600 miles going to and from medical appointments. She has proper documentation for this mileage. 17. Helen paid $5,400 for prescription drugs and $2,640 for over-the-counter (non- prescription) drugs in 2021. 18. Helen contributed $6,000 to a traditional IRA in 2021. She is not covered by another qualified retirement plan. {She should talk to her CPA about setting up a retirement plan for her business} 19. Helen received $12,000 in alimony from her ex-husband, Bobby Baker (SSN: 471-55- 5555) in 2021. Helens divorce was finalized on March 2, 2014 and the divorce settlement agreement has not been modified. 20. Helen received $18,000 in child support from her ex-husband, Bobby Baker (SSN: 471-55-5555) in 2021. 21. Helen made a $10,000 gift to her sister to congratulate her on graduating from MTSU. 22. Helen received a $25,000 gift from her great uncle Charlie in 2021. Additional notes: Helen has adequate documentation to support each of the aforementioned expenses, and they have no carryforwards from previous years that will impact their return for the current year. Round all amounts presented on the tax return to the nearest dollar and leave the cents column blank. Any lines on the tax return that you dont need to use should be left blank

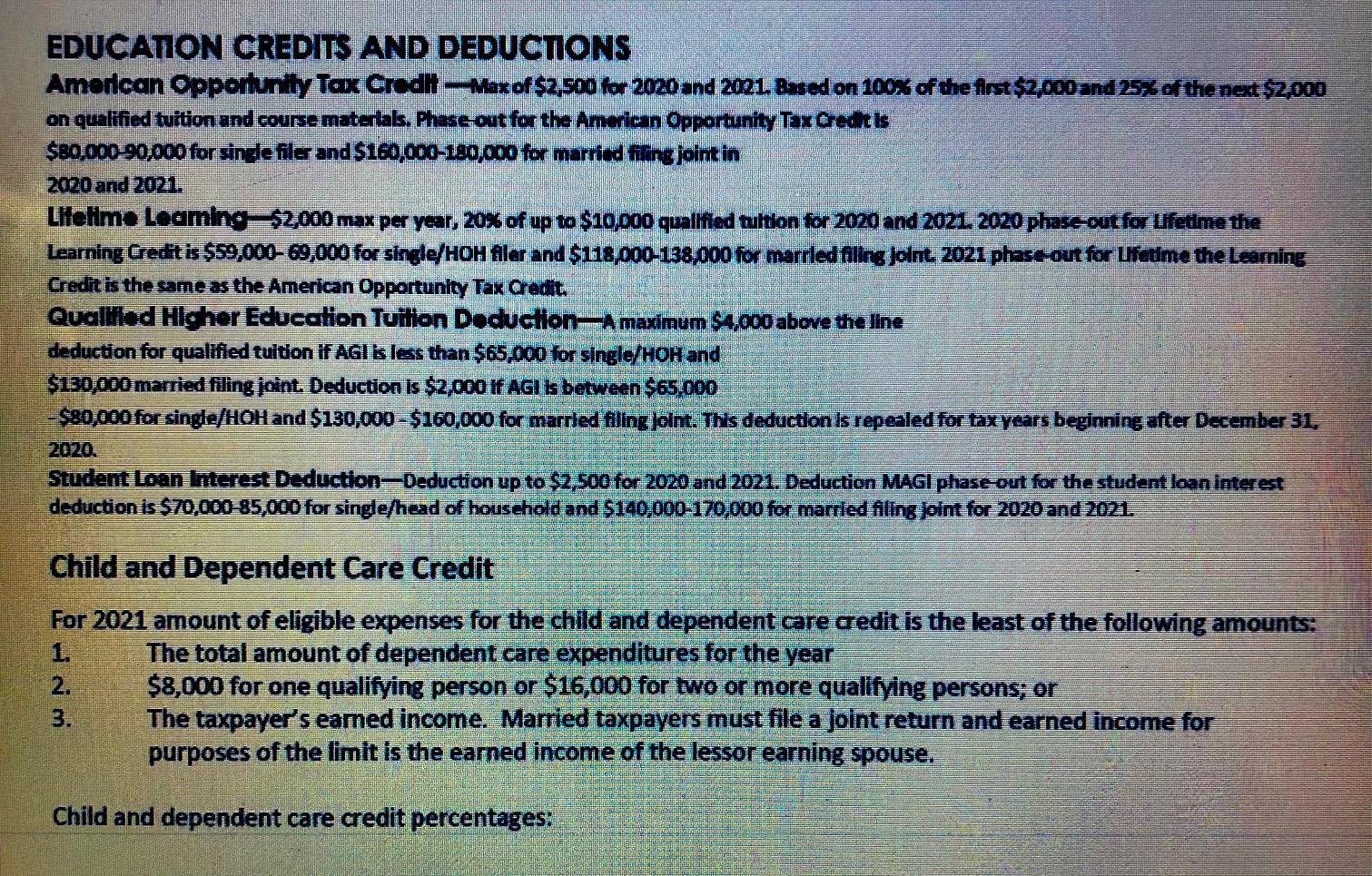

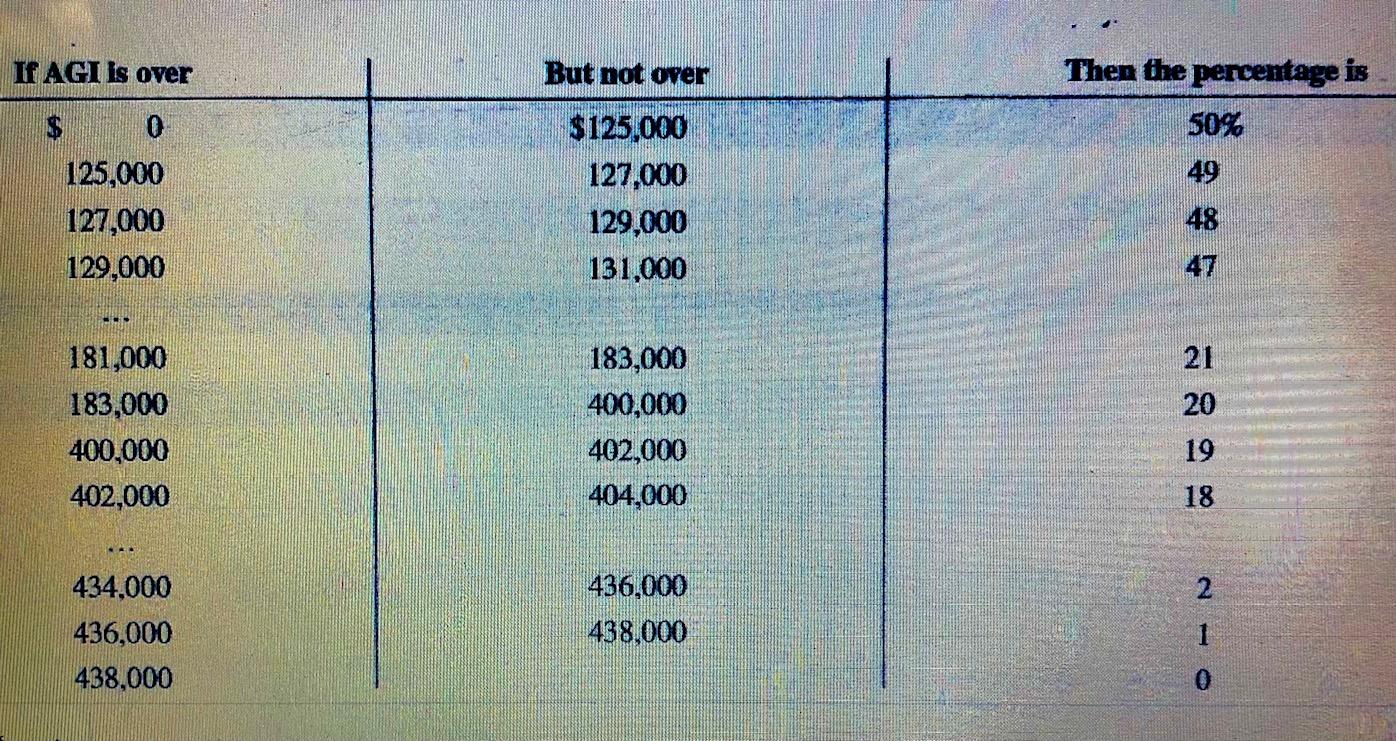

do not enter zeros. Helen has no AMT liability so you may omit Form 6251.

do not enter zeros. Helen has no AMT liability so you may omit Form 6251.

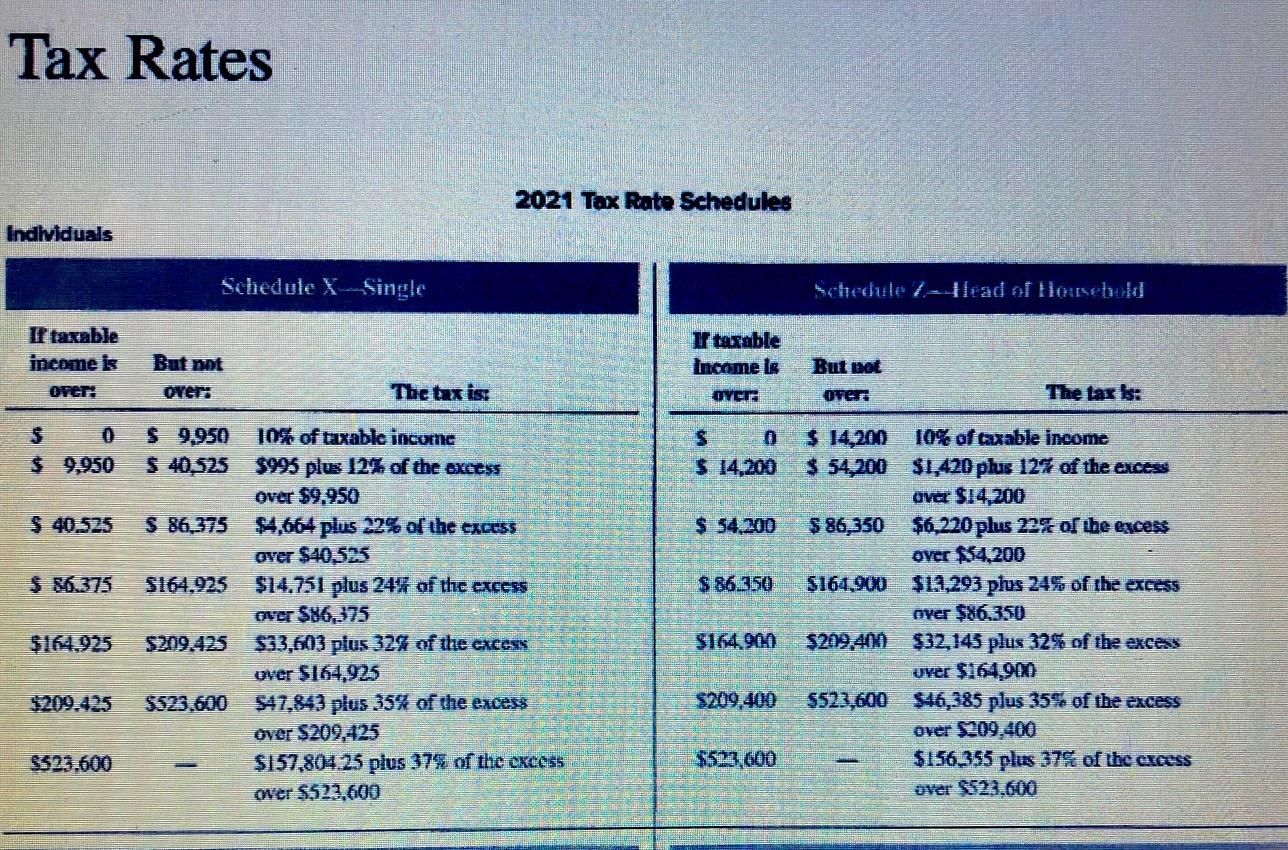

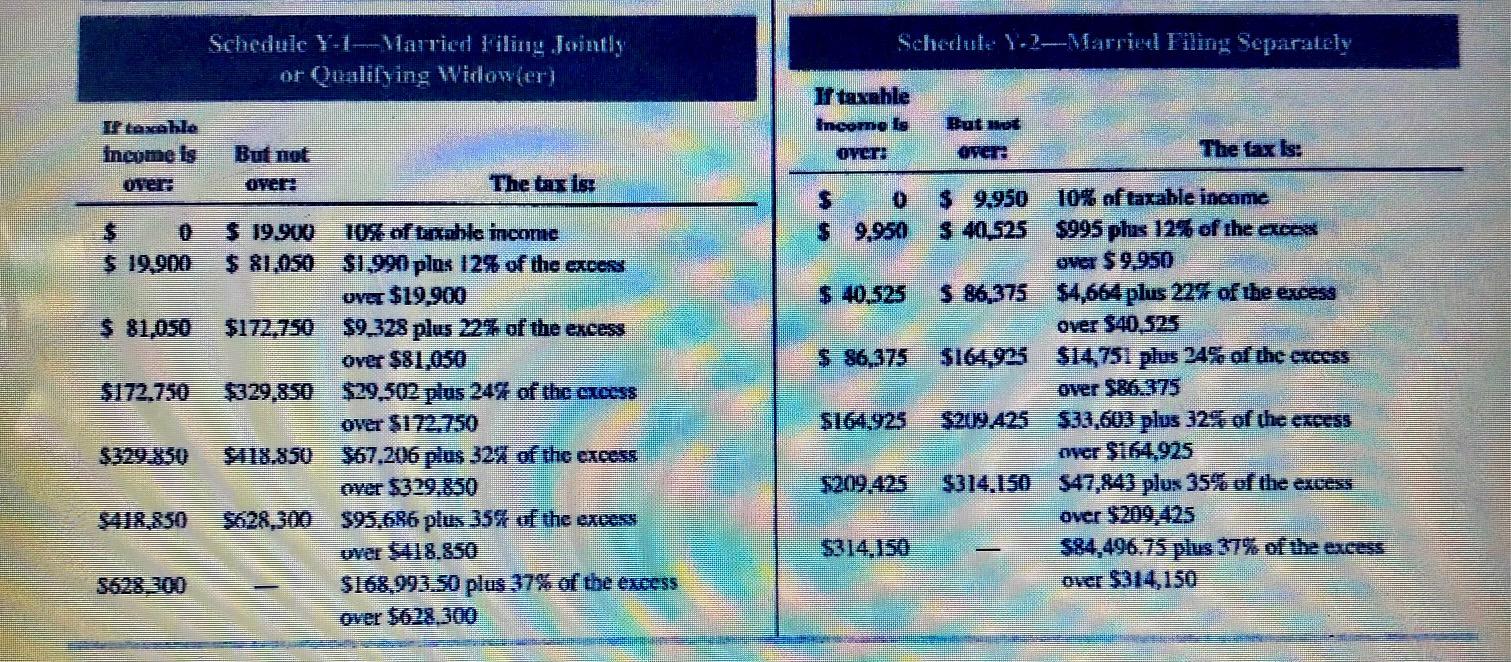

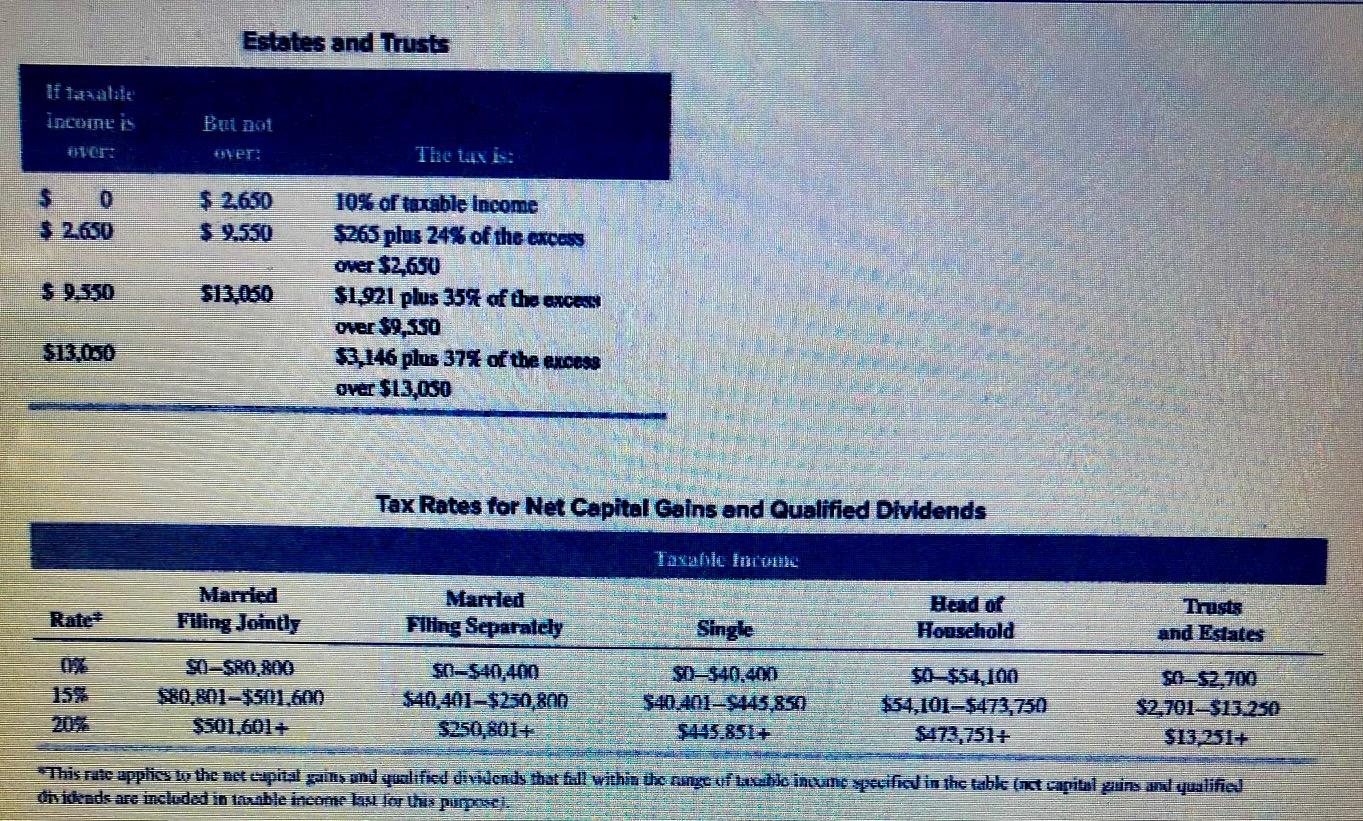

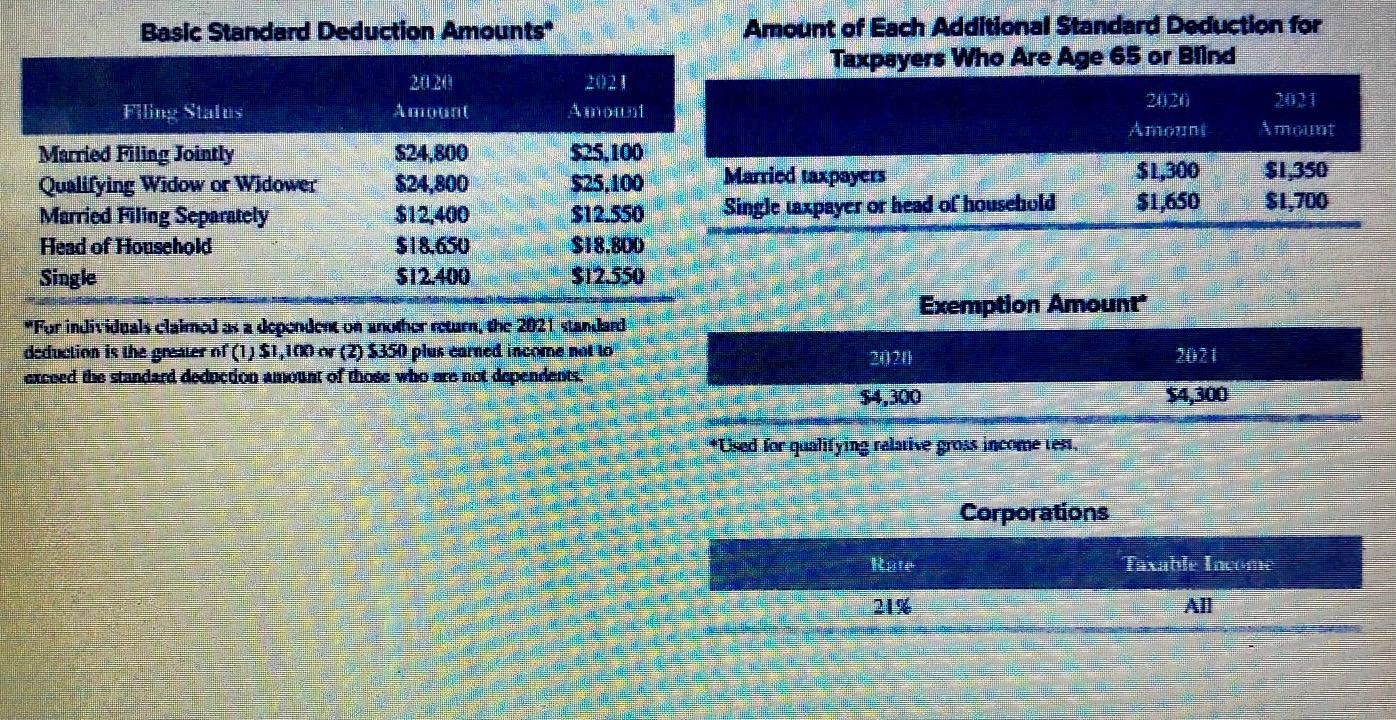

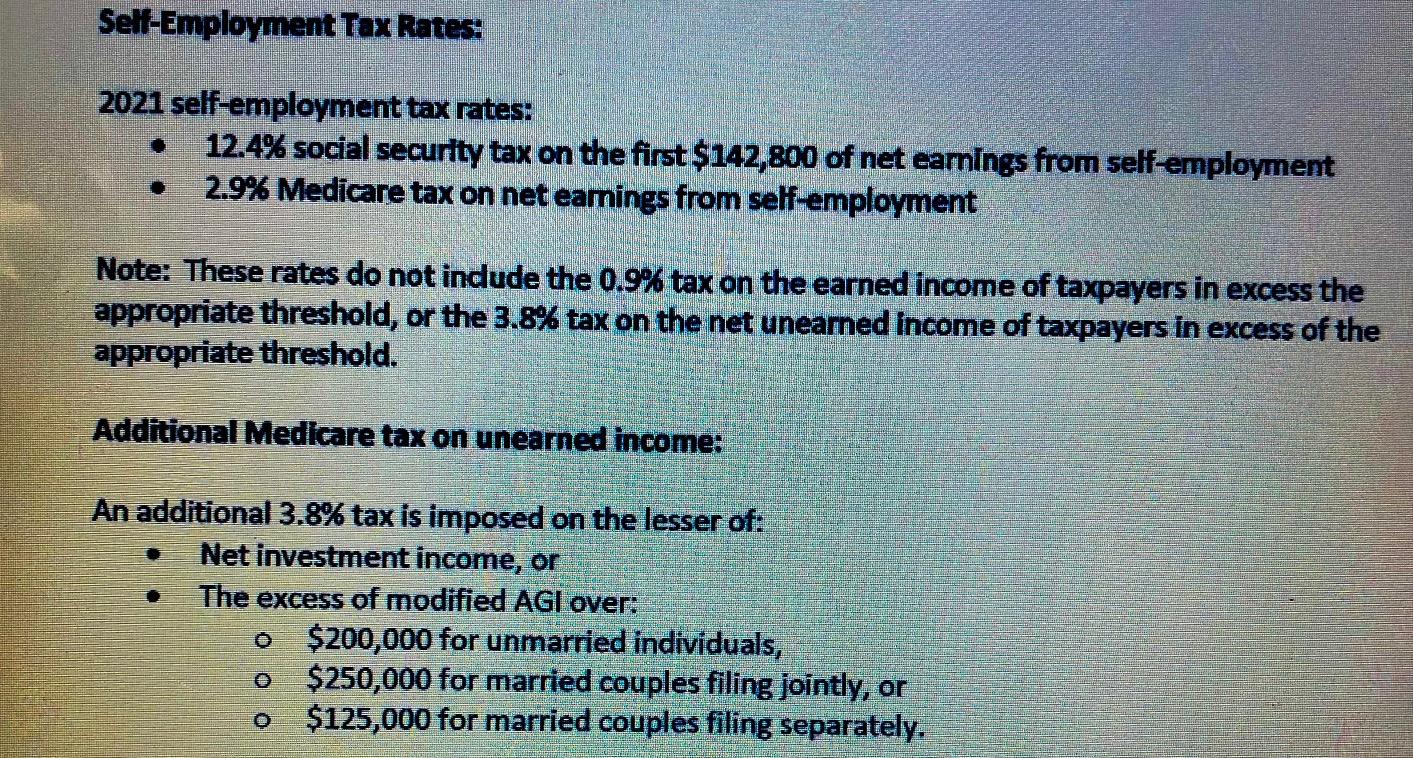

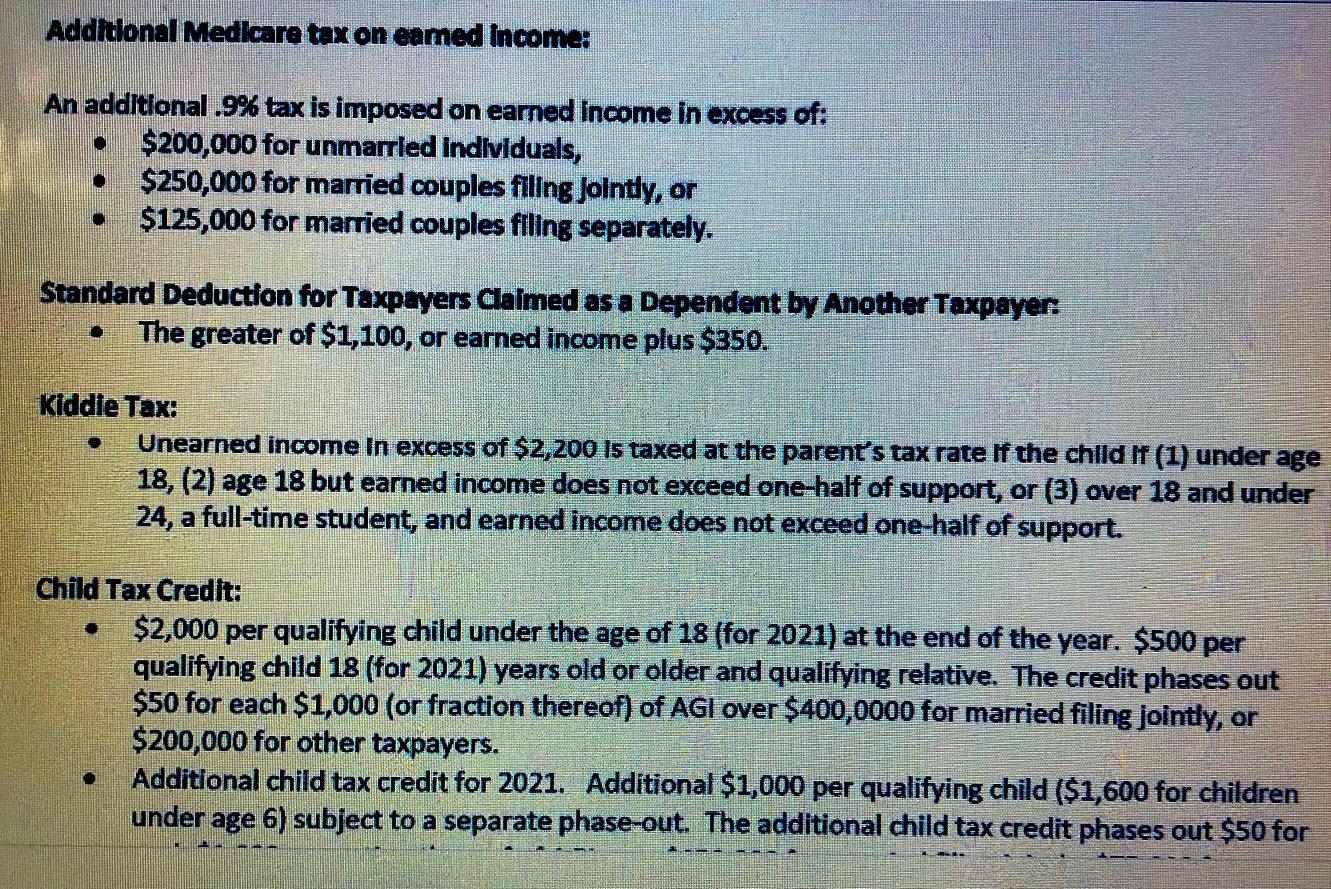

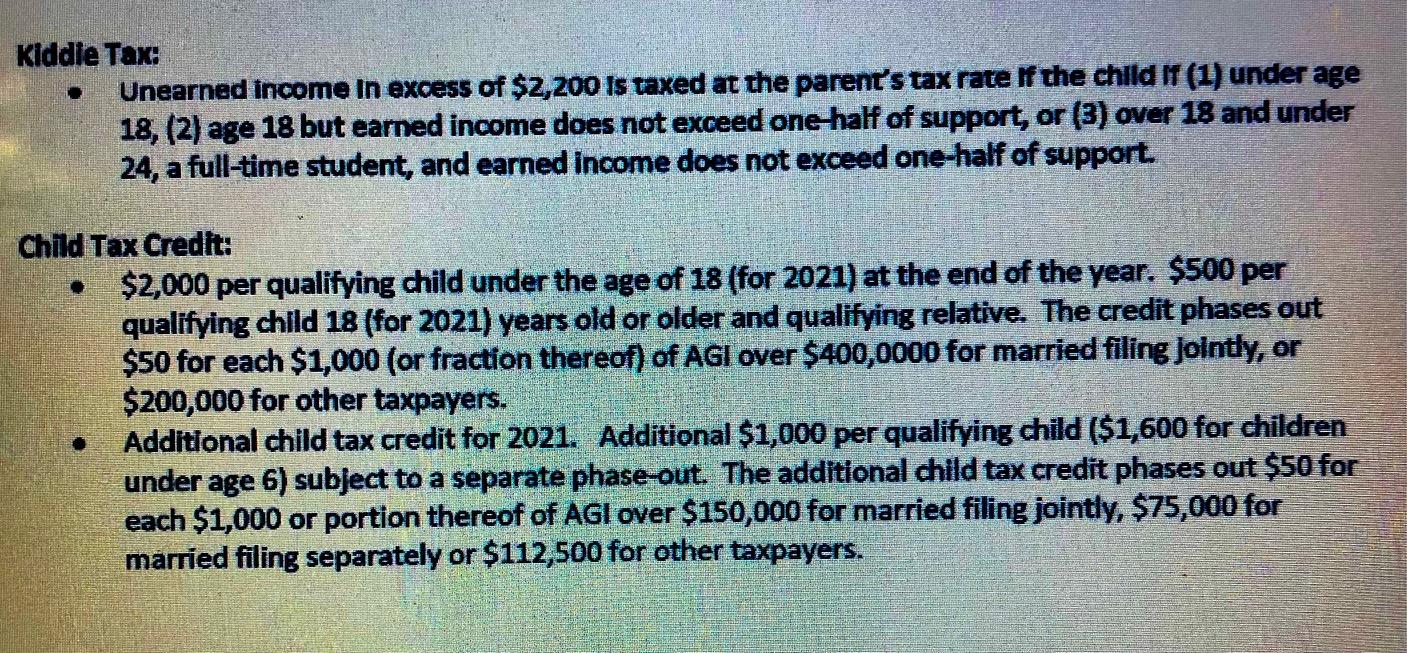

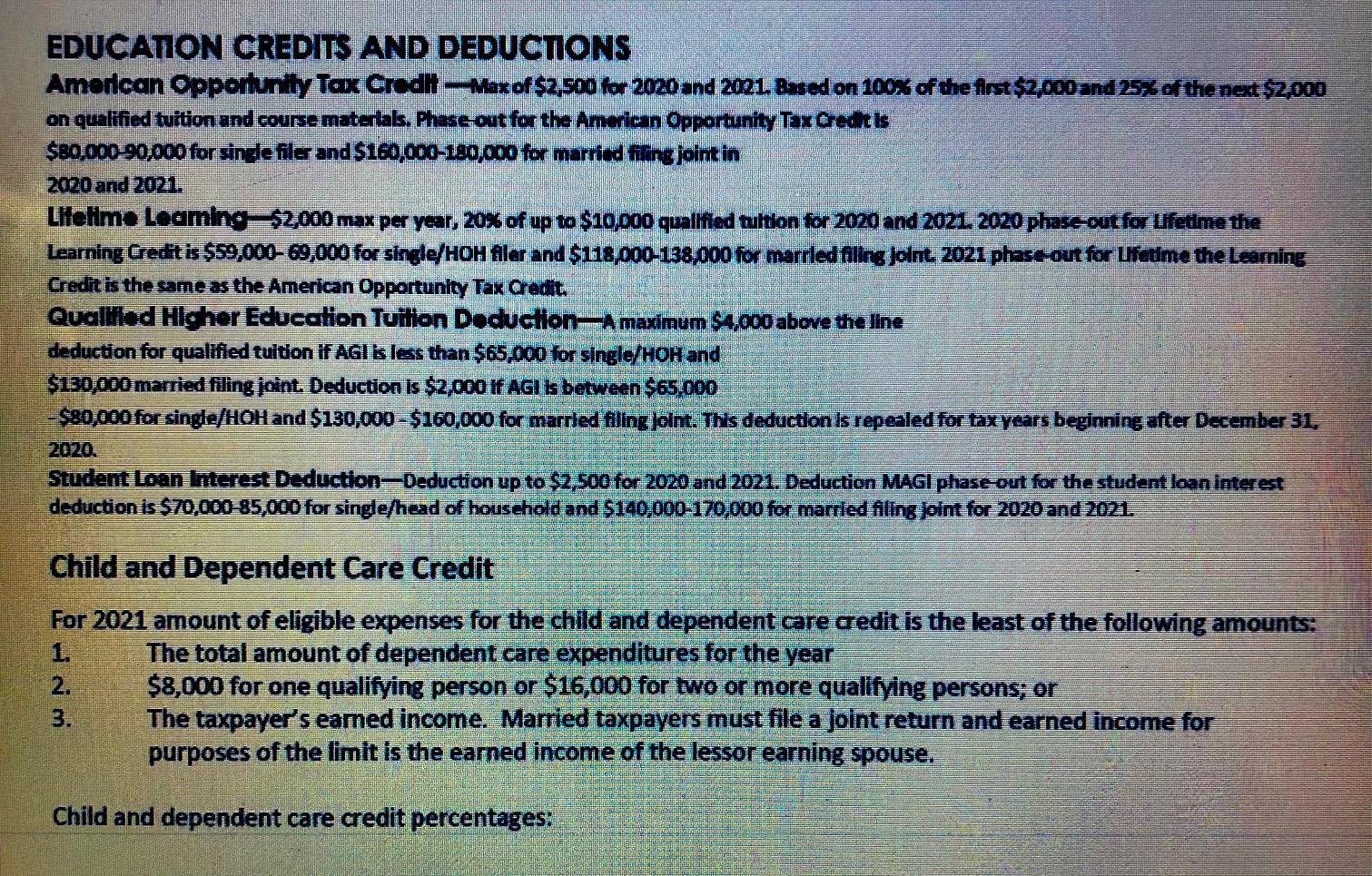

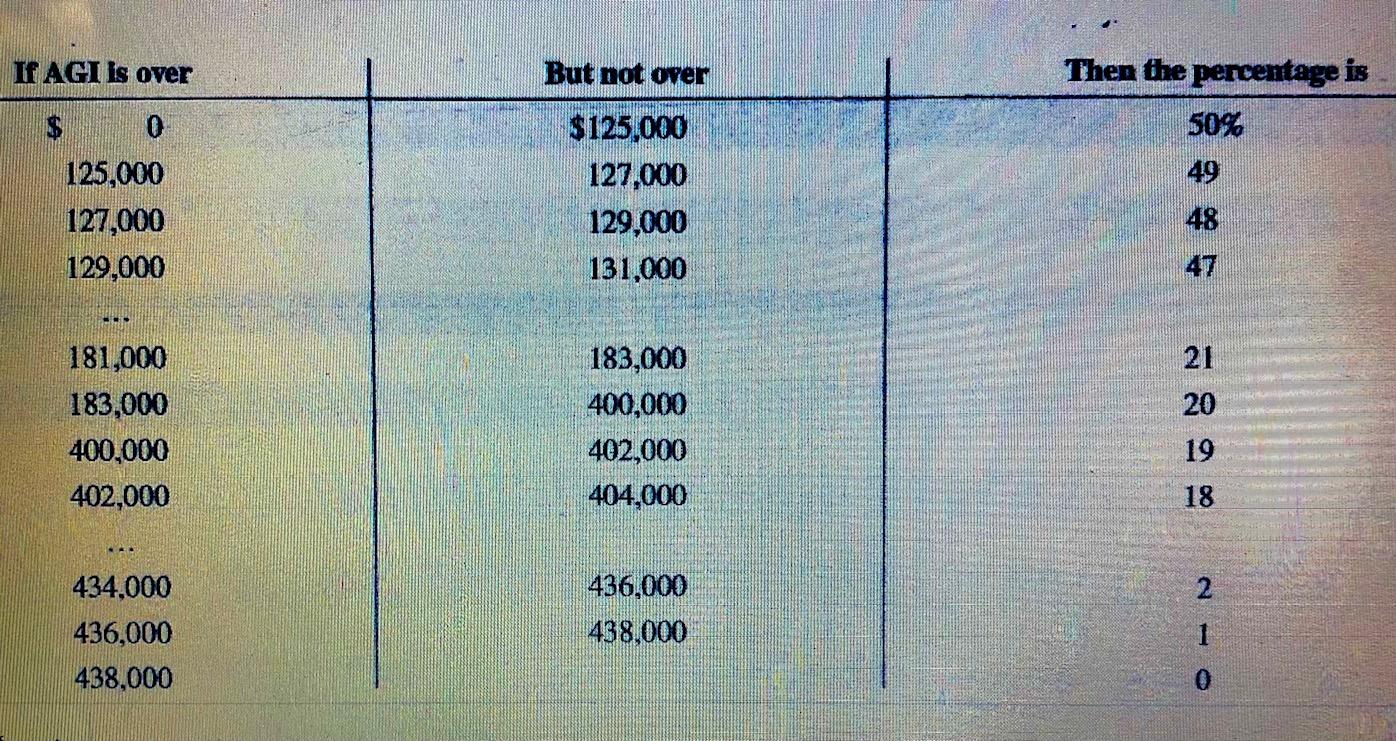

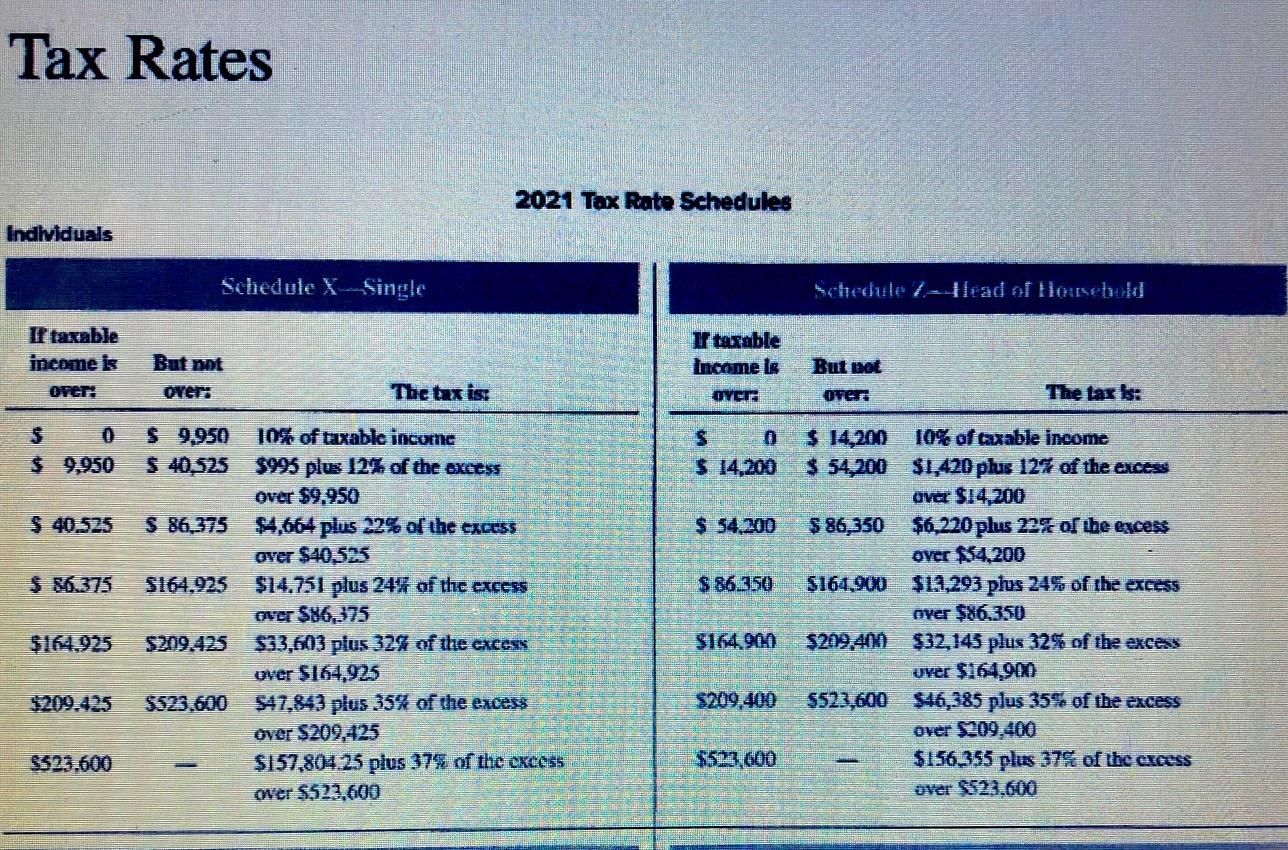

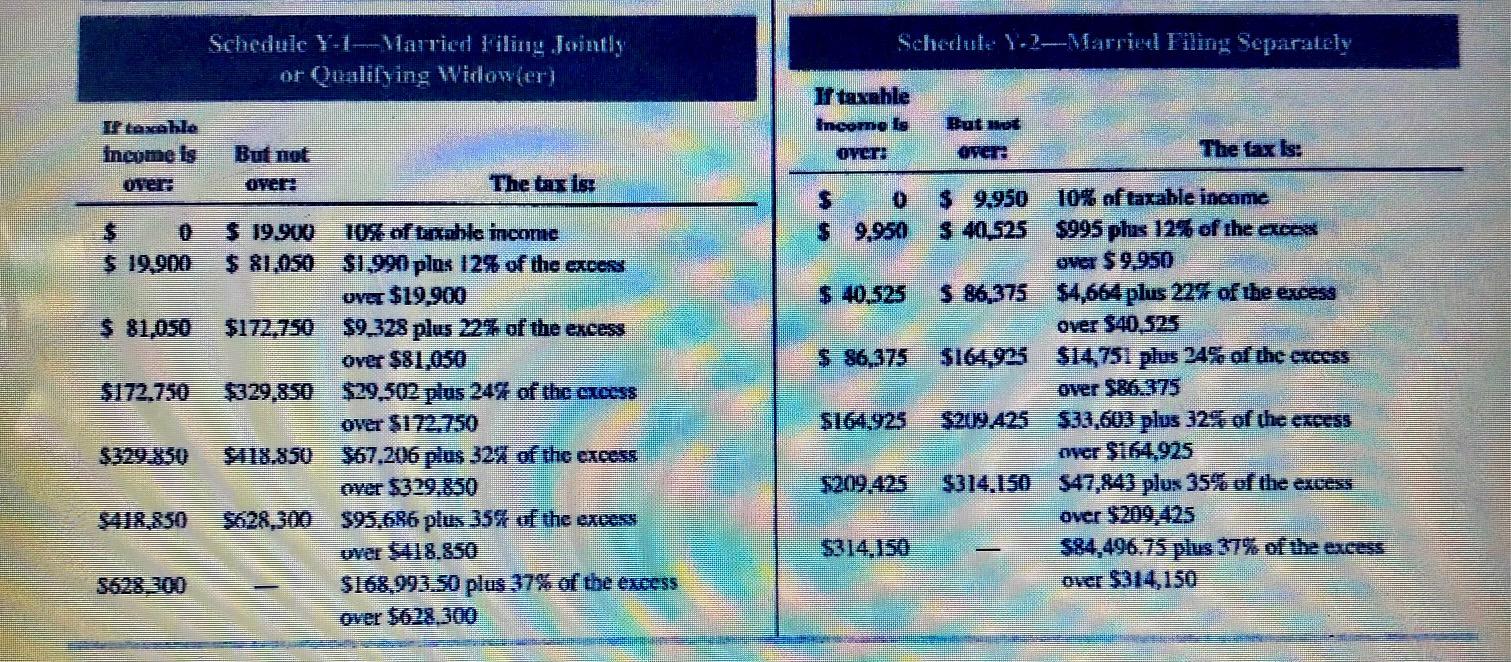

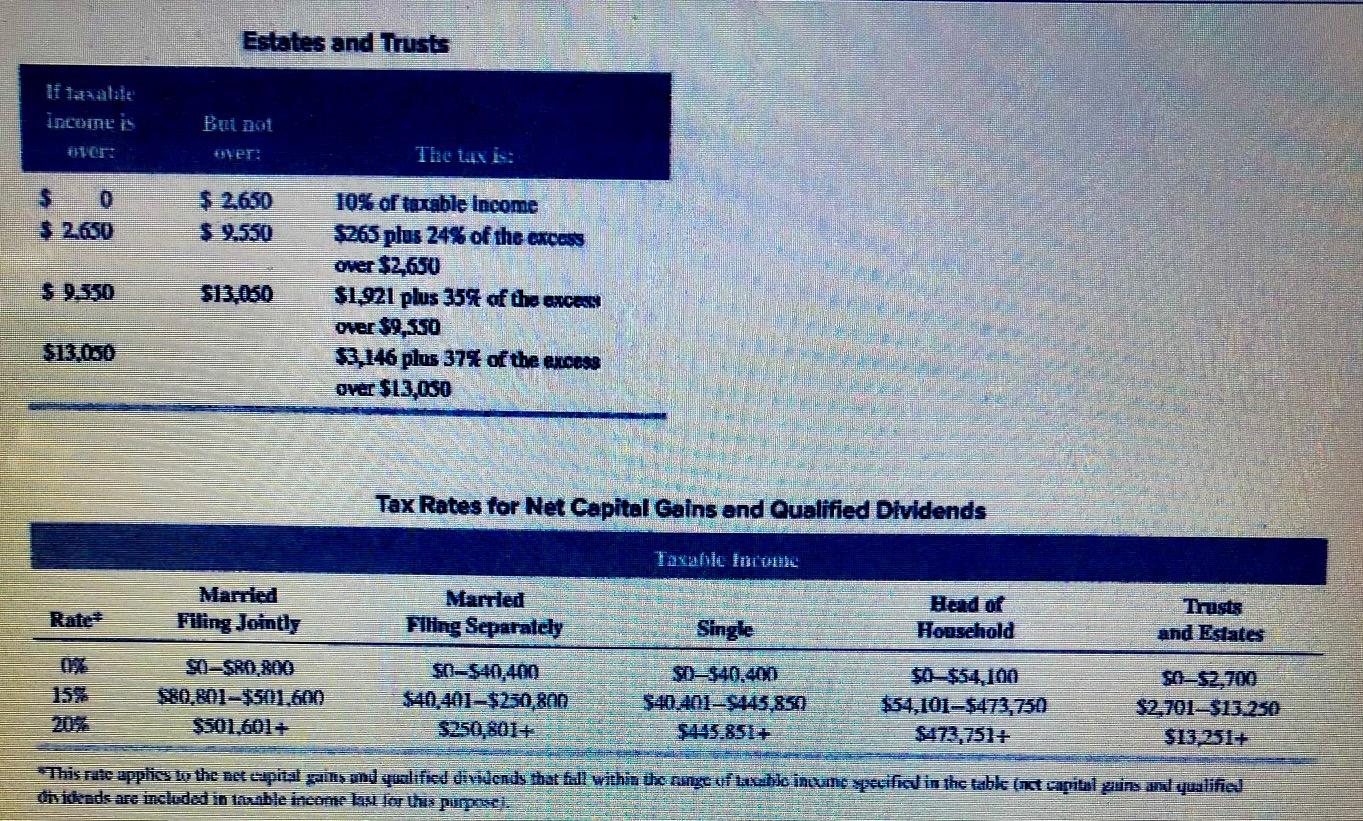

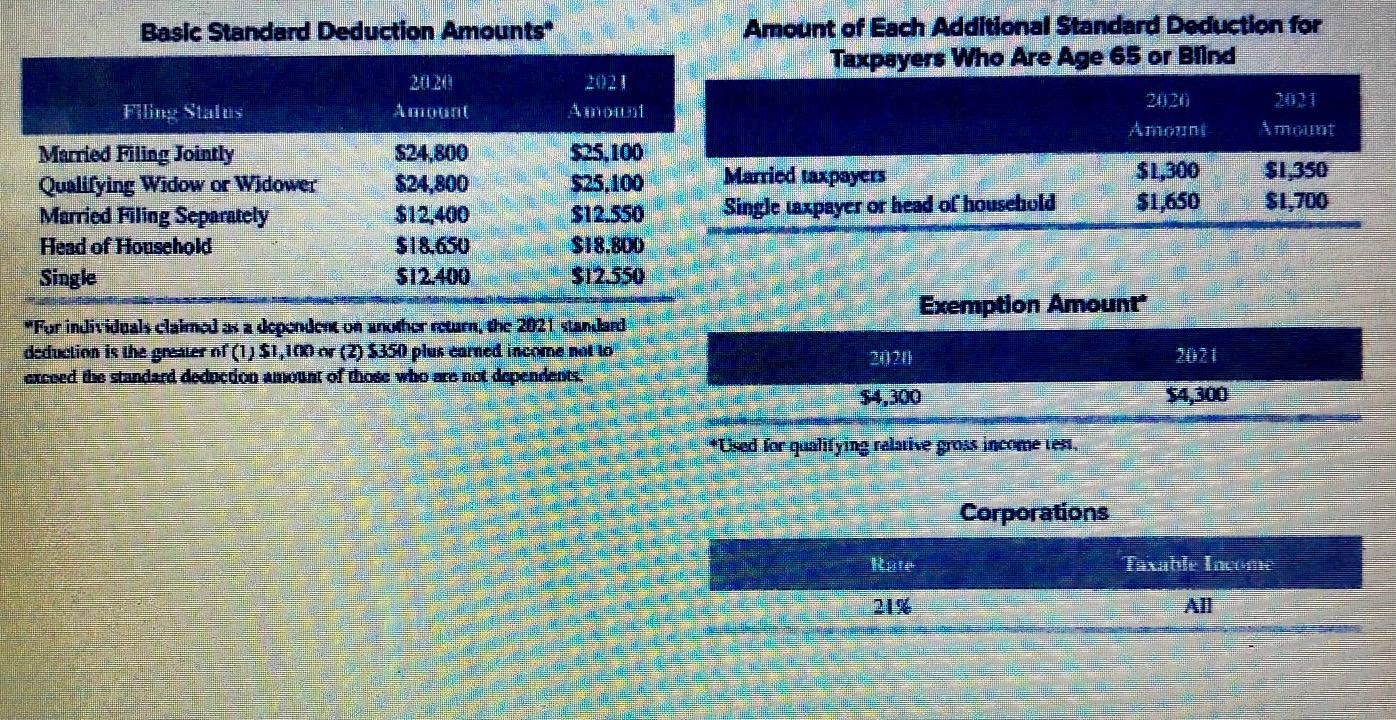

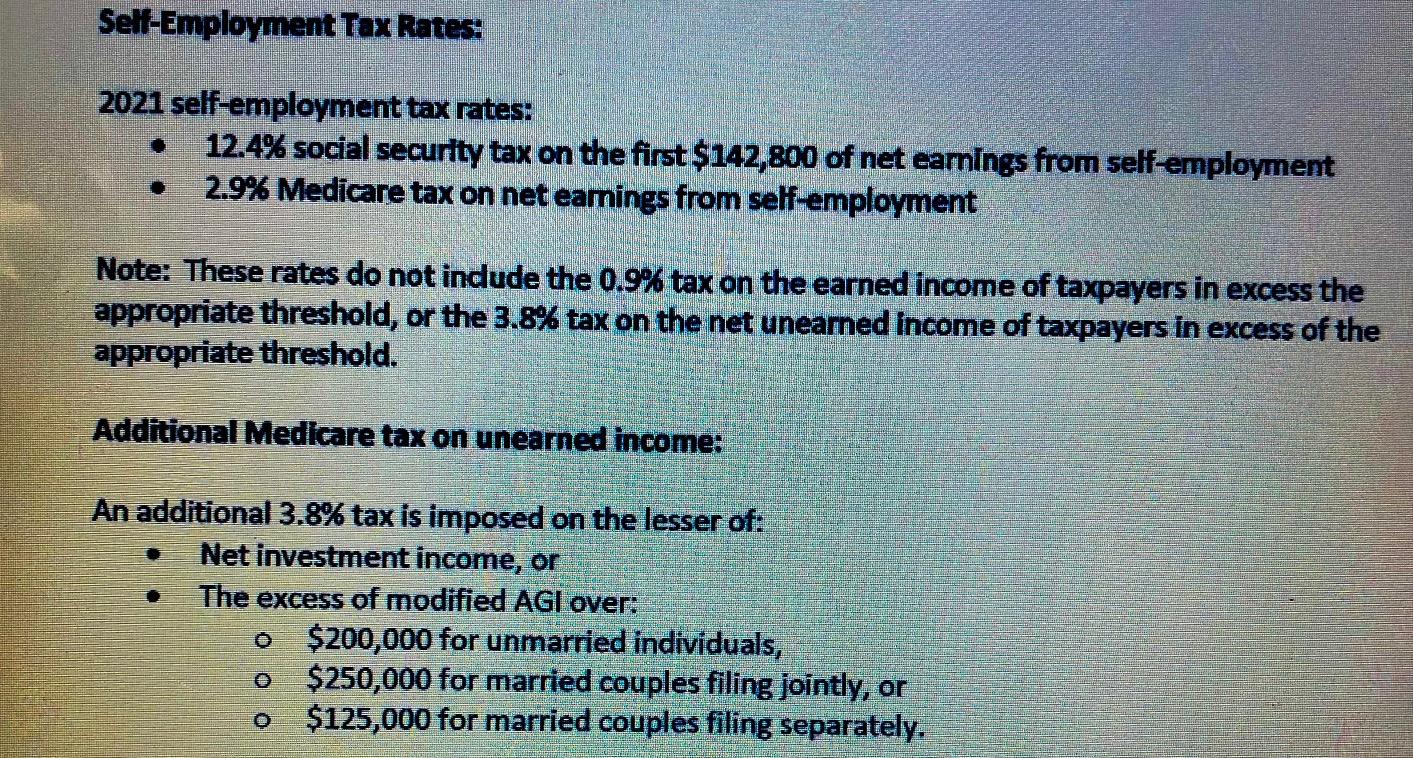

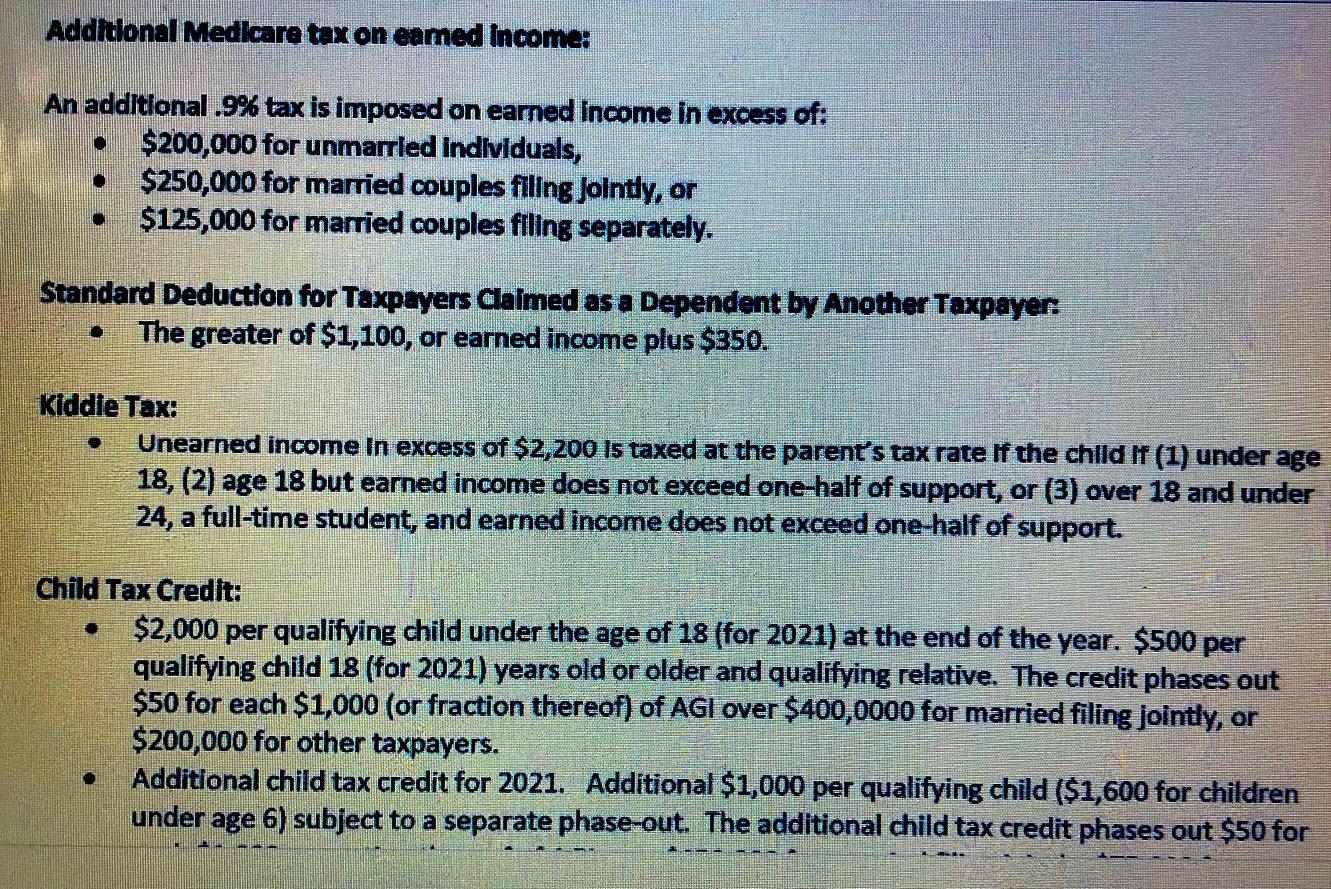

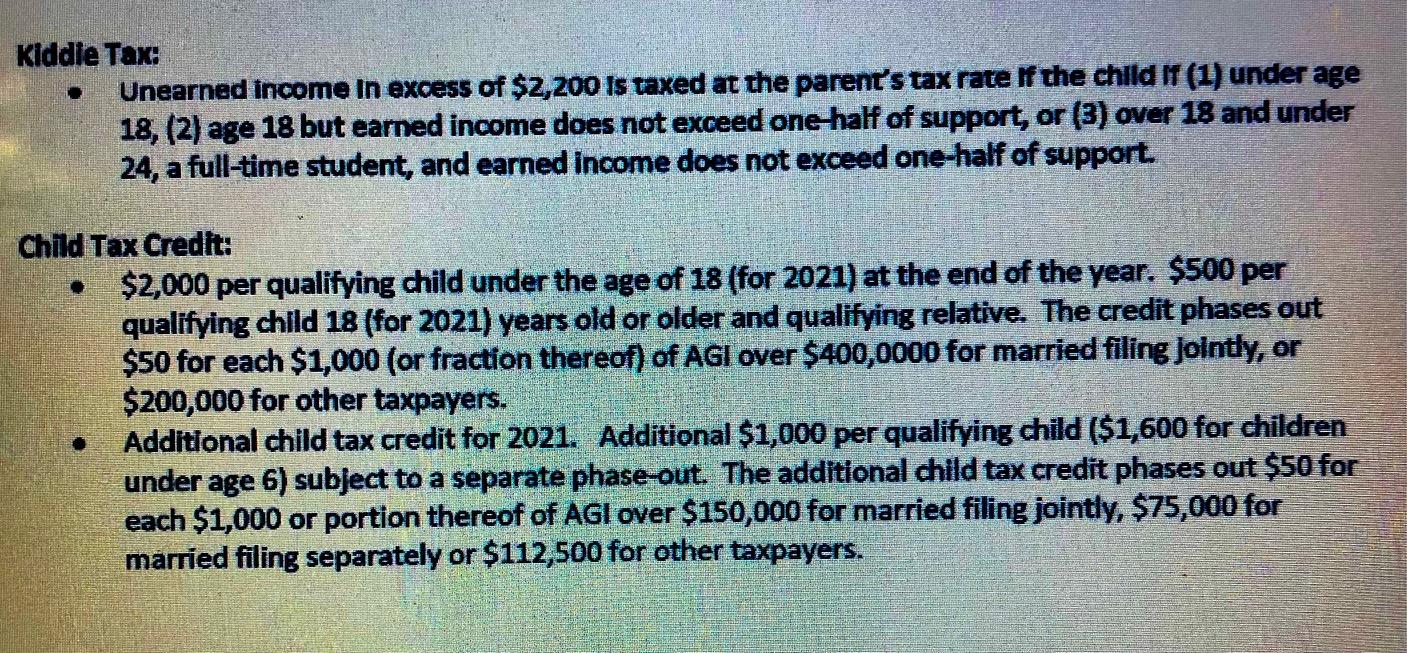

Tax Rates 2021 Tax Rate Schedules Individuals Schedule - Single Schedule tead of lourebold I taxable income i over: But not Income is But not over: The tax is: OYCE Over The tax is: $ $9.950 $0 $ 14,200 $ 40.525 $ 54,200 $6.375 $ 86,350 $ 9,950 10% of taxable income $ 40,525 $995 plus 12% of the excess over $9.950 S 86,375 $4,664 plus 22% of the excess Over $40.525 $164.925 $14.751 plus 24% of the excess over $86,375 5209.425 $33,603 plus 32% of the facce over $164.925 $523.600 $47,843 plus 35% of the excess over $209,425 $157,804.25 plus 37% of the excess over S523,600 $ 14,200 10% of taxable income $ 54,200 $1,420 plus 12% of the excess over $14,200 $ 86,350 $6,220 plus 22% of the excess over $84.200 $164,900 $13,293 plus 24% of the excess over $86.350 $209.40 $32,145 plus 32% of the excess Over $164.900 $523,600 $46,385 plus 35% of the excess over $209,400 $156,355 plus 37% of the excess over $823,600 $164.925 $164.900 $209.425 $209,400 323.600 $523,600 Schedule 1.2-Marrie Filing Separately Schedulc Y-1-Varried Filing Jointly or Qualifying Widower) Il taxahle Incerne le over: If taxahle income is But me The fax is: But not over: The tax is: $ 0 $ 9,950 $ 19,900 $ 40.525 $ 81,050 $ 86,375 $172.750 $ 19.900 10% of taable income $ 81,050 $1.990 plus 12% of the excers over $19.900 $172.750 $9,328 plus 22% of the excess over $81,050 $329,850 $29.502 plus 24% of the creess over $172.750 $418.850 367.206 plus 324 of the excess over $329.850 5628 300 $95.686 plus 35% of the excess over 18.850 $168.993.50 plus 37% of the excess over $628,300 $ 9.950 10% of taxable income $ 40.525 $995 plus 12% of the eco Over $9.950 S 86,375 $4,664 plus 22% of the excess over $40.525 $164,925 $14,751 plus 24% of the excess over $86.375 $209,425 $33,603 plus 32% of the CECESS over $164,925 $314.150 $47,843 plus 35% of the excess over $209,425 $84.496.75 plus 37% of the excess over $314,150 $164.925 $329,850 $209.425 18,850 $314.150 S600 Estates and Trusts It tas atalt incone is But not uter *ET The tuns $ 0 $ 2,630 $ 2.650 $ 9.550 $13.050 10% of taxable income $265 plus 24% of the excess over $2,650 $1.921 plus 35% of the ence over $9,550 $3,146 plus 37% of the excess Over $13,050 $13.00 Tax Rates for Net Capital Gains and Qualified Dividends Taxabic lupu Mamed Filing Jointly Married Flling Separately Single Thosts and Estates Household 15% SO-SR0.800 $80.801-$501.600 S501.601+ $0-$40,400 $40,401$250.800 $250,801+ 91)-$40.400 40 401-9445 899 $445.851 + $0-$54,100 $34,101-$473,750 $473,751+ $0-$2.700 $2.701-$13.250 $13,251+ This rute applies to the net capital gains and qualified dividends that fall within the Age of labic in unexpecific in the table (nt capital gains and qualified dividends are include in taxable income la lorts pusei. Basic Standard Deduction Amounts Amount of Each Additional Standard Deduction for Taxpayers Who Are Age 65 or Blind 2021 Filing Status Amount: Imant Married taxpayers $L,300 $1,650 $1350 $1,700 Married Filing Jointly Qualifying Widow or Widower Married Filing Separately Head of Household Single $24.800 $24,800 $12,400 $18.650 $12.400 $25.100 $25.100 $12.550 $18.800 $12.550 Single taxpayer or head of household Exemption Amount "Fur individuals calmada a dependent on muharrturn, the 2021 stanland deduction is the greater of (1) $1,100 er (2) $350 plus eamed income not to awesed he standard dedocdo anount of those who me not dependents, 2012 $4,300 $4300 Uved for qualifying relake gross income lei. Corporations Rute Dabie lacus Self-Employment Tax Rates: 2021 self-employment tax rates: 12.4% social security tax on the first $142,800 of net earnings from self-employment 2.9% Medicare tax on net eamings from self-employment 11 Note: These rates do not indude the 0.9% tax on the earned income of taxpayers in excess the appropriate threshold, or the 3.8% tax on the net uneamed Income of taxpayers in excess of the appropriate threshold. Additional Medicare tax on uneared income: An additional 3.8% tax is imposed on the lesser of: Net investment income, or The excess of modified AGI over: o $200,000 for unmarried individuals, o $250,000 for married couples filing jointly, or $125,000 for married couples filing separately. O Additional Medicare tax on eamed Income: An additional .9% tax is imposed on eamed Income in excess of: $200,000 for unmarrled individuals, $250,000 for married couples filing Jolnty, or $125,000 for married couples filing separately. Standard Deduction for Taxpayers claimed as a Dependent by Another Taxpayer. The greater of $1,100, or earned income plus $350. Kiddie Tax: Unearned income In excess of $2,200 Is taxed at the parent's tax rate if the child If (1) under age 18, (2) age 18 but earned income does not exceed one-half of support, or (3) over 18 and under 24, a full-time student, and earned income does not exceed one-half of support. Child Tax Credit: $2,000 per qualifying child under the age of 18 (for 2021) at the end of the year. $500 per qualifying child 18 (for 2021) years old or older and qualifying relative. The credit phases out $50 for each $1,000 (or fraction thereof) of AGI over $400,0000 for married filing jointly, or $200,000 for other taxpayers. Additional child tax credit for 2021. Additional $1,000 per qualifying child ($1,600 for children under age 6) subject to a separate phase-out. The additional child tax credit phases out $50 for Kiddie Tax: Unearned income in excess of $2,200 Is taxed at the parent's tax rate if the child IT (1) under age 18, (2) age 18 but earned income does not exceed one half of support, or (3) over 18 and under 24, a full-time student, and earned Income does not exceed one-half of support. Child Tax Credit: $2,000 per qualifying child under the age of 18 (for 2021) at the end of the year. $500 per qualifying child 18 (for 2021) years old or older and qualifying relative. The credit phases out $50 for each $1,000 (or fraction thereof) of AGI over $400,0000 for married filing jointly, or $200,000 for other taxpayers. Additional child tax credit for 2021. Additional $1,000 per qualifying child ($1,600 for children under age 6) subject to a separate phase-out. The additional child tax credit phases out $50 for each $1,000 or portion thereof of AGI over $150,000 for married filing jointly, $75,000 for married filing separately or $112,500 for other taxpayers. EDUCATION CREDITS AND DEDUCTIONS American opportunity Tax Credit -Maxof $2,500 for 2020 and 2021. Based on 100% of the first $2,000 and 25% of the next $2,000 on qualified tuition and course materials. Phase-out for the American Opportunity Tax Qedtls $80,000-90,000 for single file and $160,000-180,000 for married filing joint in 2020 and 2021. Literme Leaming $2,000 max per year, 20% of up to $10,000 qualified tultion for 2020 and 2021. 2020 phase-out for Lifetime the Learning Credit is $59,000-69,000 for single/HoH fller and $118,000-138,000 for marrledfiling jolnt. 2021 phase-out for lifetime the learning Credit is the same as the American Opportunity Tax Credit. Qualitled Higher Education Tuition Doduction-Amaximum $4,000 above the line deduction for qualified tuition if AGI is less than $65,000 for single/HOH and $130,000 married filing joint. Deduction is $2,000 If AGI Is between $65,000 -$80,000 for single/HOH and $130,000 - $160,000 for married filingJoint. This deduction is repealed for tax years beginning after December 31, Student Loan Interest Deduction-Deduction up to $2,500 for 2020 and 2021. Deduction MAGI phase-out for the student loan interest deduction is $70,000 $5,000 for single/head of household and $140,000-170,000 for married filing joint for 2020 and 2021. Child and Dependent Care Credit For 2021 amount of eligible expenses for the child and dependent care credit is the least of the following amounts: The total amount of dependent care expenditures for the year 2. $8,000 for one qualifying person or $16,000 for two or more qualifying persons; or 3. The taxpayer's eamed income. Married taxpayers must file a joint return and earned income for purposes of the limit is the earned income of the lessor earning spouse. Child and dependent care credit percentages: If AGI is over But not over Then the percentage is 50% 49 125,000 127,000 129,000 5125,000 127.000 129,000 131,000 48 21 20 181,000 183,000 400.000 402,000 183,000 400,000 402,000 404,000 19 18 2 434.000 436,000 438.000 436.000 438,000 1 0 Tax Rates 2021 Tax Rate Schedules Individuals Schedule - Single Schedule tead of lourebold I taxable income i over: But not Income is But not over: The tax is: OYCE Over The tax is: $ $9.950 $0 $ 14,200 $ 40.525 $ 54,200 $6.375 $ 86,350 $ 9,950 10% of taxable income $ 40,525 $995 plus 12% of the excess over $9.950 S 86,375 $4,664 plus 22% of the excess Over $40.525 $164.925 $14.751 plus 24% of the excess over $86,375 5209.425 $33,603 plus 32% of the facce over $164.925 $523.600 $47,843 plus 35% of the excess over $209,425 $157,804.25 plus 37% of the excess over S523,600 $ 14,200 10% of taxable income $ 54,200 $1,420 plus 12% of the excess over $14,200 $ 86,350 $6,220 plus 22% of the excess over $84.200 $164,900 $13,293 plus 24% of the excess over $86.350 $209.40 $32,145 plus 32% of the excess Over $164.900 $523,600 $46,385 plus 35% of the excess over $209,400 $156,355 plus 37% of the excess over $823,600 $164.925 $164.900 $209.425 $209,400 323.600 $523,600 Schedule 1.2-Marrie Filing Separately Schedulc Y-1-Varried Filing Jointly or Qualifying Widower) Il taxahle Incerne le over: If taxahle income is But me The fax is: But not over: The tax is: $ 0 $ 9,950 $ 19,900 $ 40.525 $ 81,050 $ 86,375 $172.750 $ 19.900 10% of taable income $ 81,050 $1.990 plus 12% of the excers over $19.900 $172.750 $9,328 plus 22% of the excess over $81,050 $329,850 $29.502 plus 24% of the creess over $172.750 $418.850 367.206 plus 324 of the excess over $329.850 5628 300 $95.686 plus 35% of the excess over 18.850 $168.993.50 plus 37% of the excess over $628,300 $ 9.950 10% of taxable income $ 40.525 $995 plus 12% of the eco Over $9.950 S 86,375 $4,664 plus 22% of the excess over $40.525 $164,925 $14,751 plus 24% of the excess over $86.375 $209,425 $33,603 plus 32% of the CECESS over $164,925 $314.150 $47,843 plus 35% of the excess over $209,425 $84.496.75 plus 37% of the excess over $314,150 $164.925 $329,850 $209.425 18,850 $314.150 S600 Estates and Trusts It tas atalt incone is But not uter *ET The tuns $ 0 $ 2,630 $ 2.650 $ 9.550 $13.050 10% of taxable income $265 plus 24% of the excess over $2,650 $1.921 plus 35% of the ence over $9,550 $3,146 plus 37% of the excess Over $13,050 $13.00 Tax Rates for Net Capital Gains and Qualified Dividends Taxabic lupu Mamed Filing Jointly Married Flling Separately Single Thosts and Estates Household 15% SO-SR0.800 $80.801-$501.600 S501.601+ $0-$40,400 $40,401$250.800 $250,801+ 91)-$40.400 40 401-9445 899 $445.851 + $0-$54,100 $34,101-$473,750 $473,751+ $0-$2.700 $2.701-$13.250 $13,251+ This rute applies to the net capital gains and qualified dividends that fall within the Age of labic in unexpecific in the table (nt capital gains and qualified dividends are include in taxable income la lorts pusei. Basic Standard Deduction Amounts Amount of Each Additional Standard Deduction for Taxpayers Who Are Age 65 or Blind 2021 Filing Status Amount: Imant Married taxpayers $L,300 $1,650 $1350 $1,700 Married Filing Jointly Qualifying Widow or Widower Married Filing Separately Head of Household Single $24.800 $24,800 $12,400 $18.650 $12.400 $25.100 $25.100 $12.550 $18.800 $12.550 Single taxpayer or head of household Exemption Amount "Fur individuals calmada a dependent on muharrturn, the 2021 stanland deduction is the greater of (1) $1,100 er (2) $350 plus eamed income not to awesed he standard dedocdo anount of those who me not dependents, 2012 $4,300 $4300 Uved for qualifying relake gross income lei. Corporations Rute Dabie lacus Self-Employment Tax Rates: 2021 self-employment tax rates: 12.4% social security tax on the first $142,800 of net earnings from self-employment 2.9% Medicare tax on net eamings from self-employment 11 Note: These rates do not indude the 0.9% tax on the earned income of taxpayers in excess the appropriate threshold, or the 3.8% tax on the net uneamed Income of taxpayers in excess of the appropriate threshold. Additional Medicare tax on uneared income: An additional 3.8% tax is imposed on the lesser of: Net investment income, or The excess of modified AGI over: o $200,000 for unmarried individuals, o $250,000 for married couples filing jointly, or $125,000 for married couples filing separately. O Additional Medicare tax on eamed Income: An additional .9% tax is imposed on eamed Income in excess of: $200,000 for unmarrled individuals, $250,000 for married couples filing Jolnty, or $125,000 for married couples filing separately. Standard Deduction for Taxpayers claimed as a Dependent by Another Taxpayer. The greater of $1,100, or earned income plus $350. Kiddie Tax: Unearned income In excess of $2,200 Is taxed at the parent's tax rate if the child If (1) under age 18, (2) age 18 but earned income does not exceed one-half of support, or (3) over 18 and under 24, a full-time student, and earned income does not exceed one-half of support. Child Tax Credit: $2,000 per qualifying child under the age of 18 (for 2021) at the end of the year. $500 per qualifying child 18 (for 2021) years old or older and qualifying relative. The credit phases out $50 for each $1,000 (or fraction thereof) of AGI over $400,0000 for married filing jointly, or $200,000 for other taxpayers. Additional child tax credit for 2021. Additional $1,000 per qualifying child ($1,600 for children under age 6) subject to a separate phase-out. The additional child tax credit phases out $50 for Kiddie Tax: Unearned income in excess of $2,200 Is taxed at the parent's tax rate if the child IT (1) under age 18, (2) age 18 but earned income does not exceed one half of support, or (3) over 18 and under 24, a full-time student, and earned Income does not exceed one-half of support. Child Tax Credit: $2,000 per qualifying child under the age of 18 (for 2021) at the end of the year. $500 per qualifying child 18 (for 2021) years old or older and qualifying relative. The credit phases out $50 for each $1,000 (or fraction thereof) of AGI over $400,0000 for married filing jointly, or $200,000 for other taxpayers. Additional child tax credit for 2021. Additional $1,000 per qualifying child ($1,600 for children under age 6) subject to a separate phase-out. The additional child tax credit phases out $50 for each $1,000 or portion thereof of AGI over $150,000 for married filing jointly, $75,000 for married filing separately or $112,500 for other taxpayers. EDUCATION CREDITS AND DEDUCTIONS American opportunity Tax Credit -Maxof $2,500 for 2020 and 2021. Based on 100% of the first $2,000 and 25% of the next $2,000 on qualified tuition and course materials. Phase-out for the American Opportunity Tax Qedtls $80,000-90,000 for single file and $160,000-180,000 for married filing joint in 2020 and 2021. Literme Leaming $2,000 max per year, 20% of up to $10,000 qualified tultion for 2020 and 2021. 2020 phase-out for Lifetime the Learning Credit is $59,000-69,000 for single/HoH fller and $118,000-138,000 for marrledfiling jolnt. 2021 phase-out for lifetime the learning Credit is the same as the American Opportunity Tax Credit. Qualitled Higher Education Tuition Doduction-Amaximum $4,000 above the line deduction for qualified tuition if AGI is less than $65,000 for single/HOH and $130,000 married filing joint. Deduction is $2,000 If AGI Is between $65,000 -$80,000 for single/HOH and $130,000 - $160,000 for married filingJoint. This deduction is repealed for tax years beginning after December 31, Student Loan Interest Deduction-Deduction up to $2,500 for 2020 and 2021. Deduction MAGI phase-out for the student loan interest deduction is $70,000 $5,000 for single/head of household and $140,000-170,000 for married filing joint for 2020 and 2021. Child and Dependent Care Credit For 2021 amount of eligible expenses for the child and dependent care credit is the least of the following amounts: The total amount of dependent care expenditures for the year 2. $8,000 for one qualifying person or $16,000 for two or more qualifying persons; or 3. The taxpayer's eamed income. Married taxpayers must file a joint return and earned income for purposes of the limit is the earned income of the lessor earning spouse. Child and dependent care credit percentages: If AGI is over But not over Then the percentage is 50% 49 125,000 127,000 129,000 5125,000 127.000 129,000 131,000 48 21 20 181,000 183,000 400.000 402,000 183,000 400,000 402,000 404,000 19 18 2 434.000 436,000 438.000 436.000 438,000 1 0

do not enter zeros. Helen has no AMT liability so you may omit Form 6251.

do not enter zeros. Helen has no AMT liability so you may omit Form 6251.