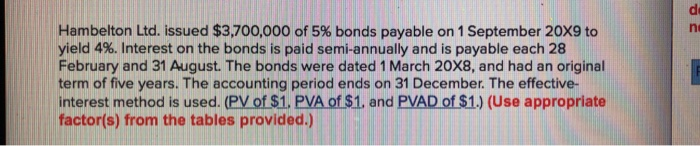

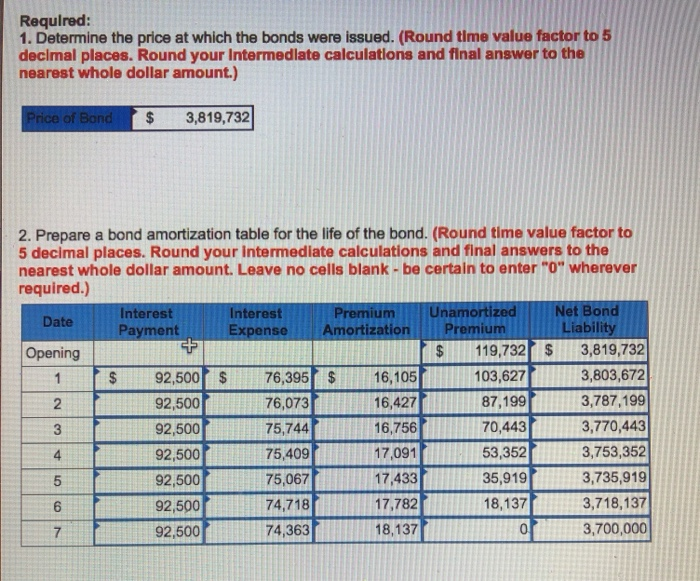

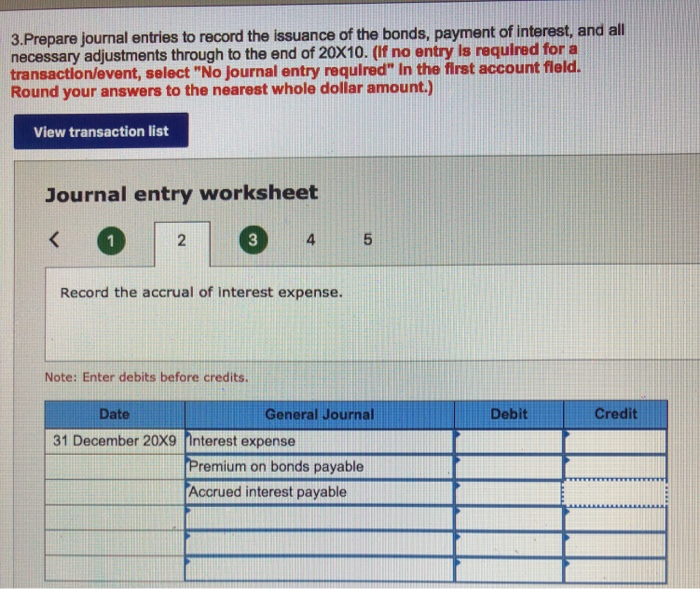

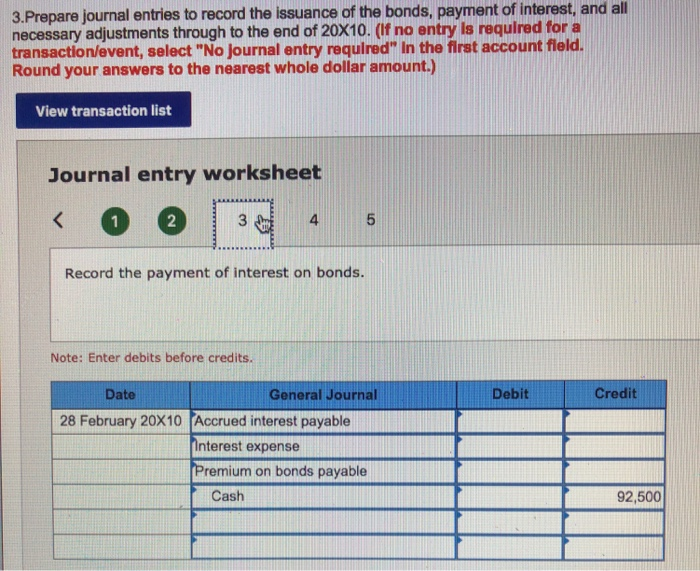

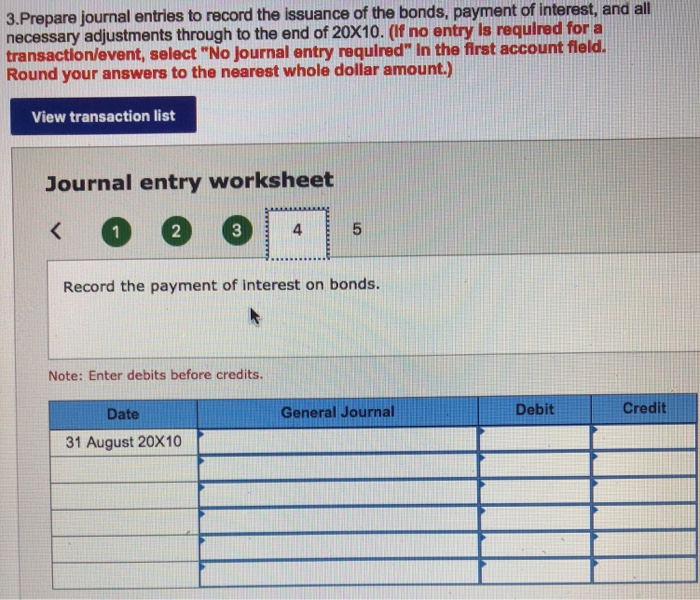

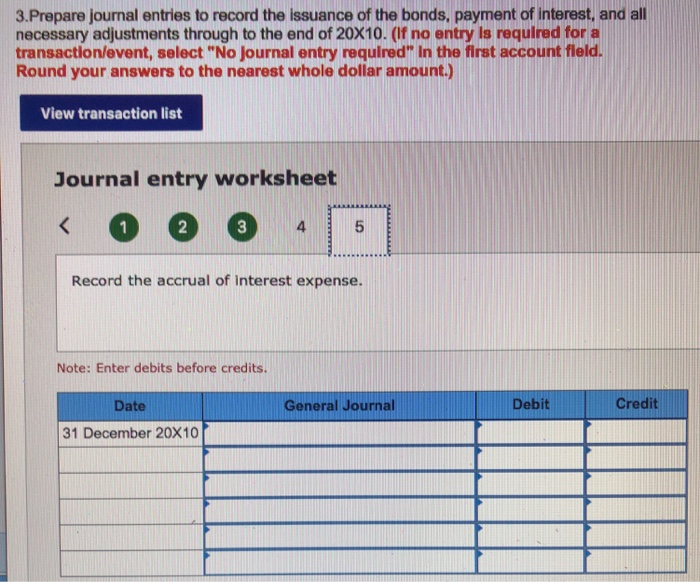

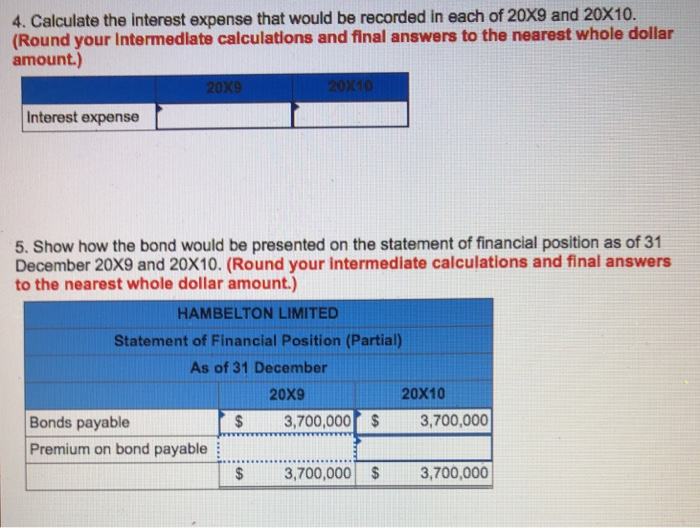

de Ham belton Ltd. issued $3,700,000 of 5% bonds payable on 1 September 20X9 to yield 4%. Interest on the bonds is paid semi-annually and is payable each 28 February and 31 August. The bonds were dated 1 March 20X8, and had an original term of five years. The accounting period ends on 31 December. The effective- interest method is used. (PV of $1. PVA of $1, and PVAD of $1.) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the price at which the bonds were issued. (Round time value factor to 5 declmal places. Round your Intermedlate calculations and final answer to the nearest whole dollar amount.) Price of Bond $3,819,732 2. Prepare a bond amortization table for the life of the bond. (Round time value factor to 5 decimal places. Round your intermediate calculations and final answers to the nearest whole dollar amount. Leave no cells blank- be certain to enter "O" wherever required.) Interest Payment Inmerest Expense Amortizati Premium UnamortizedNet Bond Liability onPremium $119,732 3,819,732 3,803,672 3,787,199 3,770,443 3,753,352 3,735,919 3,718,137 3,700,000 Opening $ 92,500 92,500 92,500 92,500 92,500 92,500 92,500 $92,500 76,395 16,105 76,073 75,744 75,409 75,067 74,718 74,363 16,427 16,756 17,091 17,433 17,782 18,137 103,627 87,199 70,443 53,352 35,919 18,137 0 2 4 6 3.Prepare journal entries to record the issuance of the bonds, payment of interest, and all necessary adjustments through to the end of 20X10. (If no entry is required for a transaction/event, select "No journal entry required" In the first account fleld. Round your answers to the nearest whole dollar amount.) View transaction list Journal entry worksheet 2 4 Record the accrual of interest expense. Note: Enter debits before credits. Date General Journal Debit Credit 31 December 20X9 Interest expense Premium on bonds payable Accrued interest payable payment of interest, and all 3.Prepare journal entries to record the issuance of the bonds, necessary adjustments through to the end of 20X10. (If no entry Is required for a transaction/event, select "No journal entry required" In the first account fleld. Round your answers to the nearest whole dollar amount.) View transaction list Journal entry worksheet 2 4 5 Record the payment of interest on bonds. Note: Enter debits before credits. Date General Journal Debit Credit Accrued interest payable Interest expense Premium on bonds payable 28 February 20X10 Cash 92,500 3.Prepare journal entries to record the issuance of the bonds, payment of interest, and all necessary adjustments through to the end of 20X10. (If no entry is required for a transaction/event, select "No journal entry required" In the first account fleld. Round your answers to the nearest whole dollar amount.) View transaction list Journal entry worksheet 2 3 4 Record the payment of interest on bonds. Note: Enter debits before credits. Date General Journal Debit Credit 31 August 20X10 3.Prepare journal entries to record the issuance of the bonds, payment of interest, and all necessary adjustments through to the end of 20X10. (If no entry ls requlred for a transaction/event, select "No Journal entry required" In the first account field. Round your answers to the nearest whole dollar amount.) View transaction list Journal entry worksheet 2 4 5 Record the accrual of interest expense. Note: Enter debits before credits. Date General Journal Debit Credit 31 December 20X10 4. Calculate the interest expense that would be recorded in each of 20X9 and 20X10. (Round your Intermedlate calculations and final answers to the nearest whole dollar amount.) 20x920X10 Interest expense 5. Show how the bond would be presented on the statement of financial position as of 31 December 20X9 and 20X10. (Round your intermediate calculations and final answers to the nearest whole dollar amount.) HAMBELTON LIMITED Statement of Financial Position (Partial) As of 31 December 20x9 20X10 $3,700,000$ 3,700,000 Bonds payable Premium on bond payable $ 3,700,000$ 3,700,000