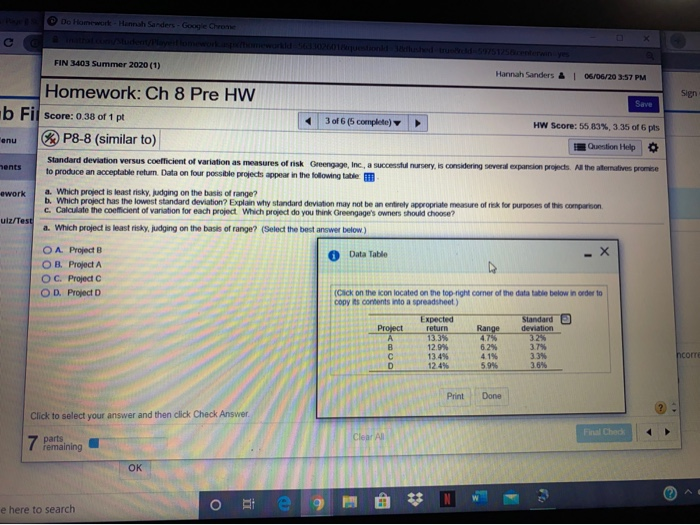

De Homework Hannah SarderGoog Chron Sign Save anu FIN 3403 Summer 2020 (1) Hannah Sanders & I 06/06/20 3:57 PM Homework: Ch 8 Pre HW b Fil Score: 0.38 of 1 pt 3 of 6 (5 complete) HW Score: 55 83% 3,35 of 6 pts P8-8 (similar to) Question Help 0 Standard deviation versus coefficient of variation as measures of risk Greengage, Inc., a succesul nursery, is considering several expansion projects. All the alternatives promise ents to produce an acceptable return. Data on four possible projects appear in the following table ework a. Which project is least risky, judging on the basis of range? b. Which project has the lowest standard deviation? Explain why standard deviation may not be an entirely appropriate measure of tiek for purposes of this comparison c. Calculate the coefficient of variation for each project which project do you think Greengage's owners should choose? uiz/Test a. Which project is least risky, judging on the basis of range? (Select the best answer below) O A Project B Data Table OB. Project A OC. Project OD. Project D (Click on the icon located on the top right corner of the datatable below in order to copy its contents into a spreadsheet) Expected Standard Project return Range deviation 13.3% 4.7% B 12.9% 6,2% 3.7% 13.4% 4.1% 3.3% D 12.4 5.9% 3.6% ncorre Print Done Click to select your answer and then click Check Answer Clear Al 7 parts remaining OK e here to search ORI e 9 De Homework Hannah SarderGoog Chron Sign Save anu FIN 3403 Summer 2020 (1) Hannah Sanders & I 06/06/20 3:57 PM Homework: Ch 8 Pre HW b Fil Score: 0.38 of 1 pt 3 of 6 (5 complete) HW Score: 55 83% 3,35 of 6 pts P8-8 (similar to) Question Help 0 Standard deviation versus coefficient of variation as measures of risk Greengage, Inc., a succesul nursery, is considering several expansion projects. All the alternatives promise ents to produce an acceptable return. Data on four possible projects appear in the following table ework a. Which project is least risky, judging on the basis of range? b. Which project has the lowest standard deviation? Explain why standard deviation may not be an entirely appropriate measure of tiek for purposes of this comparison c. Calculate the coefficient of variation for each project which project do you think Greengage's owners should choose? uiz/Test a. Which project is least risky, judging on the basis of range? (Select the best answer below) O A Project B Data Table OB. Project A OC. Project OD. Project D (Click on the icon located on the top right corner of the datatable below in order to copy its contents into a spreadsheet) Expected Standard Project return Range deviation 13.3% 4.7% B 12.9% 6,2% 3.7% 13.4% 4.1% 3.3% D 12.4 5.9% 3.6% ncorre Print Done Click to select your answer and then click Check Answer Clear Al 7 parts remaining OK e here to search ORI e 9