Answered step by step

Verified Expert Solution

Question

1 Approved Answer

DE LA three questions: 2:47:29 You have been asked to estimate the cost of capital for Gamma Tel, a telecom firm. The firm has the

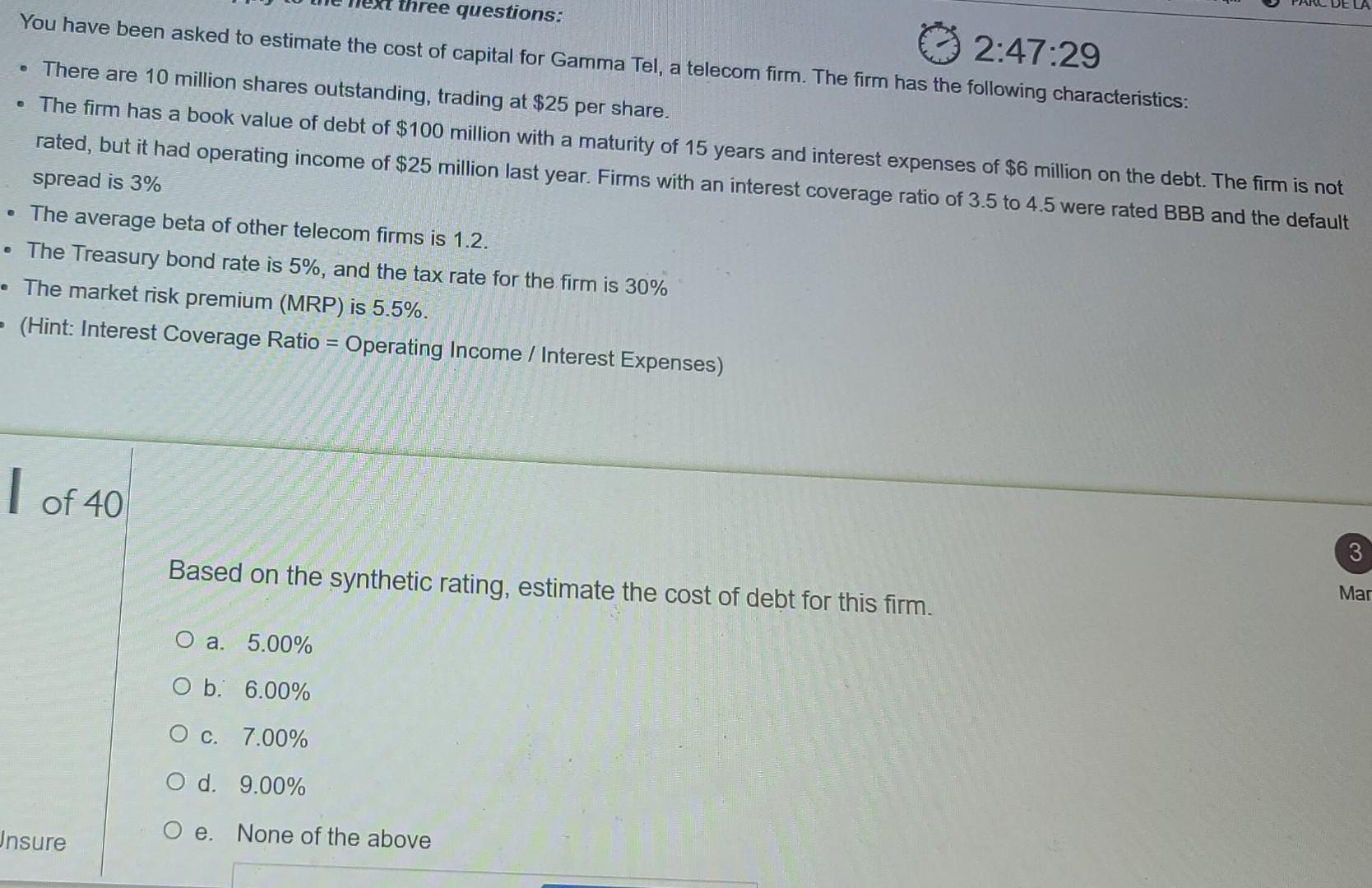

DE LA three questions: 2:47:29 You have been asked to estimate the cost of capital for Gamma Tel, a telecom firm. The firm has the following characteristics: There are 10 million shares outstanding, trading at $25 per share. The firm has a book value of debt of $100 million with a maturity of 15 years and interest expenses of $6 million on the debt. The firm is not rated, but it had operating income of $25 million last year. Firms with an interest coverage ratio of 3.5 to 4.5 were rated BBB and the default spread is 3% The average beta of other telecom firms is 1.2. The Treasury bond rate is 5%, and the tax rate for the firm is 30% The market risk premium (MRP) is 5.5%. - (Hint: Interest Coverage Ratio = Operating Income / Interest Expenses) I of 40 3 Based on the synthetic rating, estimate the cost of debt for this firm. Mar O a. 5.00% O b. 6.00% Oc. 7.00% O d. 9.00% Jnsure O e. None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started