Answered step by step

Verified Expert Solution

Question

1 Approved Answer

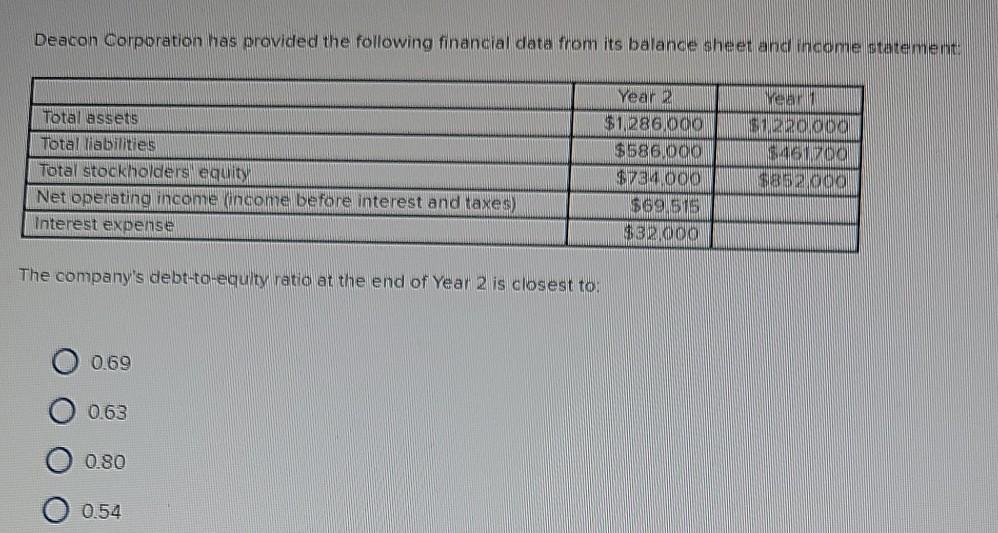

Deacon Corporation has provided the following financial data from its balance sheet and income statement Total assets Total liabilities Total stockholders equity Net operating income

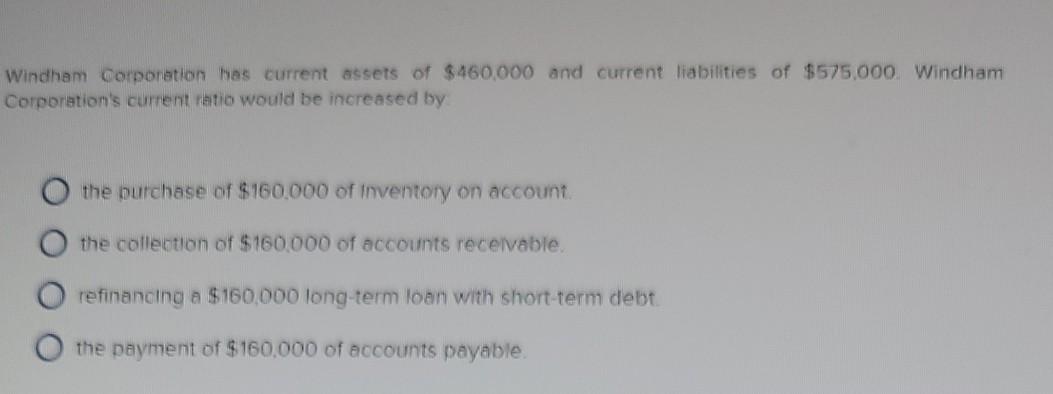

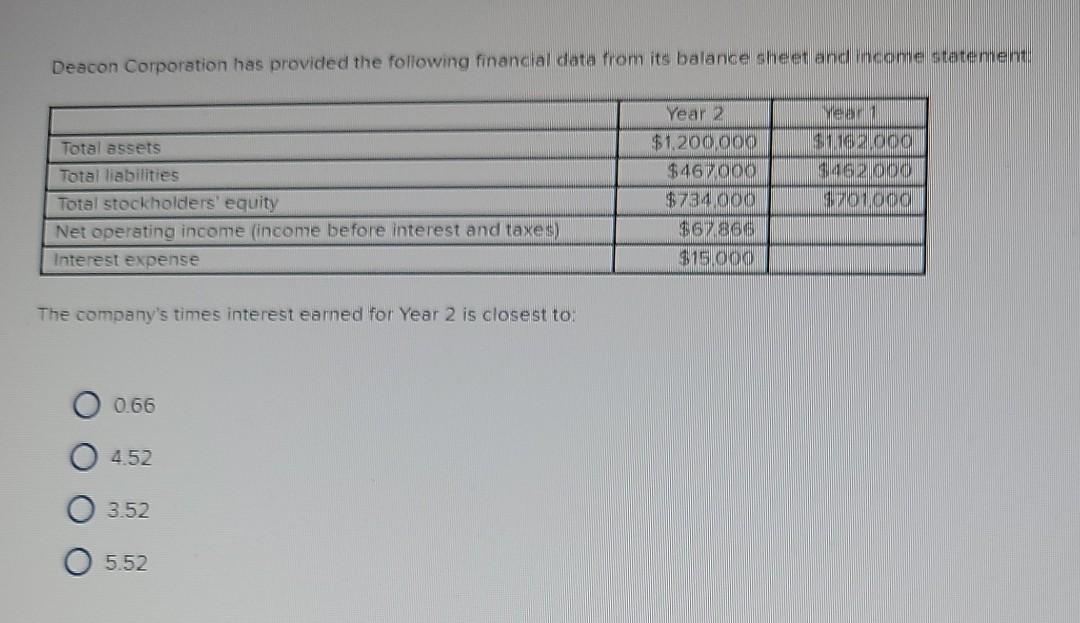

Deacon Corporation has provided the following financial data from its balance sheet and income statement Total assets Total liabilities Total stockholders equity Net operating income income before interest and taxes) Interest expense Year 2 $1,288000 $586 DOO $784 000 69 GS $32000 We 22000 DOT $85000 The company's debt-to-equity ratio at the end of Year 2 is closest to: 0.69 0.63 0.80 0.54 Windham Corporation has current assets of $460,000 and current liabilities of $575.000. Windham Corporation's current ratio would be increased by the purchase of $160,000 of Inventory on account the collection of $160.000 of accounts receivable. refinancing a $160,000 long-term loan with short-term debt the payment of $160,000 of accounts payable Deacon Corporation has provided the following financial data from its balance sheet and income statement Total assets Total liabilities Total stockholders' equity Net operating income (income before interest and taxes) Interest expense Year 2 $1,200.000 $46700 $734 000 $67866 $15.000 year 1 2000 262000 3201000 The company's times interest earned for Year 2 is closest to: 0.66 452 3.52 5.52

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started