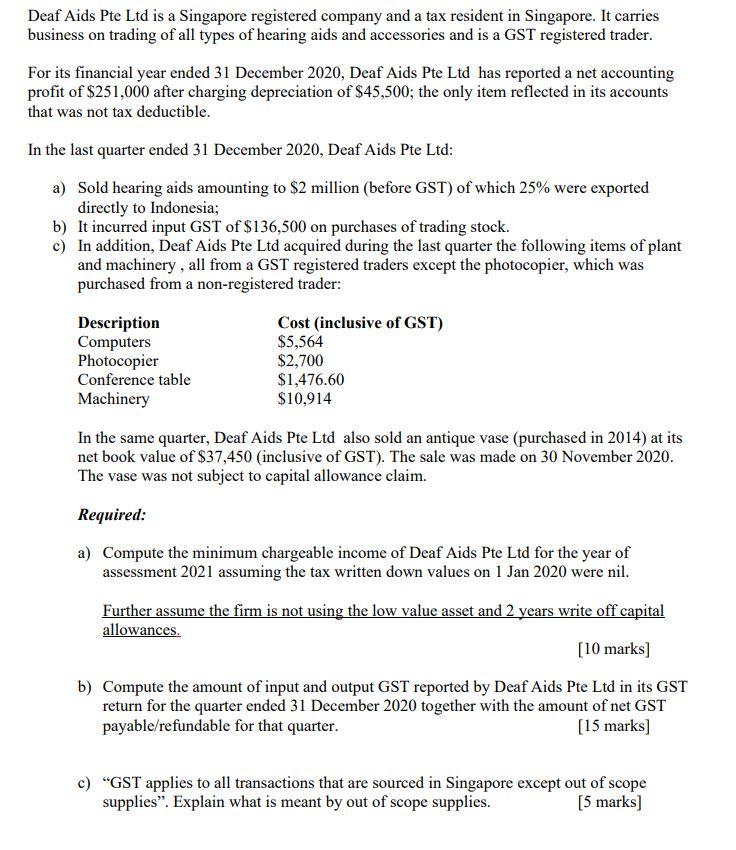

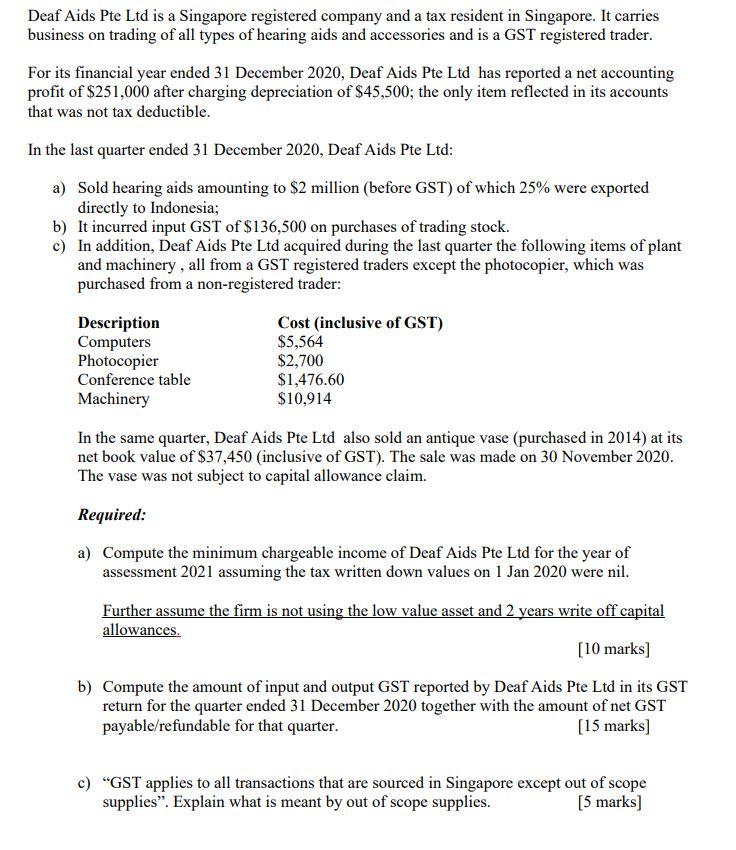

Deaf Aids Pte Ltd is a Singapore registered company and a tax resident in Singapore. It carries business on trading of all types of hearing aids and accessories and is a GST registered trader. For its financial year ended 31 December 2020, Deaf Aids Pte Ltd has reported a net accounting profit of $251,000 after charging depreciation of $45,500; the only item reflected in its accounts that was not tax deductible. In the last quarter ended 31 December 2020, Deaf Aids Pte Ltd: a) Sold hearing aids amounting to $2 million (before GST) of which 25% were exported directly to Indonesia; b) It incurred input GST of $136,500 on purchases of trading stock. c) In addition, Deaf Aids Pte Ltd acquired during the last quarter the following items of plant and machinery, all from a GST registered traders except the photocopier, which was purchased from a non-registered trader: Description Cost (inclusive of GST) Computers $5,564 Photocopier $2,700 Conference table $1,476.60 Machinery $10,914 In the same quarter, Deaf Aids Pte Ltd also sold an antique vase (purchased in 2014) at its net book value of $37,450 (inclusive of GST). The sale was made on 30 November 2020. The vase was not subject to capital allowance claim. Required: a) Compute the minimum chargeable income of Deaf Aids Pte Ltd for the year of assessment 2021 assuming the tax written down values on 1 Jan 2020 were nil. Further assume the firm is not using the low value asset and 2 years write off capital allowances. [10 marks) b) Compute the amount of input and output GST reported by Deaf Aids Pte Ltd in its GST return for the quarter ended 31 December 2020 together with the amount of net GST payable/refundable for that quarter. [15 marks) c) GST applies to all transactions that are sourced in Singapore except out of scope supplies. Explain what is meant by out of scope supplies. (5 marks) Deaf Aids Pte Ltd is a Singapore registered company and a tax resident in Singapore. It carries business on trading of all types of hearing aids and accessories and is a GST registered trader. For its financial year ended 31 December 2020, Deaf Aids Pte Ltd has reported a net accounting profit of $251,000 after charging depreciation of $45,500; the only item reflected in its accounts that was not tax deductible. In the last quarter ended 31 December 2020, Deaf Aids Pte Ltd: a) Sold hearing aids amounting to $2 million (before GST) of which 25% were exported directly to Indonesia; b) It incurred input GST of $136,500 on purchases of trading stock. c) In addition, Deaf Aids Pte Ltd acquired during the last quarter the following items of plant and machinery, all from a GST registered traders except the photocopier, which was purchased from a non-registered trader: Description Cost (inclusive of GST) Computers $5,564 Photocopier $2,700 Conference table $1,476.60 Machinery $10,914 In the same quarter, Deaf Aids Pte Ltd also sold an antique vase (purchased in 2014) at its net book value of $37,450 (inclusive of GST). The sale was made on 30 November 2020. The vase was not subject to capital allowance claim. Required: a) Compute the minimum chargeable income of Deaf Aids Pte Ltd for the year of assessment 2021 assuming the tax written down values on 1 Jan 2020 were nil. Further assume the firm is not using the low value asset and 2 years write off capital allowances. [10 marks) b) Compute the amount of input and output GST reported by Deaf Aids Pte Ltd in its GST return for the quarter ended 31 December 2020 together with the amount of net GST payable/refundable for that quarter. [15 marks) c) GST applies to all transactions that are sourced in Singapore except out of scope supplies. Explain what is meant by out of scope supplies