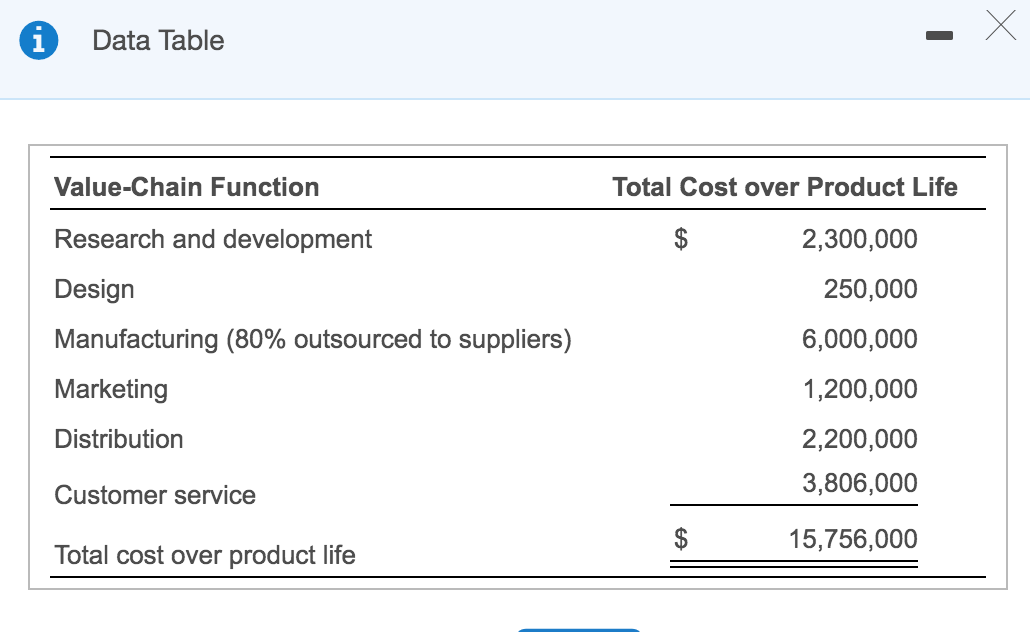

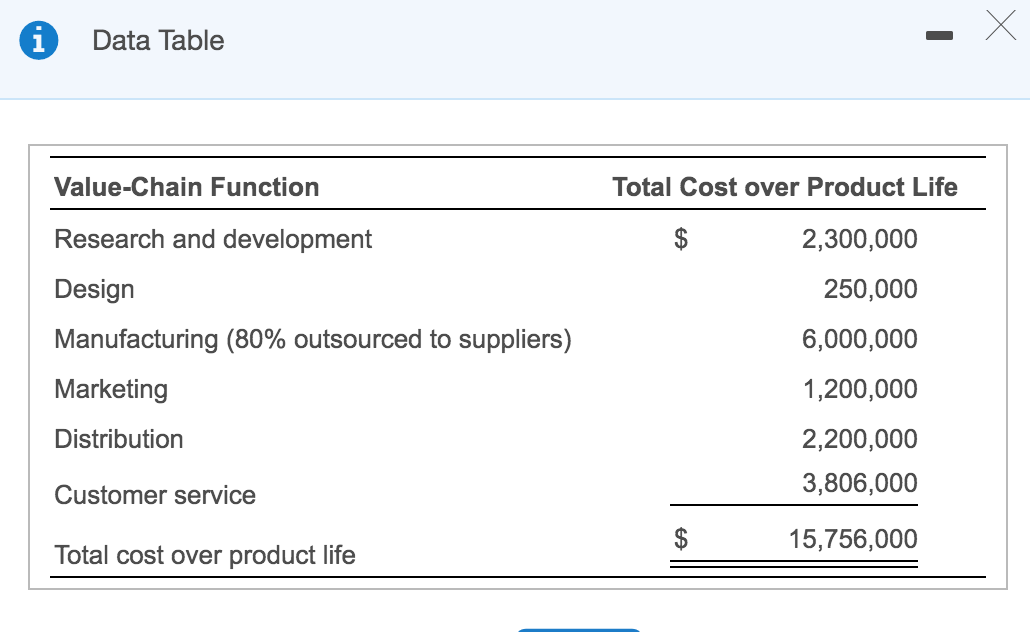

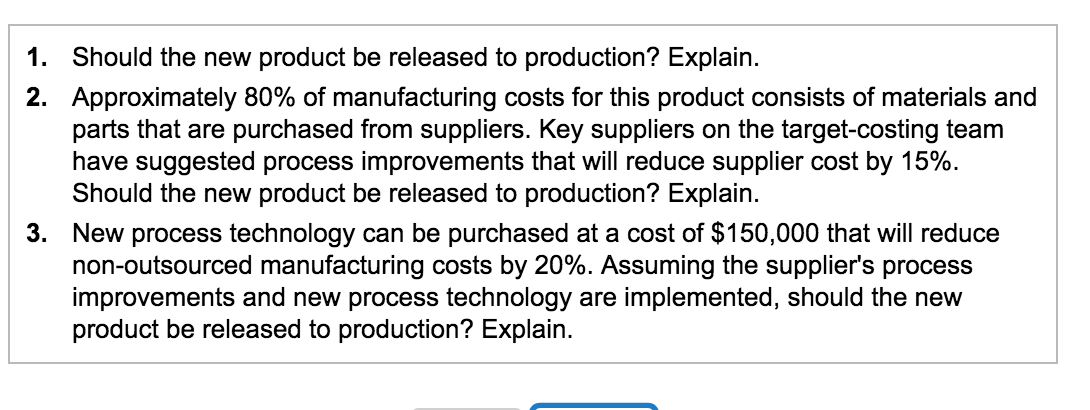

Deal Catcher Corporation uses target costing to aid in the final decision to release new products to production. A new product is being evaluated. Market research has surveyed the potential market for this product and believes that its unique features will generate a total demand over the product's life of 62,000 units at an average price of $340. The target costing team has members from market research, design, accounting, and production engineering departments. The team has worked closely with key customers and suppliers. A value analysis of the product has determined that the total cost for the various value-chain functions using the existing process technology are as follows: E: (Click the icon to view the total cost data.) Management has a target contribution to profit percentage of 30% of sales. This contribution provides sufficient funds to cover corporate support costs, taxes, and a reasonable profit. Read the requirements. Requirement 1. Should the new product be released to production? Explain. Begin by calculating the estimated excess contribution to or deficiency in profit from releasing the new product. (Use a minus sign or parentheses for a deficiency in profit.) Estimated contribution to profit Desired (target) contribution to profit Excess contribution to (deficiency in) profit Data Table Value-Chain Function Total Cost over Product Life Research and development 2,300,000 Design 250,000 Manufacturing (80% outsourced to suppliers) Marketing 6,000,000 1,200,000 2,200,000 3,806,000 Distribution Customer service 15,756,000 Total cost over product life 1. Should the new product be released to production? Explain. 2. Approximately 80% of manufacturing costs for this product consists of materials and parts that are purchased from suppliers. Key suppliers on the target-costing team have suggested process improvements that will reduce supplier cost by 15%. Should the new product be released to production? Explain. 3. New process technology can be purchased at a cost of $150,000 that will reduce non-outsourced manufacturing costs by 20%. Assuming the supplier's process improvements and new process technology are implemented, should the new product be released to production? Explain