Answered step by step

Verified Expert Solution

Question

1 Approved Answer

dear expert plz give me this 2 solution step by step plz ... i know only 1 question allow bt I have no credit left

dear expert plz give me this 2 solution step by step plz ... i know only 1 question allow bt I have no credit left remaining so plz expert give me answer step by step

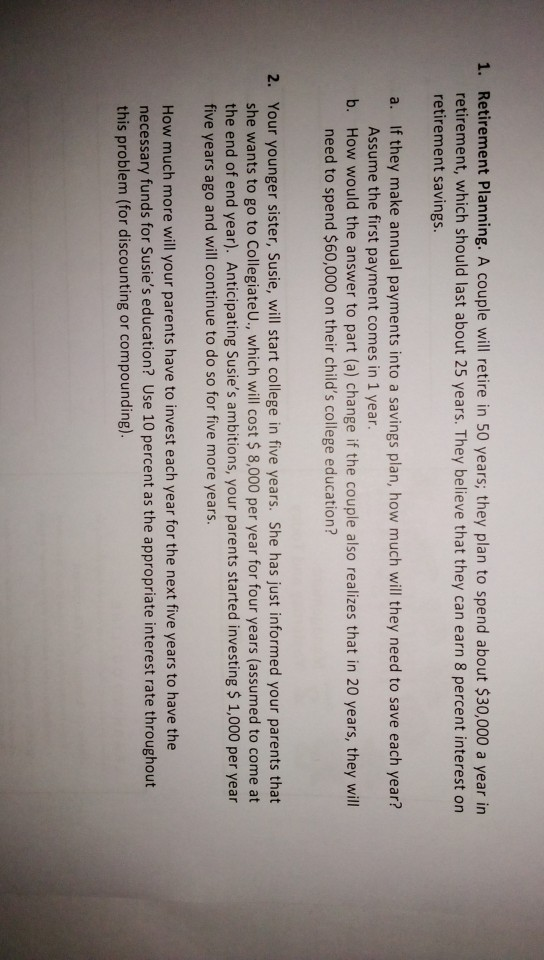

1. Retirement Planning. A couple will retire in 50 years, they plan to spend about $30,000 a year in retirement, which should last about 25 years. They believe that they can earn 8 percent interest on retirement savings. a. If they make annual payments into a savings plan, how much will they need to save each year? Assume the first payment comes in 1 year. b. How would the answer to part (a) change if the couple also realizes that in 20 years, they will need to spend $60,000 on their child's college education? 2. Your younger sister, Susie, will start college in five years. She has just informed your parents that she wants to go to CollegiateU., which will cost $ 8,000 per year for four years (assumed to come at the end of end year). Anticipating Susie's ambitions, your parents started investing $ 1,000 per year five years ago and will continue to do so for five more years. How much more will your parents have to invest each year for the next five years to have the necessary funds for Susie's education? Use 10 percent as the appropriate interest rate throughout this problem (for discounting or compounding)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started