Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dear Jacqueline, Below are the transactions that require journal entries. On February 3 , Year 1 , we received a quote for software development services

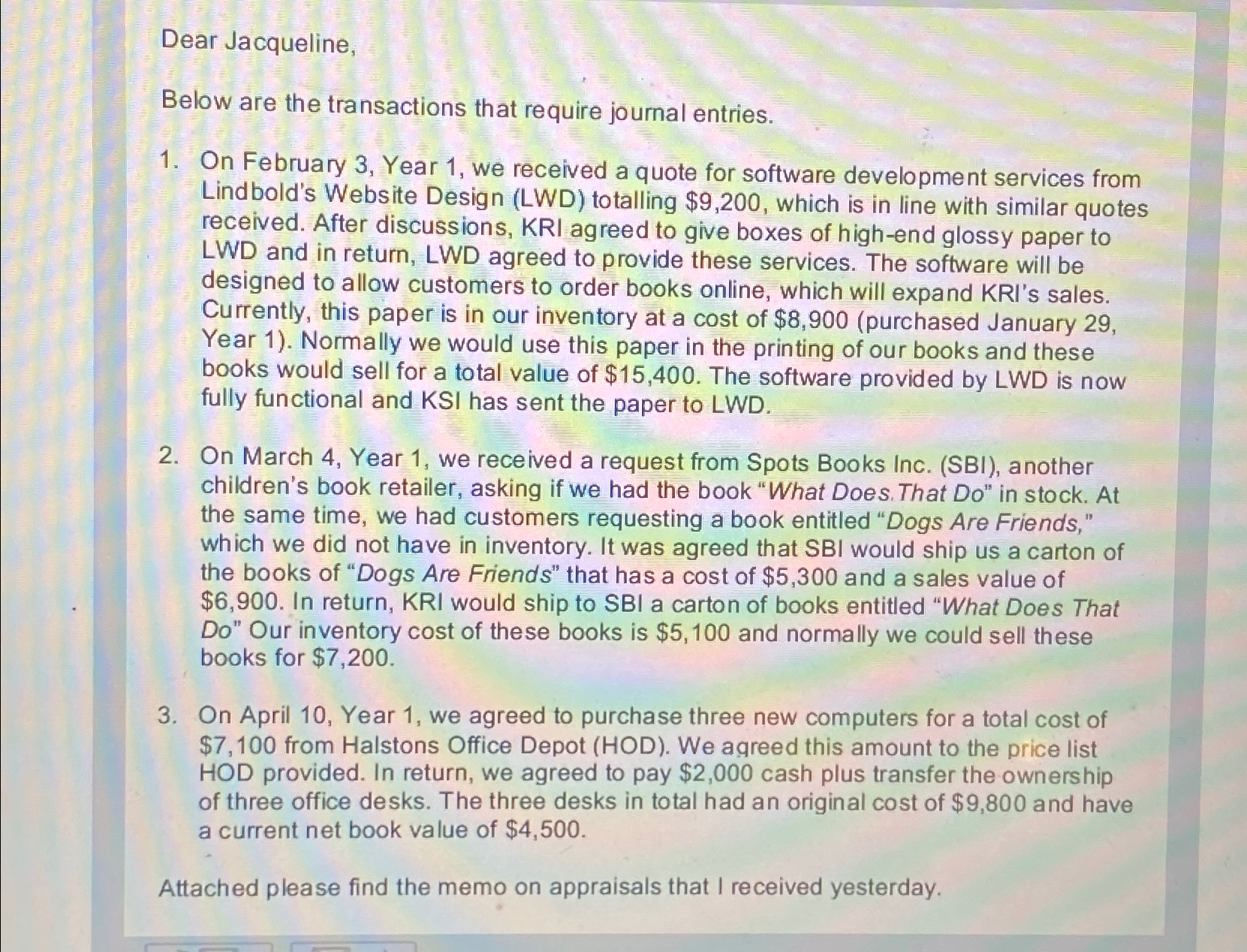

Dear Jacqueline,

Below are the transactions that require journal entries.

On February Year we received a quote for software development services from Lindbold's Website Design LWD totalling $ which is in line with similar quotes received. After discussions, KRI agreed to give boxes of highend glossy paper to LWD and in return, LWD agreed to provide these services. The software will be designed to allow customers to order books online, which will expand KRI's sales. Currently, this paper is in our inventory at a cost of $purchased January Year Normally we would use this paper in the printing of our books and these books would sell for a total value of $ The software provided by LWD is now fully functional and KSI has sent the paper to LWD

On March Year we received a request from Spots Books Inc. SBI another children's book retailer, asking if we had the book "What Does. That Do in stock. At the same time, we had customers requesting a book entitled "Dogs Are Friends," which we did not have in inventory. It was agreed that SBI would ship us a carton of the books of "Dogs Are Friends" that has a cost of $ and a sales value of $ In return, KRI would ship to SBI a carton of books entitled "What Does That Do Our inventory cost of these books is $ and normally we could sell these books for $

On April Year we agreed to purchase three new computers for a total cost of $ from Halstons Office Depot HOD We agreed this amount to the price list HOD provided. In return, we agreed to pay $ cash plus transfer the ownership of three office desks. The three desks in total had an original cost of $ and have a current net book value of $

Attached please find the memo on appraisals that I received yesterday.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started