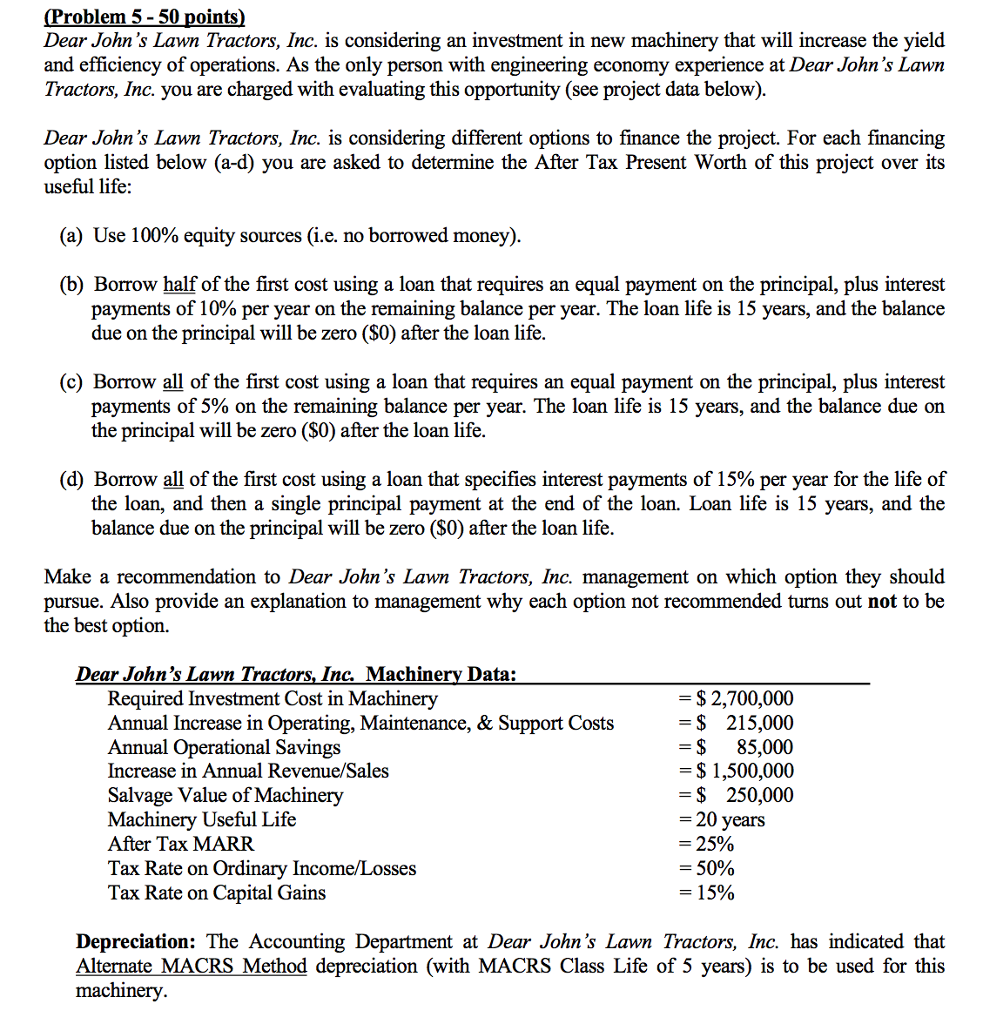

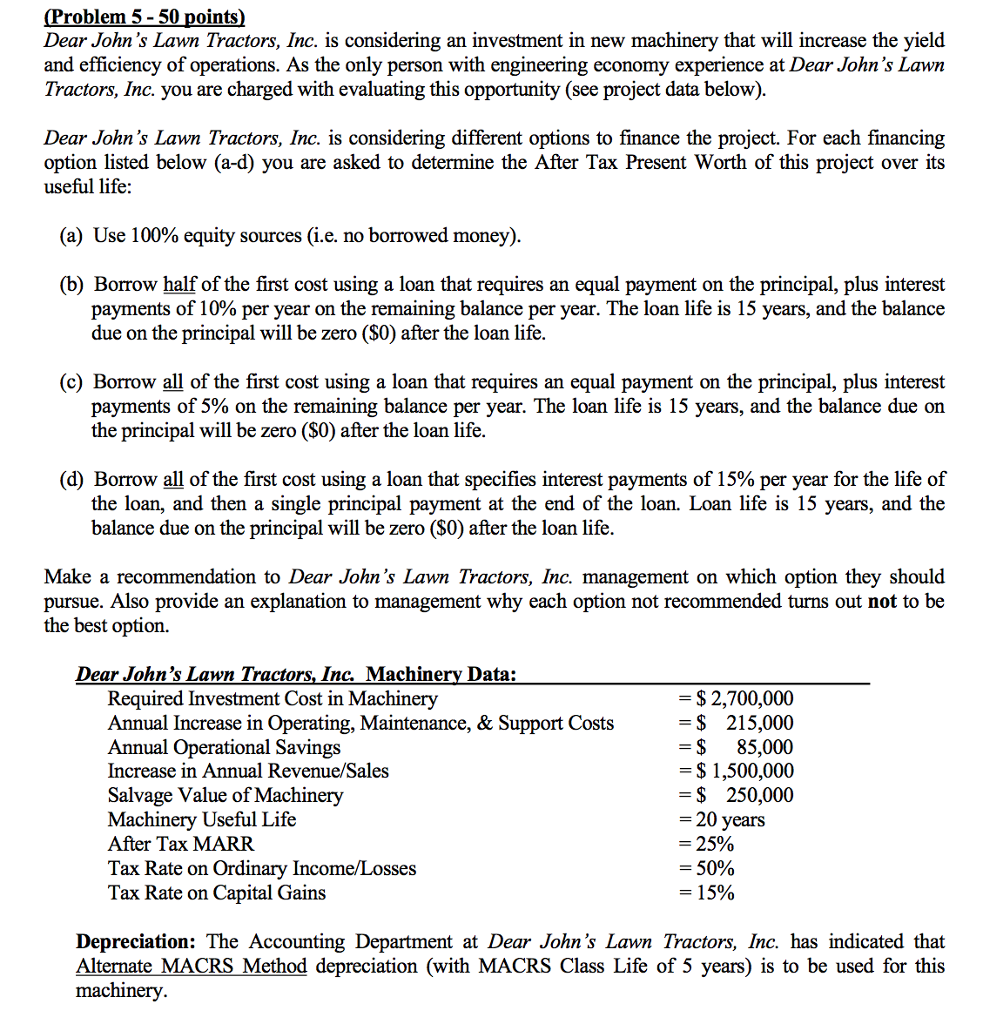

Dear John's Lawn Tractors, Inc. is considering an investment in new machinery that will increase the yield and efficiency of operations. As the only person with engineering economy experience at Dear John's Lawn Tractors, Inc. you are charged with evaluating this opportunity (see project data below). Dear John's Lawn Tractors, Inc. is considering different options to finance the project. For each financing option listed below (a-d) you are asked to determine the After Tax Present Worth of this project over its useful life: Use 100% equity sources (i.e. no borrowed money). Borrow half of the first cost using a loan that requires an equal payment on the principal, plus interest payments of 10% per year on the remaining balance per year. The loan life is 15 years, and the balance due on the principal will be zero ($0) after the loan life. Borrow all of the first cost using a loan that requires an equal payment on the principal, plus interest payments of 5% on the remaining balance per year. The loan life is 15 years, and the balance due on the principal will be zero ($0) after the loan life. Borrow all of the first cost using a loan that specifies interest payments of 15% per year for the life of the loan, and then a single principal payment at the end of the loan. Loan life is 15 years, and the balance due on the principal will be zero ($0) after the loan life. Make a recommendation to Dear John's Lawn Tractors, Inc. management on which option they should pursue. Also provide an explanation to management why each option not recommended turns out not to be the best option. Depreciation: The Accounting Department at Dear John's Lawn Tractors, Inc. has indicated that Alternate MACRS Method depreciation (with MACRS Class Life of 5 years) is to be used for this machinery. Dear John's Lawn Tractors, Inc. is considering an investment in new machinery that will increase the yield and efficiency of operations. As the only person with engineering economy experience at Dear John's Lawn Tractors, Inc. you are charged with evaluating this opportunity (see project data below). Dear John's Lawn Tractors, Inc. is considering different options to finance the project. For each financing option listed below (a-d) you are asked to determine the After Tax Present Worth of this project over its useful life: Use 100% equity sources (i.e. no borrowed money). Borrow half of the first cost using a loan that requires an equal payment on the principal, plus interest payments of 10% per year on the remaining balance per year. The loan life is 15 years, and the balance due on the principal will be zero ($0) after the loan life. Borrow all of the first cost using a loan that requires an equal payment on the principal, plus interest payments of 5% on the remaining balance per year. The loan life is 15 years, and the balance due on the principal will be zero ($0) after the loan life. Borrow all of the first cost using a loan that specifies interest payments of 15% per year for the life of the loan, and then a single principal payment at the end of the loan. Loan life is 15 years, and the balance due on the principal will be zero ($0) after the loan life. Make a recommendation to Dear John's Lawn Tractors, Inc. management on which option they should pursue. Also provide an explanation to management why each option not recommended turns out not to be the best option. Depreciation: The Accounting Department at Dear John's Lawn Tractors, Inc. has indicated that Alternate MACRS Method depreciation (with MACRS Class Life of 5 years) is to be used for this machinery