Dear Sir/Madam,

Please help me with this question and please write it down step by step so I can understand.

I promise I will upvote

Thanks a lot

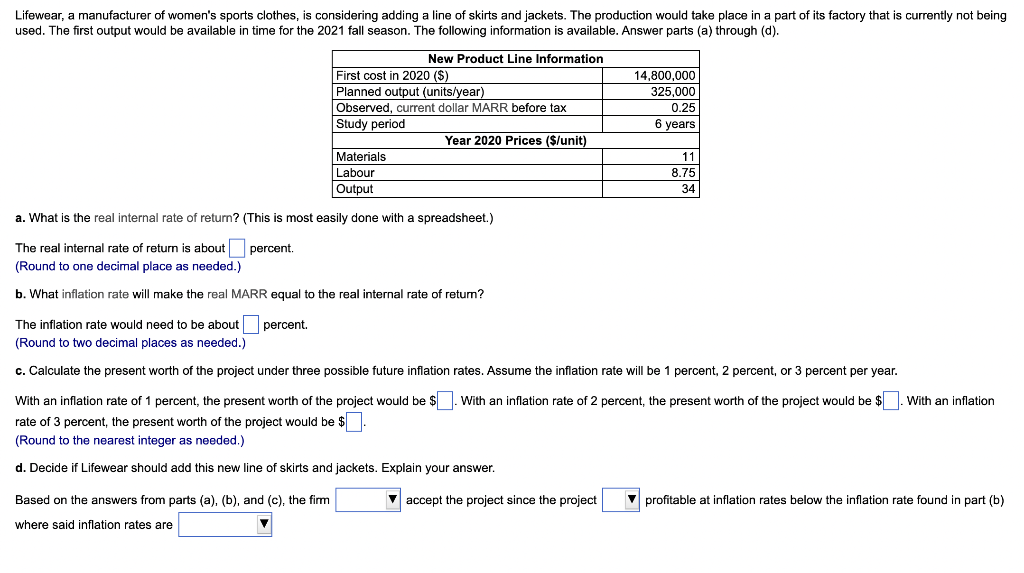

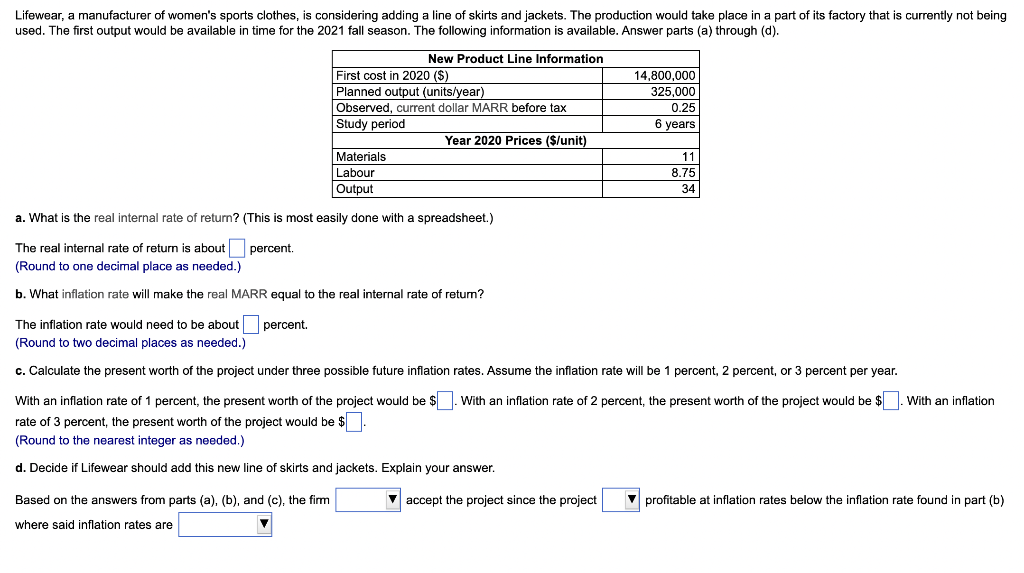

Lifewear, a manufacturer of women's sports clothes, is considering adding a line of skirts and jackets. The production would take place in a part of its factory that is currently not being used. The first output would be available in time for the 2021 fall season. The following information is available. Answer parts (a) through (d). New Product Line Information First cost in 2020 ($) Planned output (units/year) Observed, current dollar MARR before tax Study period Year 2020 Prices ($/unit) Materials Labour Output 14,800,000 325,000 0.25 6 years 11 8.75 34 a. What is the real internal rate of return? (This is most easily done with a spreadsheet.) The real internal rate of return is about percent. (Round to one decimal place as needed.) b. What inflation rate will make the real MARR equal to the real internal rate of return? The inflation rate would need to be about percent. (Round to two decimal places as needed.) c. Calculate the present worth of the project under three possible future inflation rates. Assume the inflation rate will be 1 percent, 2 percent, or 3 percent per year. With an inflation rate of 1 percent, the present worth of the project would be $ With an inflation rate of 2 percent, the present worth of the project would be $ . With an inflation rate of 3 percent, the present worth of the project would be $. (Round to the nearest integer as needed.) d. Decide if Lifewear should add this new line of skirts and jackets. Explain your answer. accept the project since the project profitable at inflation rates below the inflation rate found in part (b) Based on the answers from parts (a), (b), and (c), the firm where said inflation rates are Lifewear, a manufacturer of women's sports clothes, is considering adding a line of skirts and jackets. The production would take place in a part of its factory that is currently not being used. The first output would be available in time for the 2021 fall season. The following information is available. Answer parts (a) through (d). New Product Line Information First cost in 2020 ($) Planned output (units/year) Observed, current dollar MARR before tax Study period Year 2020 Prices ($/unit) Materials Labour Output 14,800,000 325,000 0.25 6 years 11 8.75 34 a. What is the real internal rate of return? (This is most easily done with a spreadsheet.) The real internal rate of return is about percent. (Round to one decimal place as needed.) b. What inflation rate will make the real MARR equal to the real internal rate of return? The inflation rate would need to be about percent. (Round to two decimal places as needed.) c. Calculate the present worth of the project under three possible future inflation rates. Assume the inflation rate will be 1 percent, 2 percent, or 3 percent per year. With an inflation rate of 1 percent, the present worth of the project would be $ With an inflation rate of 2 percent, the present worth of the project would be $ . With an inflation rate of 3 percent, the present worth of the project would be $. (Round to the nearest integer as needed.) d. Decide if Lifewear should add this new line of skirts and jackets. Explain your answer. accept the project since the project profitable at inflation rates below the inflation rate found in part (b) Based on the answers from parts (a), (b), and (c), the firm where said inflation rates are