Question

Deathly Ventures is a producer of video games that has outstanding debt maturing next year. The debt has a face value of $280 thousand and

Deathly Ventures is a producer of video games that has outstanding debt maturing next year. The debt has a face value of $280 thousand and an annual coupon with a coupon rate of 7.5%. The firm has just paid the coupon for the current year.

(a)(1point) How much will Deathly Ventures owe to its bondholders in one year?

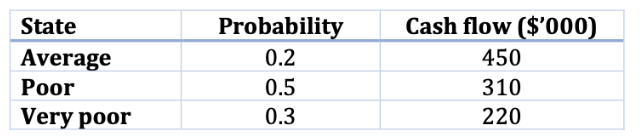

Deathly Ventures management is concerned about the firms prospects for the next year. A new competitor has entered the industry and appears to be taking some of their market share. In addition, they believe that the economy may be heading into recession. They have estimated their likely cash flow in three possible situations (or states of the world) as follows:

Assume that there are no taxes, and no explicit (accounting and legal) bankruptcy costs.

(b)(4points) What would happen to the firm, and what would be the resulting values of debt and equity, next year in each of the possible states?

(c)(4points) What are the expected values of the debt and equity next year? What are the standard deviations of those values across the three states?

Deathly Ventures debt currently has a market value of $250 thousand, while its equity has a market value of $27.5 thousand.T-Bills are currently yielding 2.2% per annum, while the excess return on the fully-diversified market portfolio is 4.4% per annum.

(d)(4points) Why would Deathly Ventures debt and equity be selling at discounts relative to their expected values next year? Do the relative discounts make sense?

(e)(8points) What are the implied annual rates of return on Deathly Venturesdebt and equity in the three states of the world? Hence, derive the expected returns on the two assets. What are the implied CAPM beta coefficients for the two assets?What is the weighted average cost of capital for Deathly Ventures?

State Average Poor Very poor Probability 0.2 0.5 0.3 Cash flow ($'000) 450 310 220 State Average Poor Very poor Probability 0.2 0.5 0.3 Cash flow ($'000) 450 310 220Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started