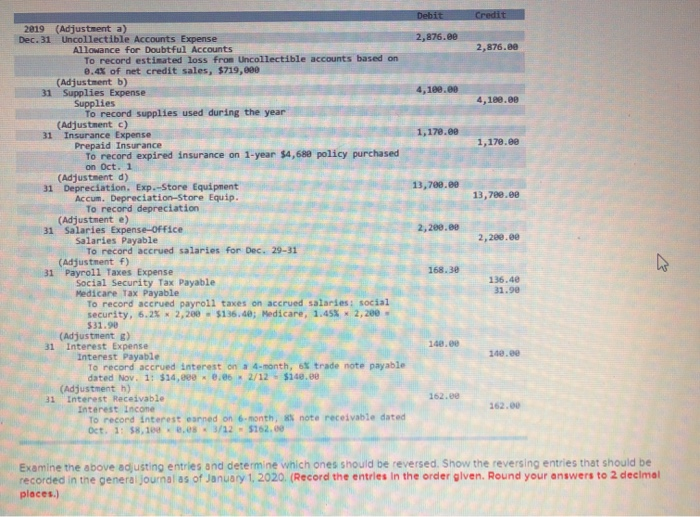

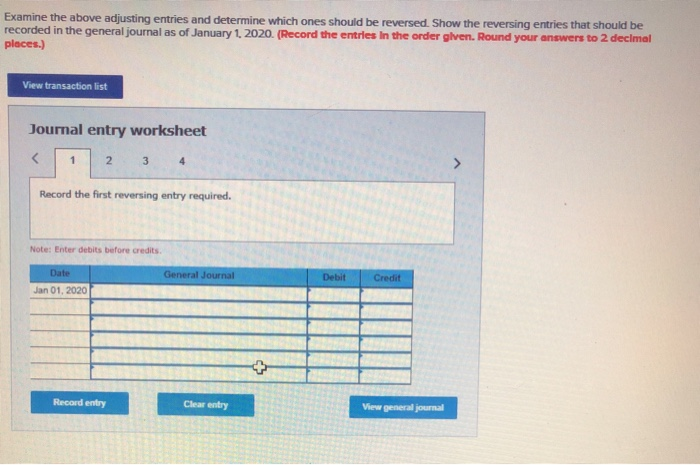

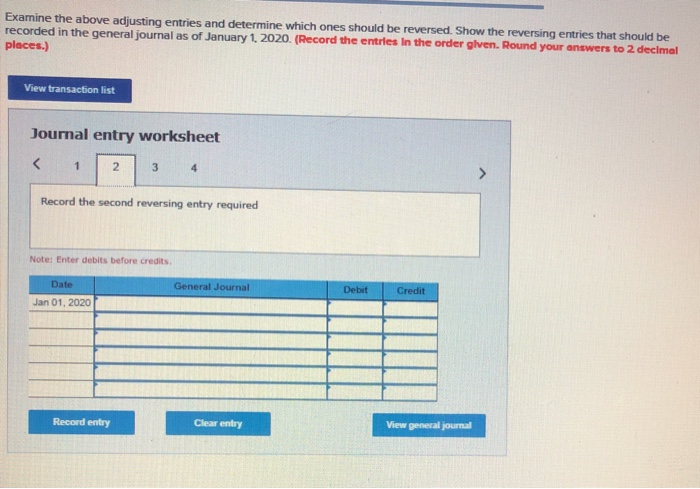

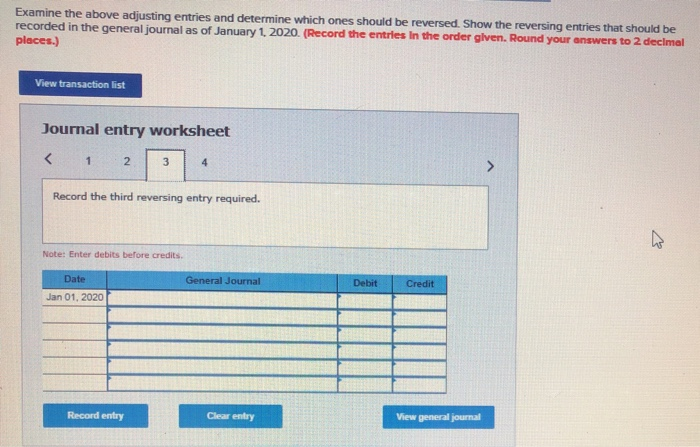

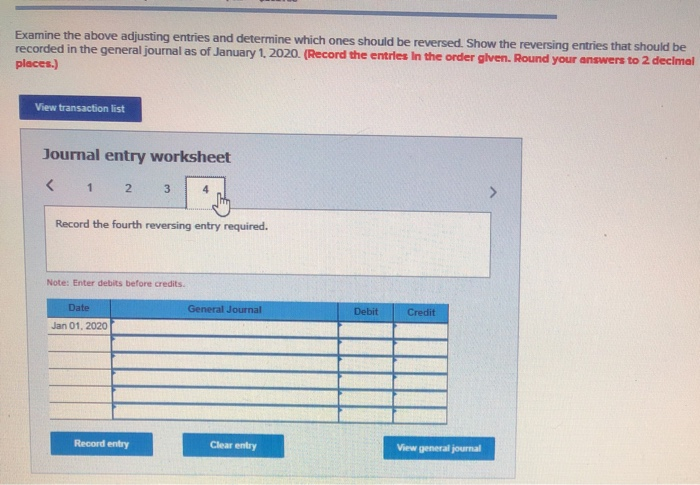

Debit credit 2,876.ee 4. 19. 1,170.ee el 2019 Adjustment a Dec.31 Uncollectible Accounts Expense Allowance for Doubtful Accounts To record estimated loss from Uncollectible accounts based on 8.4% of net credit sales, $719, (Adjustment b) 31 Supplies Expense Supplies To record supplies used during the year (Adjustment c) . 31 Insurance Expense Prepaid Insurance To record expired insurance on 1-year $4,689 policy on Oct. 1 (Adjustment d) 31 Depreciation. Exp.-Store Equipment Accum. Depreciation Store Equip. To record depreciation (Adjustment e) 31 Salaries Expense-Office Salaries Payable " To record accrued salaries for Dec. 29-31 (Adjustment f) 31 Payroll Taxes Expense Expense Social Security Tax Payable Medicare Tax Payable To record accrued payroll taxes on accrued salaries: security 5.2% x 2,200 = $136.40; Medicare, 1.45% reciation en (Adjustment ) 31 Interest Expense Interest Payable To record accrued interest on 1-month, 6* trade note payable dated Nov. 1: $14,000 0.862/12 (Adjustment h) 3 1 Interest Receivable Interest Income TO record interest earned on 6 month note receivable dated Oct. 1:58.10 0 .0 3/12 $152. Examine the above adjusting entries and determine which ones should be reversed. Show the reversing entries that should be recorded in the general Journalas of January 1, 2020. (Record the entries in the order glven. Round your answers to 2 decimal places.) Examine the above adjusting entries and determine which ones should be reversed. Show the reversing entries that should be recorded in the general journal as of January 1, 2020. (Record the entries in the order given. Round your answers to 2 decimal places.) View transaction list Journal entry worksheet 2 3 4 Record the first reversing entry required. Note: Enter debits before credits Date General Journal Debit Credit Jan 01, 2020 | LII Record entry Clear entry View general journal Examine the above adjusting entries and determine which ones should be reversed. Show the reversing entries that should be recorded in the general journal as of January 1, 2020. (Record the entries in the order glven. Round your answers to 2 decimal places.) View transaction list Journal entry worksheet