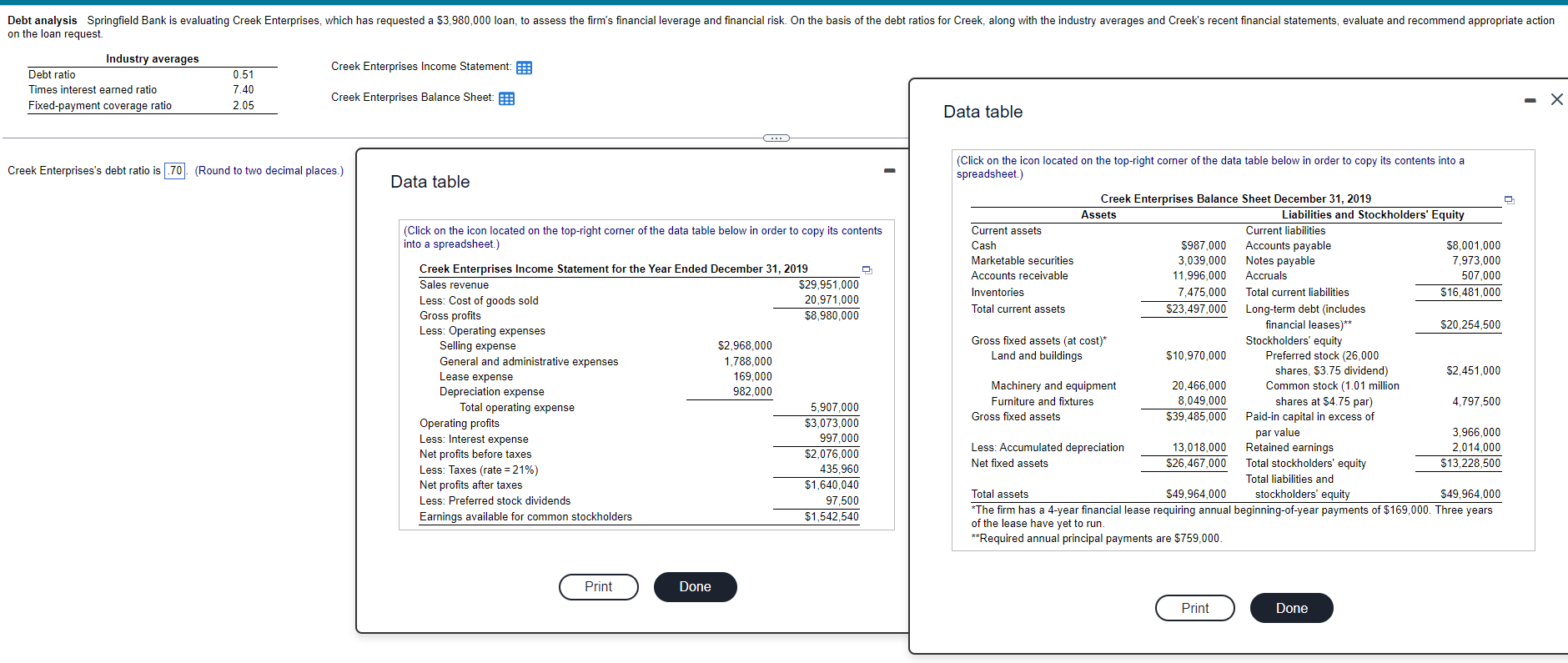

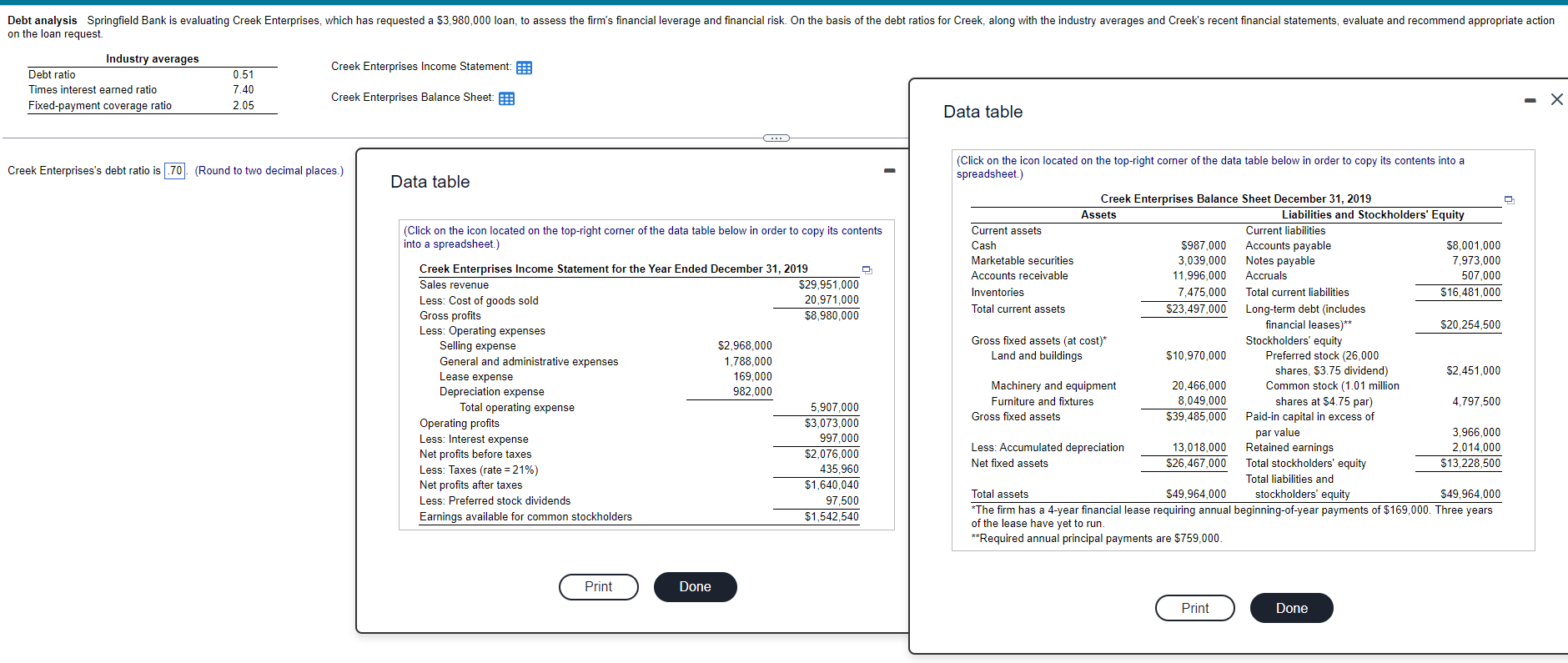

Debt analysis Springfield Bank is evaluating Creek Enterprises, which has requested a $3,980,000 loan, to assess the firm's financial leverage and financial risk. On the basis of the debt ratios for Creek, along with the industry averages and Creek's recent financial statements, evaluate and recommend appropriate action on the loan request. Creek Enterprises Income Statement : Industry averages Debt ratio Times interest earned ratio Fixed-payment coverage ratio 0.51 7.40 2.05 Creek Enterprises Balance Sheet: P: - X Data table . Creek Enterprises's debt ratio is .70. (Round to two decimal places.) Data table O (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Creek Enterprises Income Statement for the Year Ended December 31, 2019 Sales revenue $29,951,000 Less: Cost of goods sold 20,971,000 Gross profits $8,980,000 Less: Operating expenses Selling expense $2,968,000 General and administrative expenses 1,788,000 Lease expense 169,000 Depreciation expense 982,000 Total operating expense 5,907,000 Operating profits $3,073,000 Less: Interest expense 997,000 Net profits before taxes $2,076,000 Less: Taxes (rate = 21%) 435.960 Net profits after taxes $1,640,040 Less: Preferred stock dividends 97,500 Earnings available for common stockholders $1,542,540 (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Creek Enterprises Balance Sheet December 31, 2019 Assets Liabilities and Stockholders' Equity Current assets Current liabilities Cash $987,000 Accounts payable $8.001,000 Marketable securities 3,039,000 Notes payable 7,973,000 Accounts receivable 11,996,000 Accruals 507,000 Inventories 7,475,000 Total current liabilities $16,481,000 Total current assets $23,497,000 Long-term debt (includes financial leases)** $20,254,500 Gross fixed assets (at cost)* Stockholders' equity Land and buildings $10,970,000 Preferred stock (26,000 shares, $3.75 dividend) $2,451,000 Machinery and equipment 20,466,000 Common stock (1.01 million Furniture and fixtures 8,049,000 shares at $4.75 par) 4,797,500 Gross fixed assets $39,485,000 Paid-in capital in excess of par value 3.966.000 Less: Accumulated depreciation 13,018,000 Retained earnings 2,014,000 Net fixed assets $26,467,000 Total stockholders' equity S13,228,500 Total liabilities and Total assets $49,964,000 stockholders' equity $49,964,000 *The firm has a 4-year financial lease requiring annual beginning-of-year payments of $169,000. Three years of the lease have yet to run. **Required annual principal payments are $759,000 Print Done Print Done