Question

Debt, Cost of Equity and Cost of Capital 1. Check to see if your company (Nike) is rated by S&P or Moody's: just type in

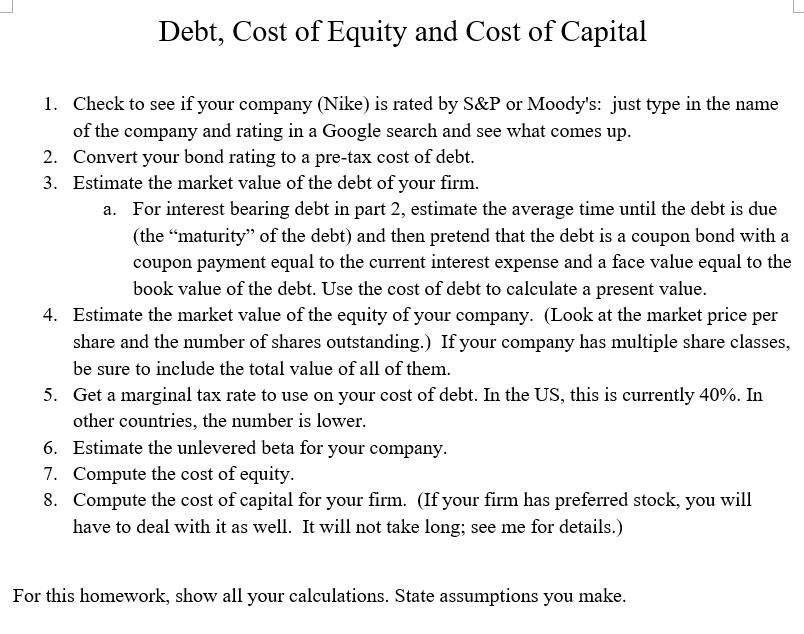

Debt, Cost of Equity and Cost of Capital 1. Check to see if your company (Nike) is rated by S&P or Moody's: just type in the name of the company and rating in a Google search and see what comes up. 2. Convert your bond rating to a pre-tax cost of debt. 3. Estimate the market value of the debt of your firm. a. For interest bearing debt in part 2, estimate the average time until the debt is due (the maturity of the debt) and then pretend that the debt is a coupon bond with a coupon payment equal to the current interest expense and a face value equal to the book value of the debt. Use the cost of debt to calculate a present value. 4. Estimate the market value of the equity of your company. (Look at the market price per share and the number of shares outstanding.) If your company has multiple share classes, be sure to include the total value of all of them. 5. Get a marginal tax rate to use on your cost of debt. In the US, this is currently 40%. In other countries, the number is lower. 6. Estimate the unlevered beta for your company. 7. Compute the cost of equity. 8. Compute the cost of capital for your firm. (If your firm has preferred stock, you will have to deal with it as well. It will not take long; see me for details.) For this homework, show all your calculations. State assumptions you make.

Debt, Cost of Equity and Cost of Capital Check to see if your company (Nike) is rated by S&P or Moody's: just type in the name of the company and rating in a Google search and see what comes up. Convert your bond rating to a pre-tax cost of debt. Estimate the market value of the debt of your firm. 1. 2. 3. For interest bearing debt in part 2, estimate the average time until the debt is due (the "maturity" of the debt) and then pretend that the debt is a coupon bond with a coupon payment equal to the cuent interest expense and a face value equal to the a. book value of the debt. Use the cost of debt to calculate a present value. Estimate the market value of the equity of your company. (Look at the market price per share and the number of shares outstanding.) If your company has multiple share classes, be sure to include the total value of all of them. Get a marginal tax rate to use on your cost of debt. In the US, this is currently 40%. In other countries, the number is lower Estimate the unlevered beta for your company. Compute the cost of equity Compute the cost of capital for your firm. (If your firm has preferred stock, you will have to deal with it as well. It will not take long: see me for details.) 4. 5. 6. 7. 8. For this homework, show all your calculations. State assumptions you make. Debt, Cost of Equity and Cost of Capital Check to see if your company (Nike) is rated by S&P or Moody's: just type in the name of the company and rating in a Google search and see what comes up. Convert your bond rating to a pre-tax cost of debt. Estimate the market value of the debt of your firm. 1. 2. 3. For interest bearing debt in part 2, estimate the average time until the debt is due (the "maturity" of the debt) and then pretend that the debt is a coupon bond with a coupon payment equal to the cuent interest expense and a face value equal to the a. book value of the debt. Use the cost of debt to calculate a present value. Estimate the market value of the equity of your company. (Look at the market price per share and the number of shares outstanding.) If your company has multiple share classes, be sure to include the total value of all of them. Get a marginal tax rate to use on your cost of debt. In the US, this is currently 40%. In other countries, the number is lower Estimate the unlevered beta for your company. Compute the cost of equity Compute the cost of capital for your firm. (If your firm has preferred stock, you will have to deal with it as well. It will not take long: see me for details.) 4. 5. 6. 7. 8. For this homework, show all your calculations. State assumptions you make

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started