Answered step by step

Verified Expert Solution

Question

1 Approved Answer

DEBT MANAGEMENT 1. Debt-to-capital Ratio 2. Time-Interest-Earned Ratio please calculate the debt management ratio from the 15 ratios of five aspect CONSOLIDATED STATEMENT OF FINANCIAL

DEBT MANAGEMENT 1. Debt-to-capital Ratio 2. Time-Interest-Earned Ratio

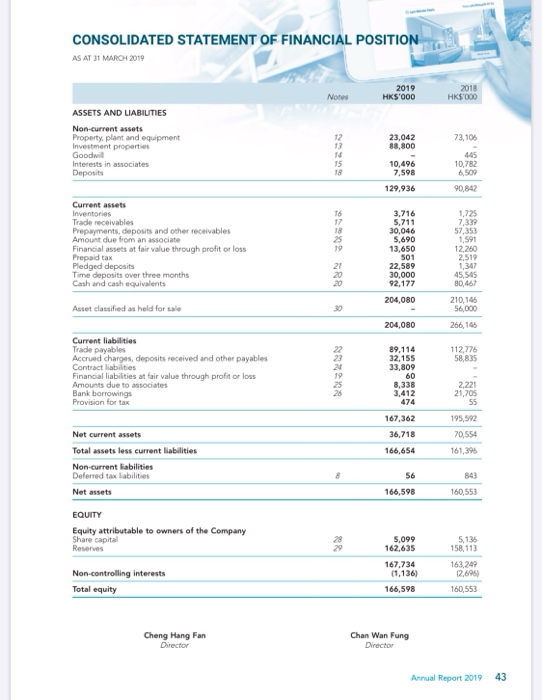

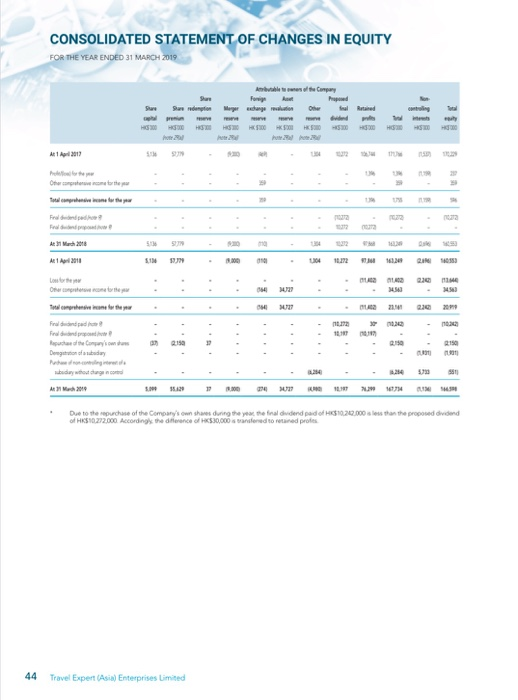

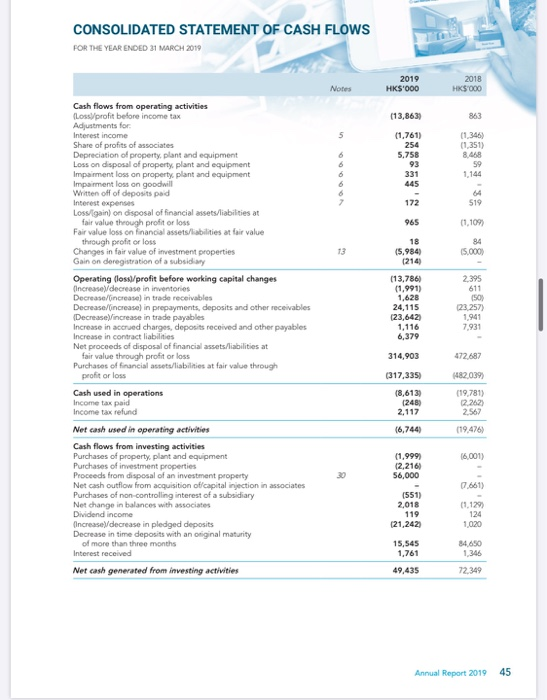

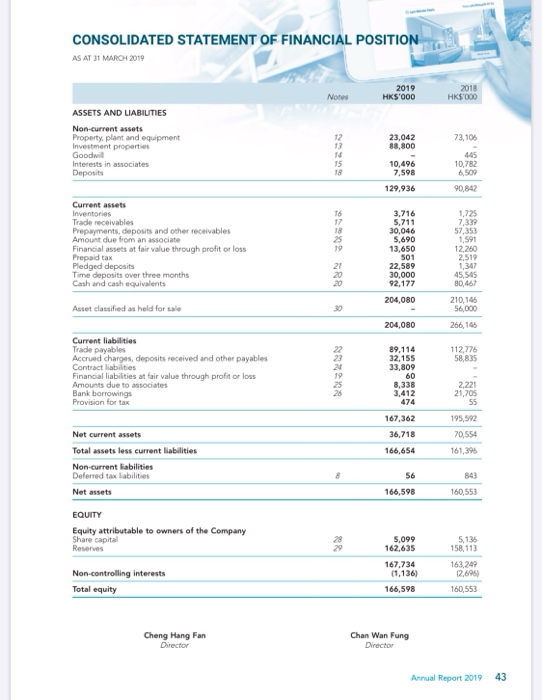

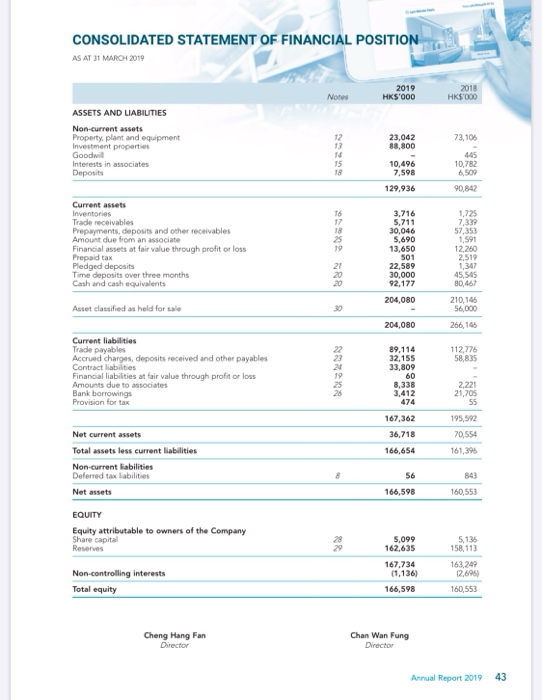

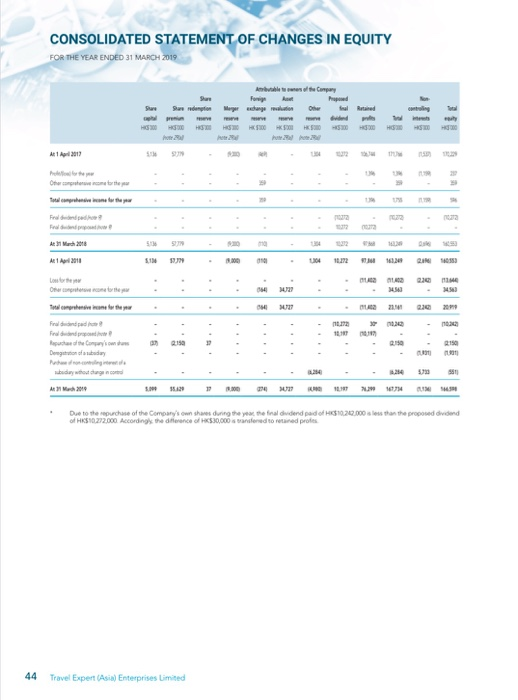

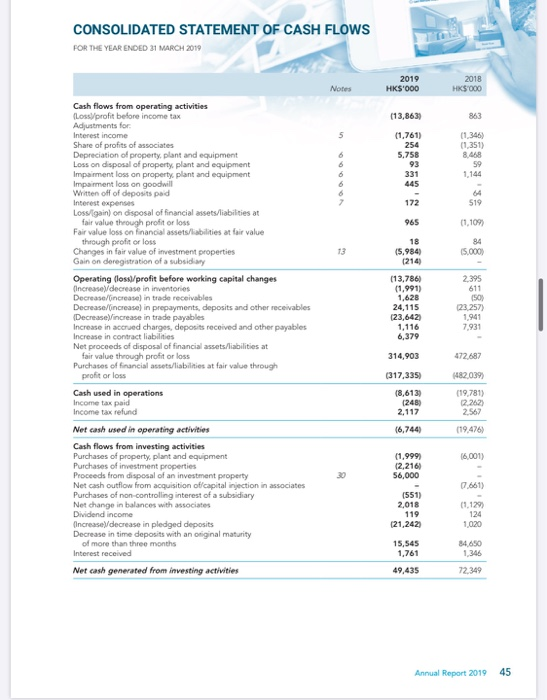

please calculate the debt management ratio from the 15 ratios of five aspect CONSOLIDATED STATEMENT OF FINANCIAL POSITION POSITION AS AT 31 MARCH 2019 2019 HKS'000 2018 Notes HK$'000 ASSETS AND LIABILTIES 23,042 88,800 73,106 Non-current assets Property, plant and equipment Investment properties Goodwil Interests in associates Deposit 10,496 7,598 10.782 6,50 129,936 90 BA? 3.716 Current assets Inventories Trade receivables Prepayments, deposits and other receivables Amount due from an associate Financial assets at fair value through profit or loss Prepaid tax Pledged deposits Time deposits over three months Cash and cash equivalents 30.046 5.690 13,650 501 22.589 30,000 92,177 1,725 7.329 52 353 1.591 12.260 2,519 45.545 8067 204,080 210 146 56,000 Asset classified as held for sale 204,080 266.145 89.114 32,155 33,809 112,776 58,835 Current liabilities Trade payables Accrued charges, deposits received and other payables Contract liabilities Financial liabilities at fair value through profit or loss Amounts due to associates Bank borrowings Provision for tax 8.338 3.412 2,221 21,705 167,362 Net current assets 36,718 166,654 195,592 70,554 161,396 Total assets less current liabilities Non-current abilities Deferred tax labilities Net assets 166,598 160,553 EQUITY Equity attributable to owners of the Company Share capital 5,099 162.635 5136 158 113 167,734 (1.136) Non-controlling interests 163,249 12.695) Total equity 166,598 160.553 Cheng Hang Fan Director Chan Wan Fung Director Annual Report 2019 43 CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED 31 MARCH 2019 . . IN . . . 2150 12 Dowody the e n d Due to the purchase of the Company's own she dung he of H 10272.000 According 10.000 w a ded ere to and protes 44 Travel Expert Asis) Enterprises Limited CONSOLIDATED STATEMENT OF CASH FLOWS FOR THE YEAR ENDED 31 MARCH 2019 2019 HKS'000 2018 Notes HK$ 000 (13,863) 863 (1,761) 254 5.758 11.345) (1351) 8468 59 1,144 93 Cash flows from operating activities Los profit before income tax Adjustments for Interest income Share of profits of associates Depreciation of property, plant and equipment Loss on disposal of property, plant and equipment Impairment loss on property plant and equipment Impairment loss on goodwill Written off of deposits paid Interest expenses Loss gain) on disposal of financial assets liabilities at fair value through profit or loss Fair value loss on financial assets/iabilities at fair value through profit or loss Changes in fair value of investment properties Gain ondoregistration of a subsidiary 331 445 172 519 965 (1.109 18 (5.984) (214) 84 15.000 2.395 611 Operating loss/profit before working capital changes Increase decrease in inventories Decrease/Gincrease in trade receivables Decrease/ increase) in prepayments, deposits and other receivables Decrease increase in trade payables Increase in accrued charges, deposits received and other payables Increase in contract liabilities Net proceeds of disposal of financial assets/iabilities at fair value through profit or loss Purchases of financial assets/liabilities at fair value through profit or loss (13,7861 (1,991) 1,628 24.115 (23,6420 1.116 6,379 23257) 1.941 7,931 314,903 472,687 1317.335 482 039) Cash used in operations Income tax paid Income tax refund (8,613) (248) 2.117 119 781) 2.262) 2.567 Net cash used in operating activities (6,744) 119.476) 16,001) (1.999) (2,216) 56,000 07.661) Cash flows from investing activities Purchases of property, plant and equipment Purchases of investment properties Proceeds from disposal of an investment property Net cash outflow from acquisition of capital injection in associates Purchases of non-controlling interest of a subsidiary Net change in balances with associates Dividend income Increasedecrease in pledged deposits Decrease in time deposits with an original maturity of more than three months Interest received (551) 2,018 119 121.2423 (1.120) 124 1,020 15.545 1.761 84 650 1345 Net cash generated from investing activities 49,435 72,349 Annual Report 2019 45

please calculate the debt management ratio from the 15 ratios of five aspect CONSOLIDATED STATEMENT OF FINANCIAL POSITION POSITION AS AT 31 MARCH 2019 2019 HKS'000 2018 Notes HK$'000 ASSETS AND LIABILTIES 23,042 88,800 73,106 Non-current assets Property, plant and equipment Investment properties Goodwil Interests in associates Deposit 10,496 7,598 10.782 6,50 129,936 90 BA? 3.716 Current assets Inventories Trade receivables Prepayments, deposits and other receivables Amount due from an associate Financial assets at fair value through profit or loss Prepaid tax Pledged deposits Time deposits over three months Cash and cash equivalents 30.046 5.690 13,650 501 22.589 30,000 92,177 1,725 7.329 52 353 1.591 12.260 2,519 45.545 8067 204,080 210 146 56,000 Asset classified as held for sale 204,080 266.145 89.114 32,155 33,809 112,776 58,835 Current liabilities Trade payables Accrued charges, deposits received and other payables Contract liabilities Financial liabilities at fair value through profit or loss Amounts due to associates Bank borrowings Provision for tax 8.338 3.412 2,221 21,705 167,362 Net current assets 36,718 166,654 195,592 70,554 161,396 Total assets less current liabilities Non-current abilities Deferred tax labilities Net assets 166,598 160,553 EQUITY Equity attributable to owners of the Company Share capital 5,099 162.635 5136 158 113 167,734 (1.136) Non-controlling interests 163,249 12.695) Total equity 166,598 160.553 Cheng Hang Fan Director Chan Wan Fung Director Annual Report 2019 43 CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED 31 MARCH 2019 . . IN . . . 2150 12 Dowody the e n d Due to the purchase of the Company's own she dung he of H 10272.000 According 10.000 w a ded ere to and protes 44 Travel Expert Asis) Enterprises Limited CONSOLIDATED STATEMENT OF CASH FLOWS FOR THE YEAR ENDED 31 MARCH 2019 2019 HKS'000 2018 Notes HK$ 000 (13,863) 863 (1,761) 254 5.758 11.345) (1351) 8468 59 1,144 93 Cash flows from operating activities Los profit before income tax Adjustments for Interest income Share of profits of associates Depreciation of property, plant and equipment Loss on disposal of property, plant and equipment Impairment loss on property plant and equipment Impairment loss on goodwill Written off of deposits paid Interest expenses Loss gain) on disposal of financial assets liabilities at fair value through profit or loss Fair value loss on financial assets/iabilities at fair value through profit or loss Changes in fair value of investment properties Gain ondoregistration of a subsidiary 331 445 172 519 965 (1.109 18 (5.984) (214) 84 15.000 2.395 611 Operating loss/profit before working capital changes Increase decrease in inventories Decrease/Gincrease in trade receivables Decrease/ increase) in prepayments, deposits and other receivables Decrease increase in trade payables Increase in accrued charges, deposits received and other payables Increase in contract liabilities Net proceeds of disposal of financial assets/iabilities at fair value through profit or loss Purchases of financial assets/liabilities at fair value through profit or loss (13,7861 (1,991) 1,628 24.115 (23,6420 1.116 6,379 23257) 1.941 7,931 314,903 472,687 1317.335 482 039) Cash used in operations Income tax paid Income tax refund (8,613) (248) 2.117 119 781) 2.262) 2.567 Net cash used in operating activities (6,744) 119.476) 16,001) (1.999) (2,216) 56,000 07.661) Cash flows from investing activities Purchases of property, plant and equipment Purchases of investment properties Proceeds from disposal of an investment property Net cash outflow from acquisition of capital injection in associates Purchases of non-controlling interest of a subsidiary Net change in balances with associates Dividend income Increasedecrease in pledged deposits Decrease in time deposits with an original maturity of more than three months Interest received (551) 2,018 119 121.2423 (1.120) 124 1,020 15.545 1.761 84 650 1345 Net cash generated from investing activities 49,435 72,349 Annual Report 2019 45

DEBT MANAGEMENT

1. Debt-to-capital Ratio

2. Time-Interest-Earned Ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started