Debt Management Ratios

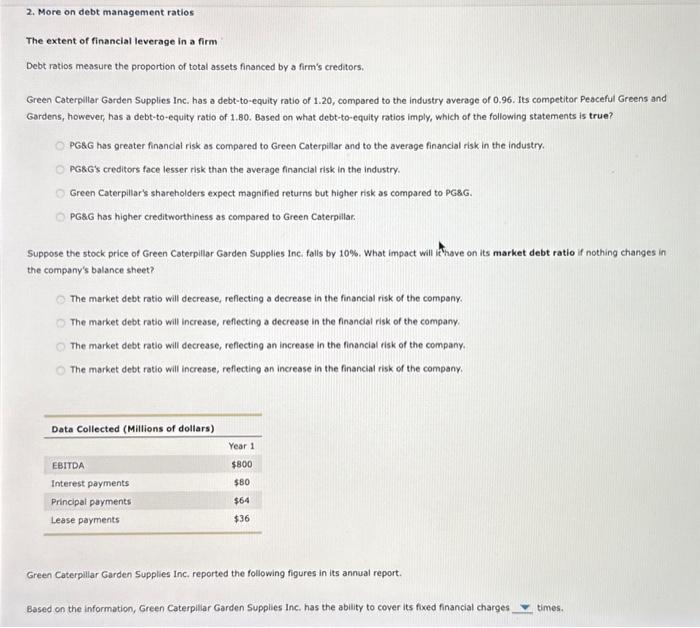

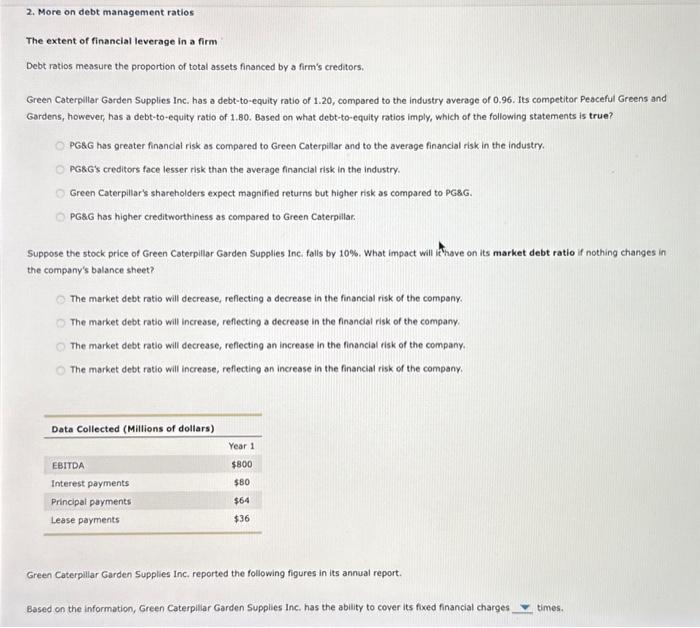

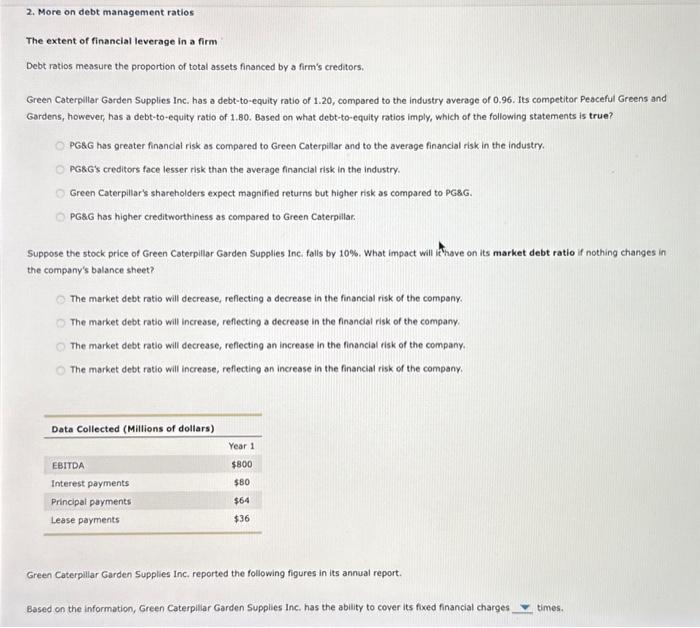

The extent of financial leverage in a firm Debt ratios measure the proportion of total assets financed by a firm's creditors. Green Caterpultar Garden Supplies Inc. has a debt-to-equity ratio of 1.20, compared to the industry average of 0.96 . Its competitor Peaceful Greens and Gardens, however, has a debt-to-equity ratio of 1.80 . Based on what debt-to-equity ratios imply, which of the following statements is true? PGAG has greater financlal risk as compared to Green Caterpillar and to the average financial risk in the industry. PGBG's creditors face lesser risk than the average financial risk in the industry. Green Caterpillar's shareholders expect magnified returns but higher risk as compared to PGBG. PG\&G has higher creditworthiness as compared to Green Caterpillar. Suppose the stock price of Green Caterpillar Garden Supplies Inc: falls by 10%. What impoct will ithave on its market debt ratio if nothing changes in the company's balance sheet? The market debt ratio will decrease, reflecting a decrease in the financial risk of the company. The market debt ratio will increase, reflecting a decrease in the finandal risk of the company. The market debt ratio will decrease, reflecting an increase in the financial risk of the company. The market debt ratio will increase, reflecting an increase in the financial risk of the company. Green Caterpillar Garden Supplies Inc, reported the following figures in its annual report. Based on the information, Green Caterpillar Garden Supplies Inc. has the ability to cover its foxed financial charges times. The extent of financial leverage in a firm Debt ratios measure the proportion of total assets financed by a firm's creditors. Green Caterpultar Garden Supplies Inc. has a debt-to-equity ratio of 1.20, compared to the industry average of 0.96 . Its competitor Peaceful Greens and Gardens, however, has a debt-to-equity ratio of 1.80 . Based on what debt-to-equity ratios imply, which of the following statements is true? PGAG has greater financlal risk as compared to Green Caterpillar and to the average financial risk in the industry. PGBG's creditors face lesser risk than the average financial risk in the industry. Green Caterpillar's shareholders expect magnified returns but higher risk as compared to PGBG. PG\&G has higher creditworthiness as compared to Green Caterpillar. Suppose the stock price of Green Caterpillar Garden Supplies Inc: falls by 10%. What impoct will ithave on its market debt ratio if nothing changes in the company's balance sheet? The market debt ratio will decrease, reflecting a decrease in the financial risk of the company. The market debt ratio will increase, reflecting a decrease in the finandal risk of the company. The market debt ratio will decrease, reflecting an increase in the financial risk of the company. The market debt ratio will increase, reflecting an increase in the financial risk of the company. Green Caterpillar Garden Supplies Inc, reported the following figures in its annual report. Based on the information, Green Caterpillar Garden Supplies Inc. has the ability to cover its foxed financial charges times