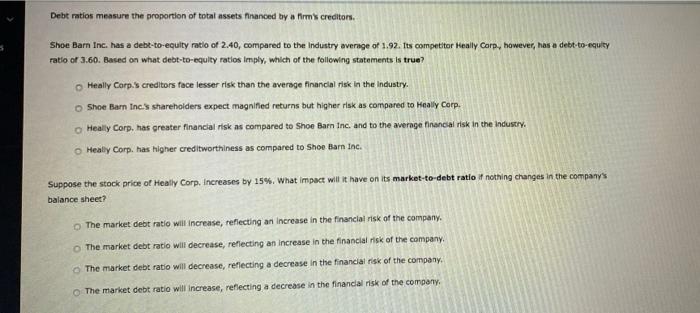

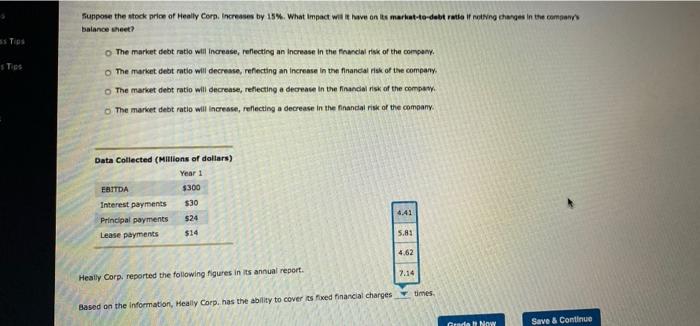

Debt ratio measure the proportion of total assets financed by a firm's creditors. Shoe Barn Inc. has a debt-to-equity ratio of 2.40, compared to the Industry average of 1.92. Its competitor Heally Corp, however, has a debt-to-equity ratio of 3.60. Based on what debt-to-equity ratlos imply, which of the following statements is true? Heally Corps creditors face lesser risk than the average financial risk in the Industry. Shoe Barn Inc.'s shareholders expect magnified returns but higher risk as compared to Heally Corp. Heally Corp, has greater financial risk as compared to Shoe Barn Inc. and to the average financial risk in the Industry Meally Corp. has higher creditworthiness as compared to Shoe Barn Inc. Suppose the stock price of Heally Corp. Increases by 15%. What impact will it have on its market-to-debt ratio if nothing changes in the company's balance sheet? The market debt ratio will increase, reflecting an increase in the financial risk of the company. The market debt ratio will decrease, reflecting an increase in the financial risk of the company. The market debt ratio will decrease, reflecting a decrease in the financial risk of the company D The market debt ratio will increase, reflecting a decrease in the financial risk of the company, Suppose the stock price of Heally Corn. Increases by 15% What Impact will have on its market-to-debt ratio if noting changes in the company's balance sheet? 5 Tips Tips o The market debt ratio will increase, reflecting an increase in the Pancial risk of the company o The market debt ratio will decrease, reflecting an increase in the financial risk of the company The market debt ratio will decrease, reflecting a decrease in the financial risk of the company. The market debt ratio will increase, reflecting a decrease in the financial risk of the company $300 Data Collected (Millions of dollars) Year 1 EBITDA Interest payments $30 Principal payments $24 Lease payments $14 4.41 5.81 4.62 7.14 Heally Corp. reported the following figures in its annual report. Based on the information, Heally Corp. has the ability to cover is fixed financial charges y times Genda NOW Save & Continue