Answered step by step

Verified Expert Solution

Question

1 Approved Answer

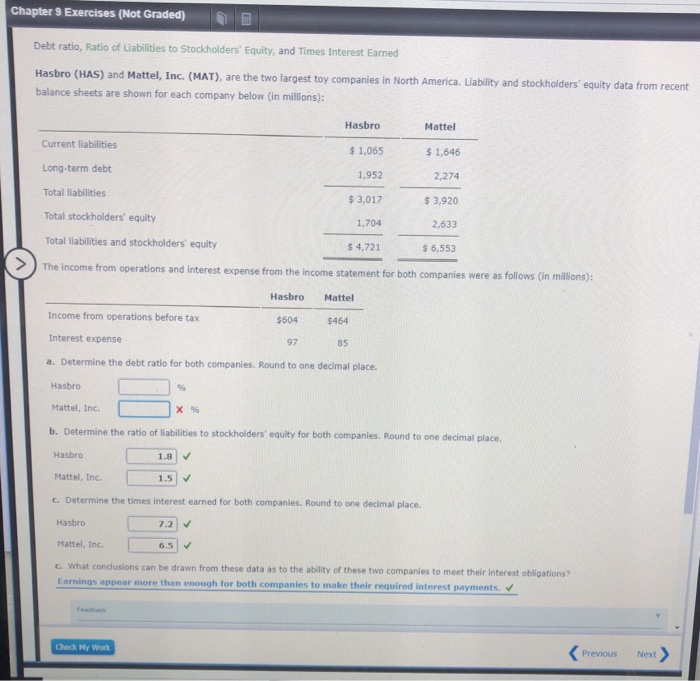

Debt ratio, ratio of liabilitiesTo stockholders equity, and times interest earned. Hasbro and Mattell, Inc. are the two largest 20 companies in North America. Liability

Debt ratio, ratio of liabilitiesTo stockholders equity, and times interest earned.

Hasbro and Mattell, Inc. are the two largest 20 companies in North America. Liability and stockholders equity data from recent mail at sheets are showing for each company below (in millions)

Previous answers on this are not correct for the picture below letter a. Thank you in advance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started