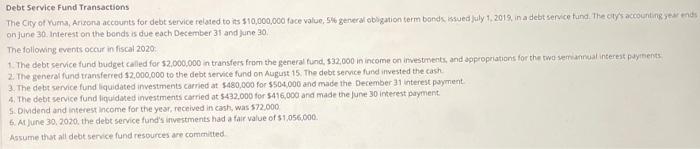

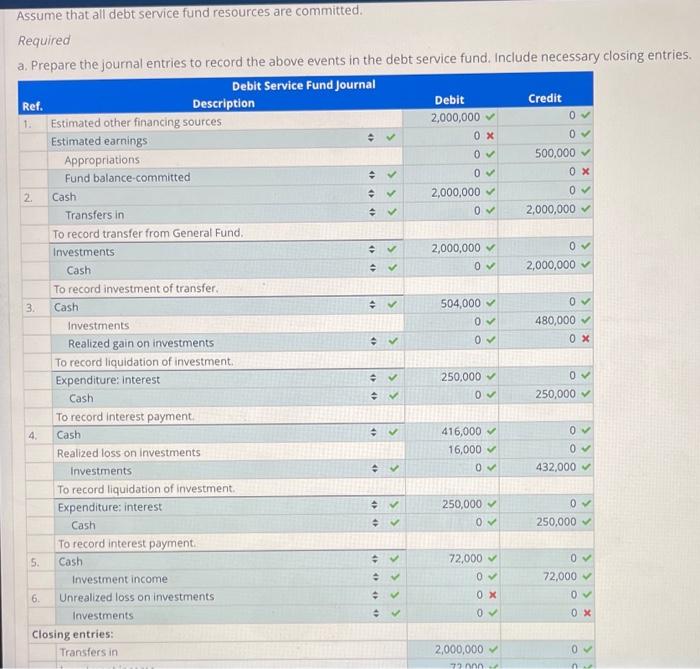

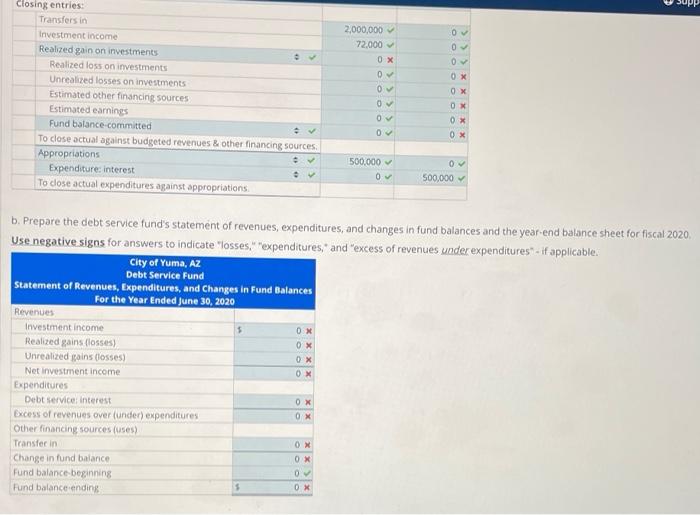

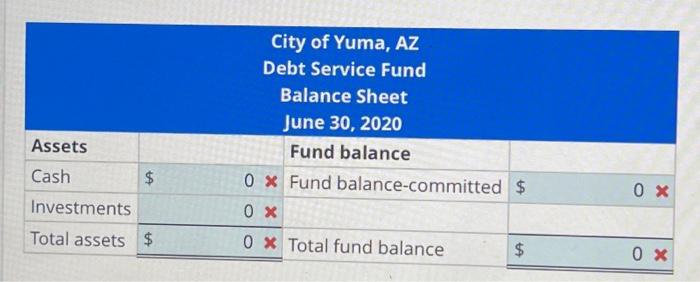

Debt Service Fund Transactions The City of Yuma, Arizona accounts for debt service related to its 510,000,000 face value, 5% general obligation term bonds sued july 1, 2013 in a debt service und. The city's accounting se ends on June 30. Interest on the bonds is due each December 31 and june 30 The following events occur in fiscal 2020 1. The debt service fund budget called for $2,000,000 in transfers from the general fund, 532,000 in income on investments, and appropriations for the two semiannual interest payments 2. The general fund transferred 52,000,000 to the debt service fund on August 15. The debt service fund invested the cash 3. The debt service fund liquidated investments carried at $480,000 for $504,000 and made the December 31 interest payment 4. The debt service fund liquidated investments carried at 5432,000 for $416,000 and made the June 30 interest payment S. Dividend and interest income for the year, received in cash, was 572.000 6. Al June 30, 2020, the debt service fund's investments had a fair value of $1,056.000. Assume that all debt service fund resources are committed Assume that all debt service fund resources are committed. Required a. Prepare the journal entries to record the above events in the debt service fund. Include necessary closing entries. Debit Service Fund Journal Ref. Description Debit Credit 1. Estimated other financing sources 2,000,000 0 Estimated earnings OX 0 Appropriations 0 500,000 Fund balance committed 0 0X 2. Cash 2,000,000 0 Transfers in 07 2,000,000 To record transfer from General Fund, Investments 2,000,000 0 Cash 0 2,000,000 To record investment of transfer. 3 Cash 504,000 0 Investments 0 480,000 Realized gain on investments 0 OX To record liquidation of investment Expenditure interest 250,000 0 Cash 0 250,000 To record interest payment 4 Cash 416,000 0 Realized loss on investments 16,000 0 Investments 0 432,000 To record liquidation of investment Expenditure: interest 250,000 0 Cash 0 250,000 To record interest payment 5. Cash 72,000 0 Investment income 0 72,000 6. Unrealized loss on investments 0 x 0 Investments 0 OX Closing entries: Transfers in 2,000,000 0 14) . Closing entries: Transfers in Investment income Realized gain on investments Realized loss on investments Unrealized losses on investments Estimated other financing sources Estimated earnings Fund balance committed To dose actual against budgeted revenues & other financing sources Appropriations . Expenditure: interest . To close actual expenditures against appropriations 2,000,000 72,000 OX 0 0 0 0 0 0. OX OX OX Ov 0 x OX 500,000 0 0 500,000 $ OX b. Prepare the debt service fund's statement of revenues, expenditures, and changes in fund balances and the year-end balance sheet for fiscal 2020, Use negative signs for answers to indicate losses," expenditures," and "excess of revenues under expenditures" - if applicable City of Yuma, AZ Debt Service Fund statement of Revenues, Expenditures, and Changes in Fund Balances For the Year Ended June 30, 2020 Revenues Investment income Realized gains classes Unrealized gains (losses) Net investment income Expenditures Debt service interest Excess of revenues over (under) expenditures Other financing sources (uses) Transfer in Change in fund balance Fund balance beginning Fund balance ending OX OX OX OX OX OX OX 0 OX City of Yuma, AZ Debt Service Fund Balance Sheet June 30, 2020 Fund balance 0 X Fund balance-committed $ Assets 0X Cash $ Investments Total assets $ OX 0x Total fund balance $