Question

Debt Service Requirements: MMI New Loans Term Loan (monthly payment of P & I) $____________ x 12 = Annual Pymt $___________ Line of Credit (at

Debt Service Requirements:

Debt Service Requirements:

MMI New Loans

Term Loan (monthly payment of P & I) $____________ x 12 = Annual Pymt $___________

Line of Credit (at max.loan amt. outstanding $_________x 8.75% = Annual Pymt $ ___________

[Prime Rate was 7.75 in April 06. Interest is P+1.00%]

Total Debt Service for MMI $_________ MI New Loans

Mortgage Loan (monthly payment of P & I) $__________ x 12 = Annual Pymt $___________

Total Debt Service for MI $___________

Total Debt Service both companies $___________

Does both companies total profitability cover debt service? Yes_____ No_____

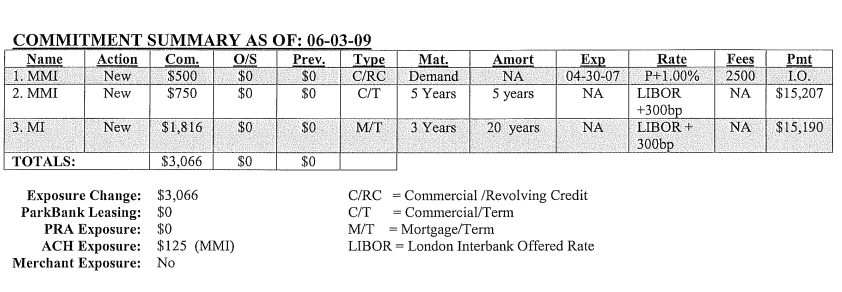

COMMITMENT SUMMARY AS OF: 06-03-09 Name Action | Com. O/S | Prev. Type | Mat. 1. MMI New T $500 $0 $0 C/RC Demand 2. MMI New $750 $0 C/T 5 Years Amort NA 5 years | Exp | 04-30-07 NA Fees | Pmt 2500 1.0. NA $15,207 $0 R ate P+1.00% LIBOR +300bp LIBOR + 300bp 3. MI New $1,816 M/T 3 Years20 years NA 1 NA $15,190 TOTALS: $3,066 $0 $0 Exposure Change: $3,066 ParkBank Leasing: $0 PRA Exposure: $0 ACH Exposure: $125 (MMI) Merchant Exposure: No C/RC = Commercial /Revolving Credit C/T = Commercial/Term M/T = Mortgage/Term LIBOR = London Interbank Offered Rate COMMITMENT SUMMARY AS OF: 06-03-09 Name Action | Com. O/S | Prev. Type | Mat. 1. MMI New T $500 $0 $0 C/RC Demand 2. MMI New $750 $0 C/T 5 Years Amort NA 5 years | Exp | 04-30-07 NA Fees | Pmt 2500 1.0. NA $15,207 $0 R ate P+1.00% LIBOR +300bp LIBOR + 300bp 3. MI New $1,816 M/T 3 Years20 years NA 1 NA $15,190 TOTALS: $3,066 $0 $0 Exposure Change: $3,066 ParkBank Leasing: $0 PRA Exposure: $0 ACH Exposure: $125 (MMI) Merchant Exposure: No C/RC = Commercial /Revolving Credit C/T = Commercial/Term M/T = Mortgage/Term LIBOR = London Interbank Offered Rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started