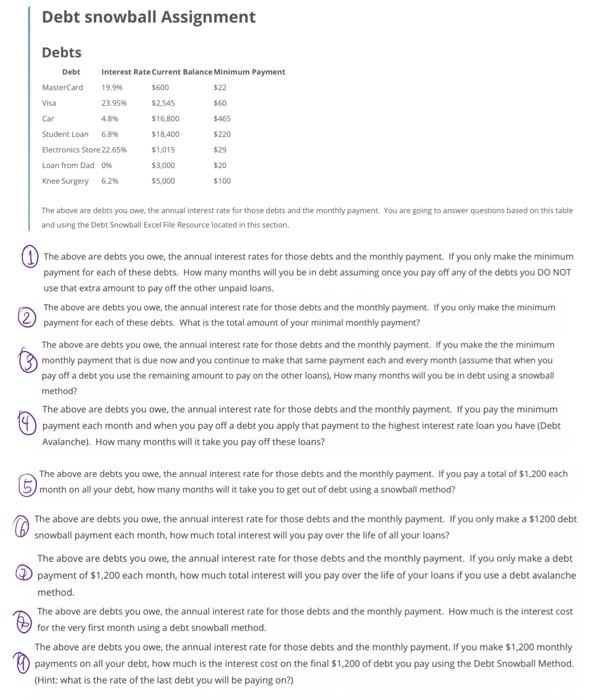

Debt snowball Assignment Debts Debt Interest Rate Current Balance Minimum Payment MasterCard 19.9% $600 $22 Visa 23.95% 52.545 4.8% $16,800 $.465 Student Loan 6.8% $18,400 5220 Electronics Store 22,65% 51,015 Loan from Dad 0% $3,000 Knee Surgery 6.2% 55.000 $100 The above are debts you owe the annual interest rate for those debts and the monthly payment. You are going to answer questions based on this table and using the Debt Snowball Excel file Resource located in this section The above are debts you owe, the annual interest rates for those debts and the monthly payment. If you only make the minimum payment for each of these debts. How many months will you be in debt assuming once you pay off any of the debts you DO NOT use that extra amount to pay off the other unpaid loans. The above are debts you owe, the annual interest rate for those debts and the monthly payment. If you only make the minimum payment for each of these debts. What is the total amount of your minimal monthly payment? The above are debts you owe, the annual interest rate for those debts and the monthly payment. If you make the the minimum 3 monthly payment that is due now and you continue to make that same payment each and every month (assume that when you pay off a debt you use the remaining amount to pay on the other loans). How many months will you be in debt using a snowball method? The above are debts you owe, the annual interest rate for those debts and the monthly payment. If you pay the minimum payment each month and when you pay off a debt you apply that payment to the highest interest rate loan you have (Debt Avalanche). How many months will it take you pay off these loans? The above are debts you owe, the annual interest rate for those debts and the monthly payment. If you pay a total of $1,200 each (5) month on all your debt, how many months will it take you to get out of debt using a snowball method? The above are debts you owe, the annual interest rate for those debts and the monthly payment. If you only make a $1200 debt snowball payment each month, how much total interest will you pay over the life of all your loans? The above are debts you owe, the annual interest rate for those debts and the monthly payment. If you only make a debt payment of $1,200 each month, how much total interest will you pay over the life of your loans if you use a debt avalanche method. The above are debts you owe, the annual interest rate for those debts and the monthly payment. How much is the interest cost for the very first month using a debt snowball method. The above are debts you owe, the annual interest rate for those debts and the monthly payment. If you make $1,200 monthly 4) payments on all your debt, how much is the interest cost on the final $1,200 of debt you pay using the Debt Snowball Method. (Hint: what is the rate of the last debt you will be paying on?) Debt snowball Assignment Debts Debt Interest Rate Current Balance Minimum Payment MasterCard 19.9% $600 $22 Visa 23.95% 52.545 4.8% $16,800 $.465 Student Loan 6.8% $18,400 5220 Electronics Store 22,65% 51,015 Loan from Dad 0% $3,000 Knee Surgery 6.2% 55.000 $100 The above are debts you owe the annual interest rate for those debts and the monthly payment. You are going to answer questions based on this table and using the Debt Snowball Excel file Resource located in this section The above are debts you owe, the annual interest rates for those debts and the monthly payment. If you only make the minimum payment for each of these debts. How many months will you be in debt assuming once you pay off any of the debts you DO NOT use that extra amount to pay off the other unpaid loans. The above are debts you owe, the annual interest rate for those debts and the monthly payment. If you only make the minimum payment for each of these debts. What is the total amount of your minimal monthly payment? The above are debts you owe, the annual interest rate for those debts and the monthly payment. If you make the the minimum 3 monthly payment that is due now and you continue to make that same payment each and every month (assume that when you pay off a debt you use the remaining amount to pay on the other loans). How many months will you be in debt using a snowball method? The above are debts you owe, the annual interest rate for those debts and the monthly payment. If you pay the minimum payment each month and when you pay off a debt you apply that payment to the highest interest rate loan you have (Debt Avalanche). How many months will it take you pay off these loans? The above are debts you owe, the annual interest rate for those debts and the monthly payment. If you pay a total of $1,200 each (5) month on all your debt, how many months will it take you to get out of debt using a snowball method? The above are debts you owe, the annual interest rate for those debts and the monthly payment. If you only make a $1200 debt snowball payment each month, how much total interest will you pay over the life of all your loans? The above are debts you owe, the annual interest rate for those debts and the monthly payment. If you only make a debt payment of $1,200 each month, how much total interest will you pay over the life of your loans if you use a debt avalanche method. The above are debts you owe, the annual interest rate for those debts and the monthly payment. How much is the interest cost for the very first month using a debt snowball method. The above are debts you owe, the annual interest rate for those debts and the monthly payment. If you make $1,200 monthly 4) payments on all your debt, how much is the interest cost on the final $1,200 of debt you pay using the Debt Snowball Method. (Hint: what is the rate of the last debt you will be paying on?)