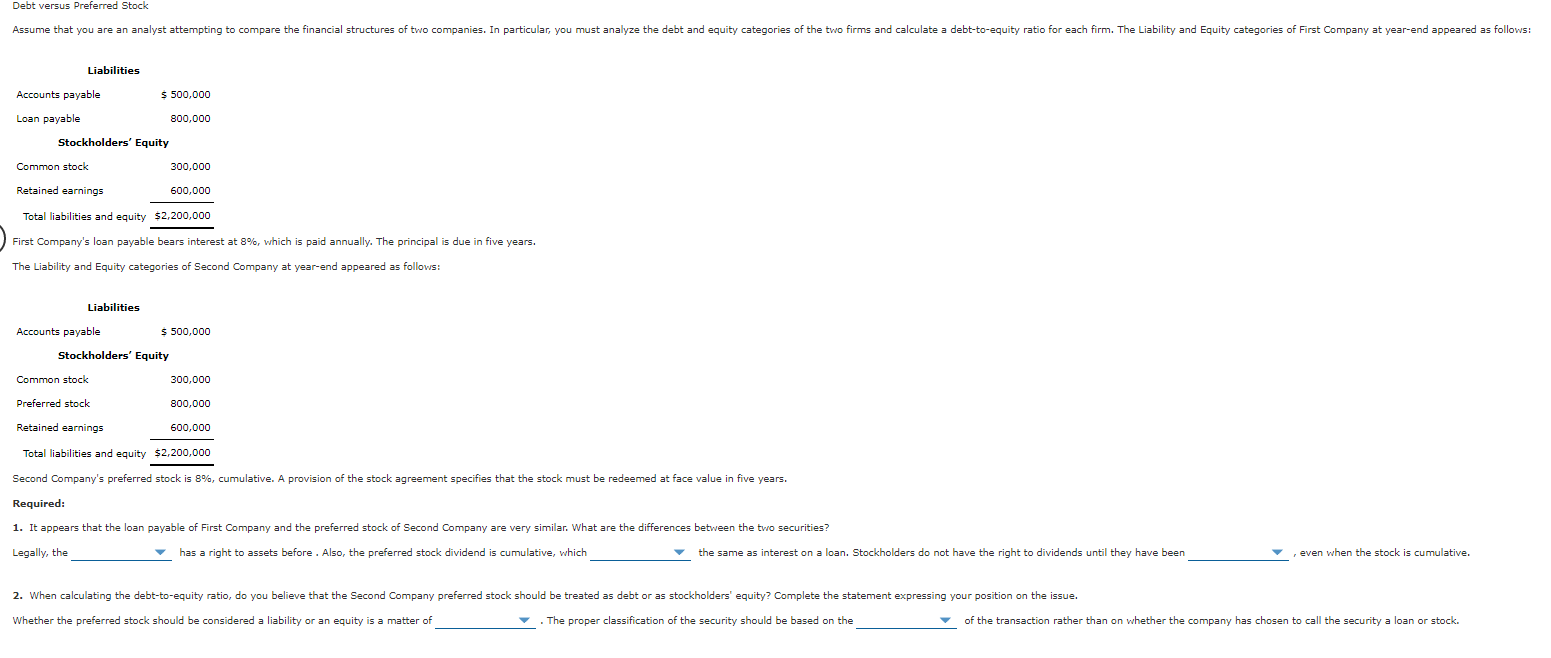

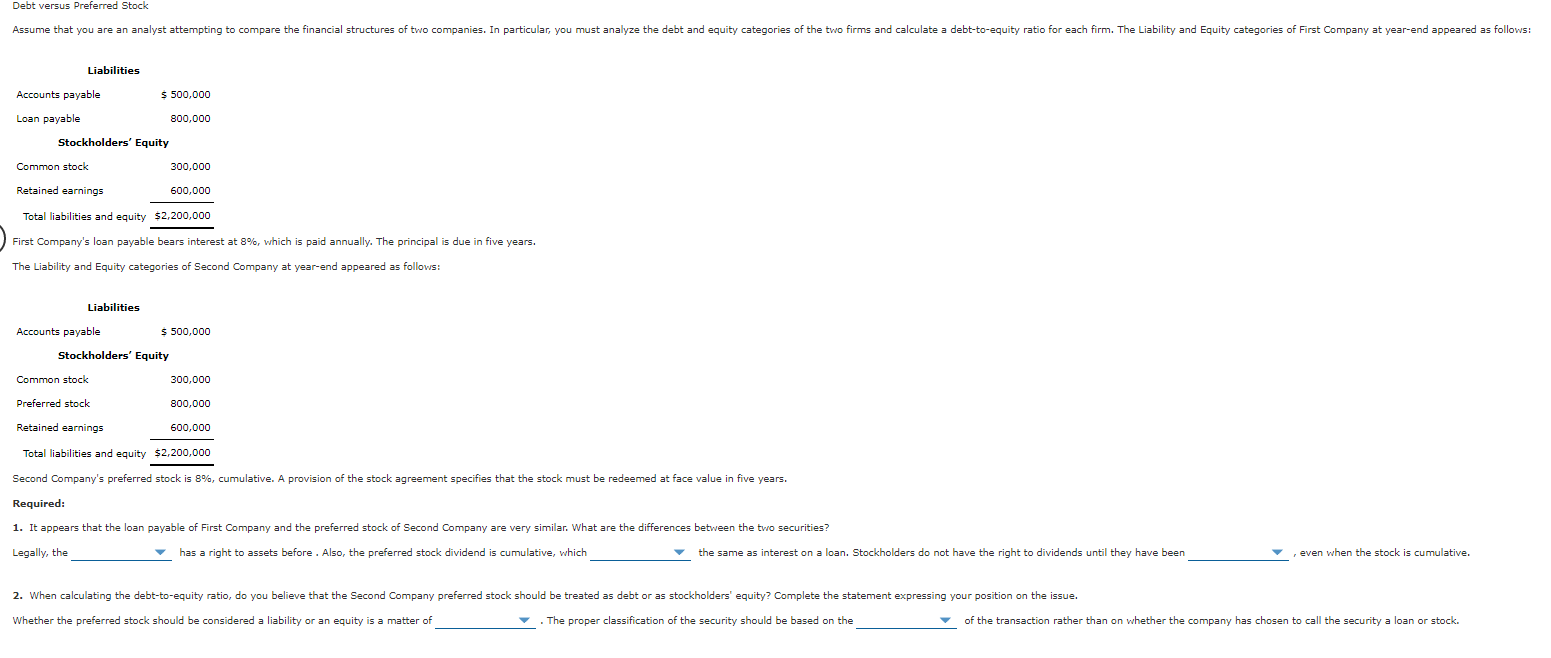

Debt versus Preferred Stock Assume that you are an analyst attempting to compare the financial structures of two companies. In particular, you must analyze the debt and equity categories of the two firms and calculate a debt-to-equity ratio for each firm. The Liability and Equity categories of First Company at year-end appeared as follows: Liabilities Accounts payable $ 500,000 Loan payable 800,000 Stockholders' Equity Common stock 300,000 Retained earnings 600,000 Total liabilities and equity $2,200,000 First Company's loan payable bears interest at 8%, which is paid annually. The principal is due in five years. The Liability and Equity categories of Second Company at year-end appeared as follows: Liabilities Accounts payable $ 500,000 Stockholders' Equity Common stock 300,000 Preferred stock 800,000 Retained earnings 600,000 Total liabilities and equity $2,200,000 Second Company's preferred stock is 8%, cumulative. A provision of the stock agreement specifies that the stock must be redeemed at face value in five years. Required: 1. It appears that the loan payable of First Company and the preferred stock of Second Company are very similar. What are the differences between the two securities? Legally, the has a right to assets before. Also, the preferred stock dividend cumulative, which the same as interest on a loan. Stockholders do not have the right to dividends until they have been even when the stock is cumulative. 2. When calculating the debt-to-equity ratio, do you believe that the Second Company preferred stock should be treated as debt or as stockholders' equity? Complete the statement expressing your position on the issue. Whether the preferred stock should be considered a liability or an equity is a matter of . The proper classification of the security should be based on the of the transaction rather than on whether the company has chosen to call the security a loan or stock. Debt versus Preferred Stock Assume that you are an analyst attempting to compare the financial structures of two companies. In particular, you must analyze the debt and equity categories of the two firms and calculate a debt-to-equity ratio for each firm. The Liability and Equity categories of First Company at year-end appeared as follows: Liabilities Accounts payable $ 500,000 Loan payable 800,000 Stockholders' Equity Common stock 300,000 Retained earnings 600,000 Total liabilities and equity $2,200,000 First Company's loan payable bears interest at 8%, which is paid annually. The principal is due in five years. The Liability and Equity categories of Second Company at year-end appeared as follows: Liabilities Accounts payable $ 500,000 Stockholders' Equity Common stock 300,000 Preferred stock 800,000 Retained earnings 600,000 Total liabilities and equity $2,200,000 Second Company's preferred stock is 8%, cumulative. A provision of the stock agreement specifies that the stock must be redeemed at face value in five years. Required: 1. It appears that the loan payable of First Company and the preferred stock of Second Company are very similar. What are the differences between the two securities? Legally, the has a right to assets before. Also, the preferred stock dividend cumulative, which the same as interest on a loan. Stockholders do not have the right to dividends until they have been even when the stock is cumulative. 2. When calculating the debt-to-equity ratio, do you believe that the Second Company preferred stock should be treated as debt or as stockholders' equity? Complete the statement expressing your position on the issue. Whether the preferred stock should be considered a liability or an equity is a matter of . The proper classification of the security should be based on the of the transaction rather than on whether the company has chosen to call the security a loan or stock