Question

Debt: XYZ issues 100 10-year bonds selling at $970 with a par of $1000. They have a coupon of 10% paid semiannually. Preferred Stock: XYZ

Debt: XYZ issues 100 10-year bonds selling at $970 with a par of $1000. They have a coupon of 10% paid semiannually.

Preferred Stock: XYZ issues 1000 shares of preferred stock selling at $50 with an annual dividend of 5% based on $100 par.

Common Stock: XYZ issues 10000 common shares at $7. XYZ just paid a dividend of $0.25. Investors require a 200% return.

Other relevant information: Taxes are at 20%. Assume no flotation costs. Dividends have been paid over the past 5 years:

1 $0.01

2 $0.02

3 $0.04

4 $0.08

5 $0.16

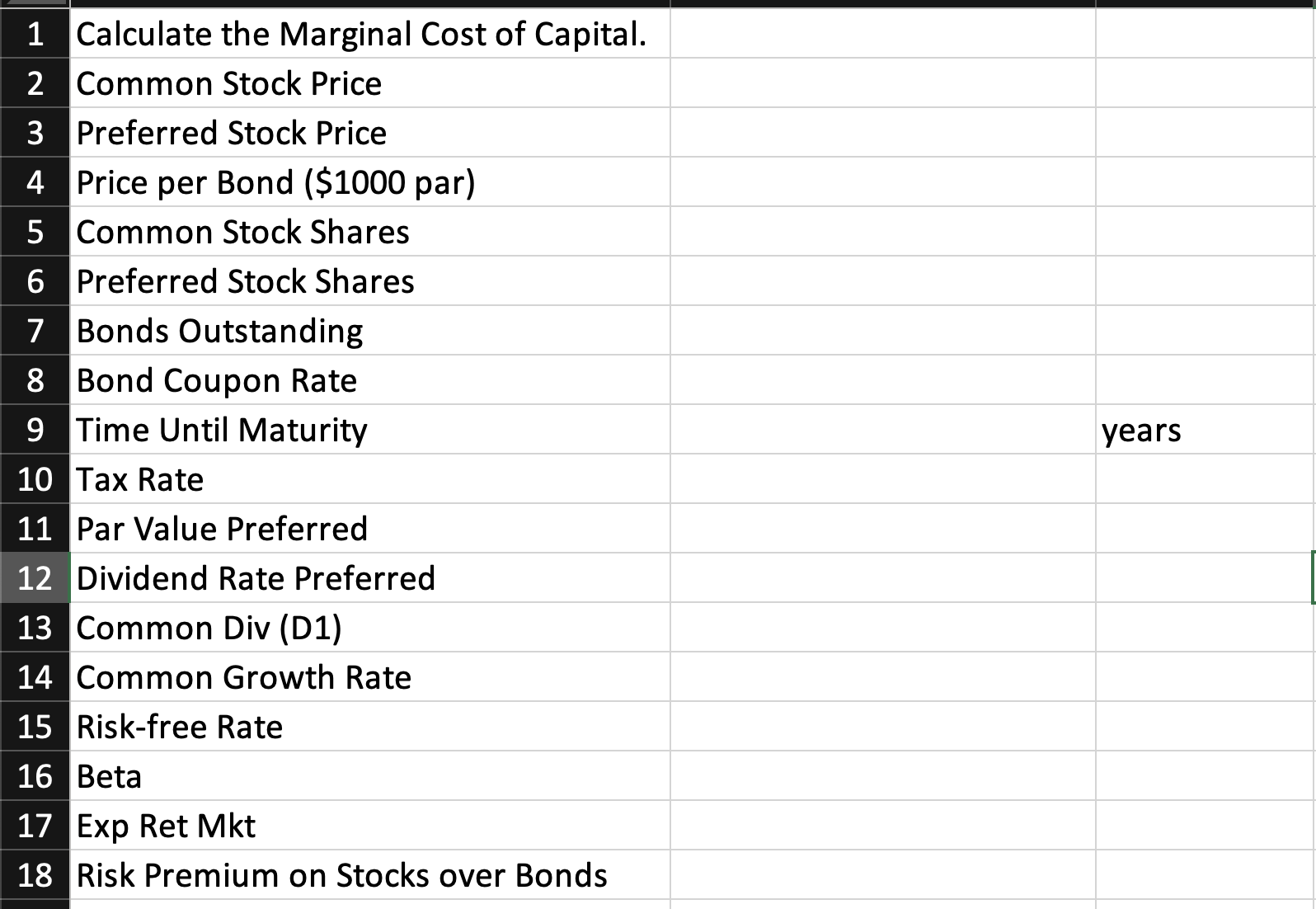

help to filing the first portion of the excel document I will attach as a picture.

1 Calculate the Marginal Cost of Capital. 2 Common Stock Price 3 Preferred Stock Price 4 5 Price per Bond ($1000 par) Common Stock Shares 6 Preferred Stock Shares 7 Bonds Outstanding 8 Bond Coupon Rate 9 Time Until Maturity 10 Tax Rate 11 Par Value Preferred 12 Dividend Rate Preferred 13 Common Div (D1) 14 Common Growth Rate 15 Risk-free Rate 16 Beta 17 Exp Ret Mkt 18 Risk Premium on Stocks over Bonds years

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Here are the steps to fill in the first portion of the Exce...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started