Answered step by step

Verified Expert Solution

Question

1 Approved Answer

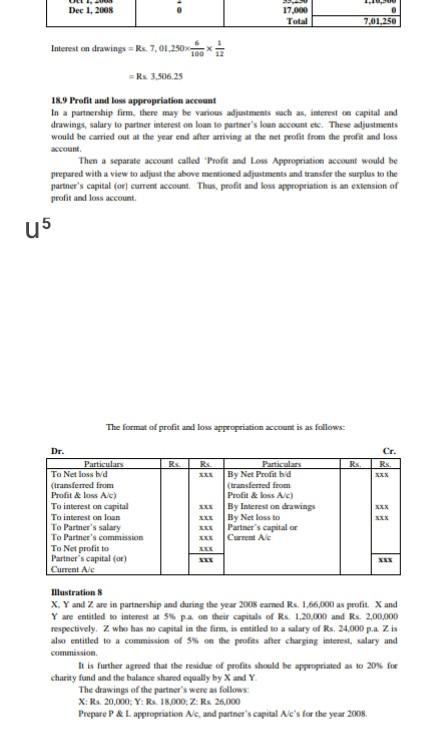

Dec 1, 2008 17.000 Total 7.01.250 Interest on drawings =Rx7,01.250x 100 ** = Rs 3.506,25 18.9 Profit and low appropriation account In a partnership firm,

Dec 1, 2008 17.000 Total 7.01.250 Interest on drawings =Rx7,01.250x 100 ** = Rs 3.506,25 18.9 Profit and low appropriation account In a partnership firm, there may be various adjustments such as interest on capital and drawings, salary to partner interest on loan to partner's loan account etc. These adjustments would be carried out at the year end after arriving at the net prodit from the profit and loss account Then a separate account called "Profit and Loss Appropriation account would be prepared with a view to adjust the above mentioned adjustments and transfer the surplus to the partner's capital for current account. Thus, profit and loss appropriation is an extension of profit and loss account u5 The format of profit and loss appropriation account is as follows Rs Rs Rs Cr. Rs. XXX Dr. Particulars To Netloss b/d (transferred from Profit&loss Ale) To interest on capital To interest on loan To Partner's salary To Partner's commission To Net profitto Partner's capital (0) Current Ale Particlass By Net Profit hid transferred from Proti & Bass A By Interest on drawings By Net loss to Partner's capital or Curren Ac XXX XXX MIX Illustration X. Y and Z are in partnership and during the year 2008 cared Rs. 1.66,000 as profit. X and Y are entitled to interest at 3% pa on their capitals of Rs 1.20,000 and Rs. 2,00,000 respectively. Z who has no capital in the firm, is entitled to a salary of Rs. 24,000 p.a. Zin also entitled to a commission of on the poolts after charging interest, salary and commission to la further agreed that the residue of profits should be appropriated as to 2016 fue churity fund and the balance shared equally by X and Y The drawings of the partner's were as follows X: Rs 20,000, YRA 18,000: Rs 25,000 Prepare P & L. appropriation Nc and partner's capital Alc's for the year 2008

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started