Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dec. 10 transaction: $48,000 Assignment: Dusty Fine Jewelers designs and manufactures posh jewelry. Before the books can be closed on 31 December 2019 so the

Dec. 10 transaction: $48,000

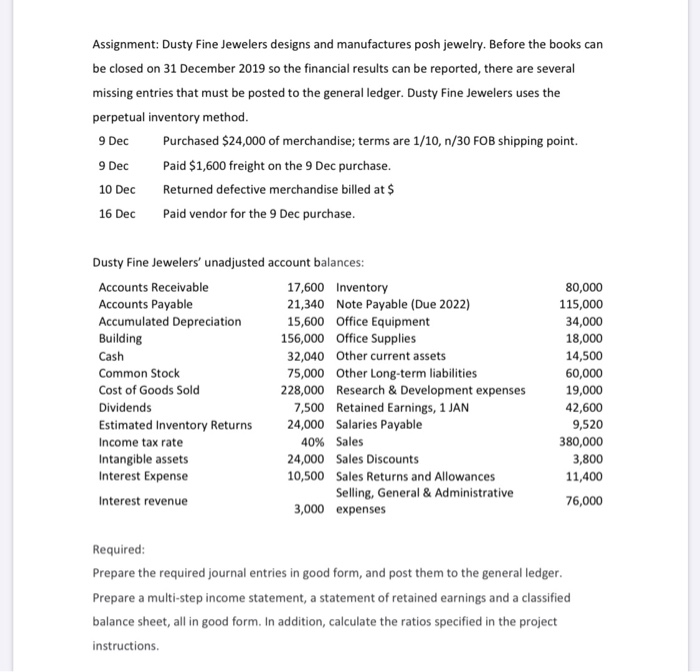

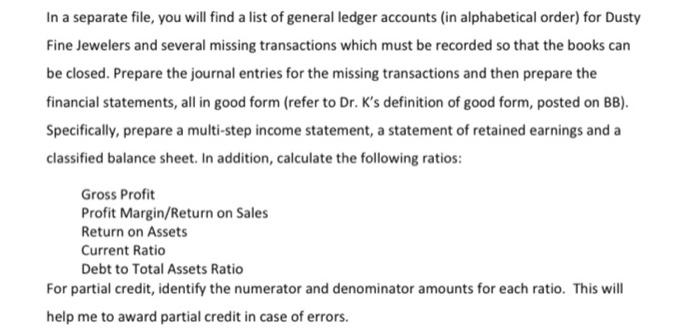

Assignment: Dusty Fine Jewelers designs and manufactures posh jewelry. Before the books can be closed on 31 December 2019 so the financial results can be reported, there are several missing entries that must be posted to the general ledger. Dusty Fine Jewelers uses the perpetual inventory method. 9 Dec Purchased $24,000 of merchandise; terms are 1/10,n/30 FOB shipping point. 9 Dec Paid $1,600 freight on the 9 Dec purchase. 10 Dec Returned defective merchandise billed at $ 16 Dec Paid vendor for the 9 Dec purchase. Dusty Fine Jewelers' unadjusted account balances: Accounts Receivable 17,600 Inventory Accounts Payable 21,340 Note Payable (Due 2022) Accumulated Depreciation 15,600 Office Equipment Building 156,000 Office Supplies Cash 32,040 Other current assets Common Stock 75,000 Other Long-term liabilities Cost of Goods Sold 228,000 Research & Development expenses Dividends 7,500 Retained Earnings, 1 JAN Estimated Inventory Returns 24,000 Salaries Payable Income tax rate 40% Sales Intangible assets 24,000 Sales Discounts Interest Expense 10,500 Sales Returns and Allowances Interest revenue Selling, General & Administrative 3,000 expenses 80,000 115,000 34,000 18,000 14,500 60,000 19,000 42,600 9,520 380,000 3,800 11,400 76,000 Required: Prepare the required journal entries in good form, and post them to the general ledger. Prepare a multi-step income statement, a statement of retained earnings and a classified balance sheet, all in good form. In addition, calculate the ratios specified in the project instructions. In a separate file, you will find a list of general ledger accounts (in alphabetical order) for Dusty Fine Jewelers and several missing transactions which must be recorded so that the books can be closed. Prepare the journal entries for the missing transactions and then prepare the financial statements, all in good form (refer to Dr. K's definition of good form, posted on BB). Specifically, prepare a multi-step income statement, a statement of retained earnings and a classified balance sheet. In addition, calculate the following ratios: Gross Profit Profit Margin/Return on Sales Return on Assets Current Ratio Debt to Total Assets Ratio For partial credit, identify the numerator and denominator amounts for each ratio. This will help me to award partial credit in case of errors. Assignment: Dusty Fine Jewelers designs and manufactures posh jewelry. Before the books can be closed on 31 December 2019 so the financial results can be reported, there are several missing entries that must be posted to the general ledger. Dusty Fine Jewelers uses the perpetual inventory method. 9 Dec Purchased $24,000 of merchandise; terms are 1/10,n/30 FOB shipping point. 9 Dec Paid $1,600 freight on the 9 Dec purchase. 10 Dec Returned defective merchandise billed at $ 16 Dec Paid vendor for the 9 Dec purchase. Dusty Fine Jewelers' unadjusted account balances: Accounts Receivable 17,600 Inventory Accounts Payable 21,340 Note Payable (Due 2022) Accumulated Depreciation 15,600 Office Equipment Building 156,000 Office Supplies Cash 32,040 Other current assets Common Stock 75,000 Other Long-term liabilities Cost of Goods Sold 228,000 Research & Development expenses Dividends 7,500 Retained Earnings, 1 JAN Estimated Inventory Returns 24,000 Salaries Payable Income tax rate 40% Sales Intangible assets 24,000 Sales Discounts Interest Expense 10,500 Sales Returns and Allowances Interest revenue Selling, General & Administrative 3,000 expenses 80,000 115,000 34,000 18,000 14,500 60,000 19,000 42,600 9,520 380,000 3,800 11,400 76,000 Required: Prepare the required journal entries in good form, and post them to the general ledger. Prepare a multi-step income statement, a statement of retained earnings and a classified balance sheet, all in good form. In addition, calculate the ratios specified in the project instructions. In a separate file, you will find a list of general ledger accounts (in alphabetical order) for Dusty Fine Jewelers and several missing transactions which must be recorded so that the books can be closed. Prepare the journal entries for the missing transactions and then prepare the financial statements, all in good form (refer to Dr. K's definition of good form, posted on BB). Specifically, prepare a multi-step income statement, a statement of retained earnings and a classified balance sheet. In addition, calculate the following ratios: Gross Profit Profit Margin/Return on Sales Return on Assets Current Ratio Debt to Total Assets Ratio For partial credit, identify the numerator and denominator amounts for each ratio. This will help me to award partial credit in case of errors Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started