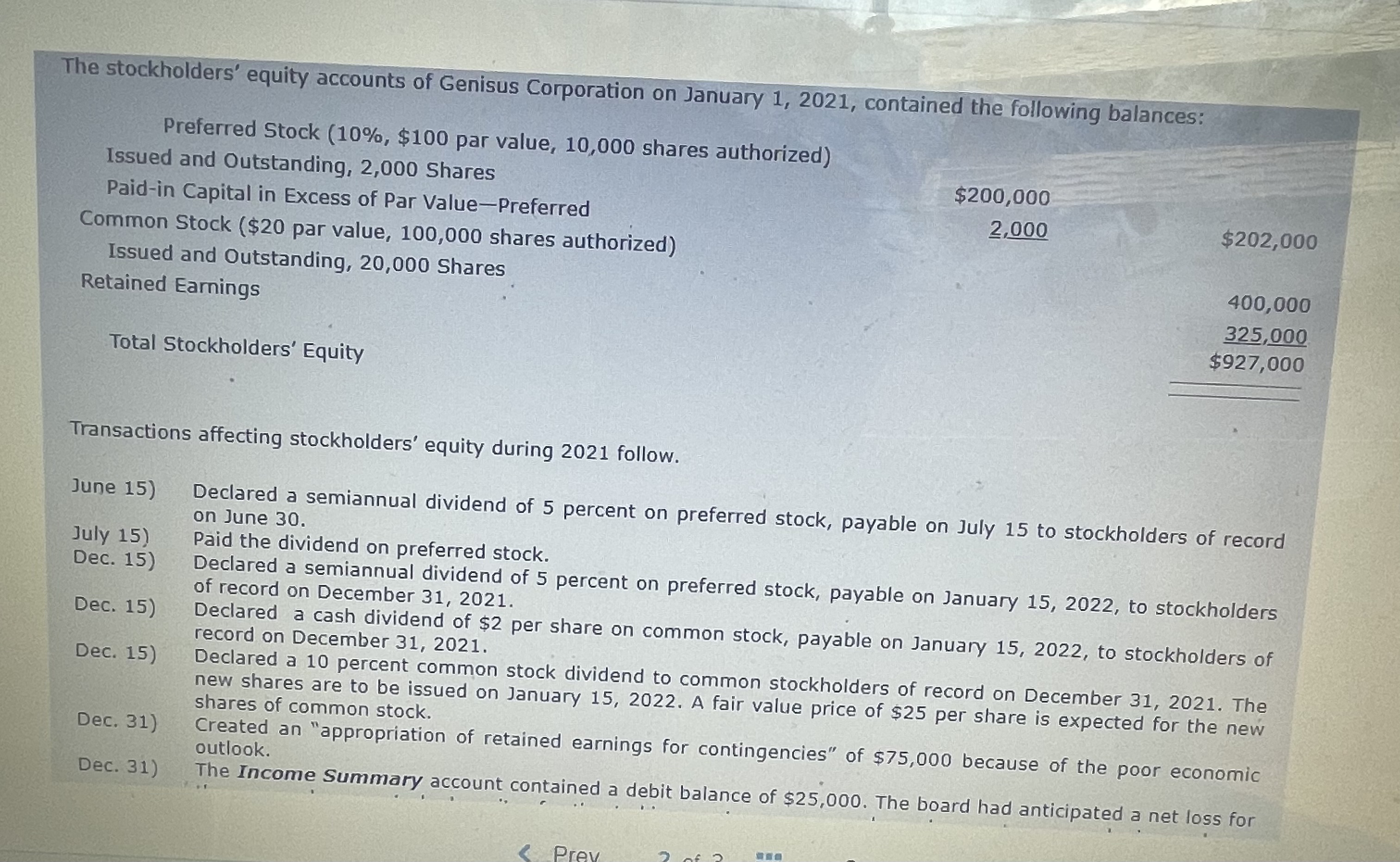

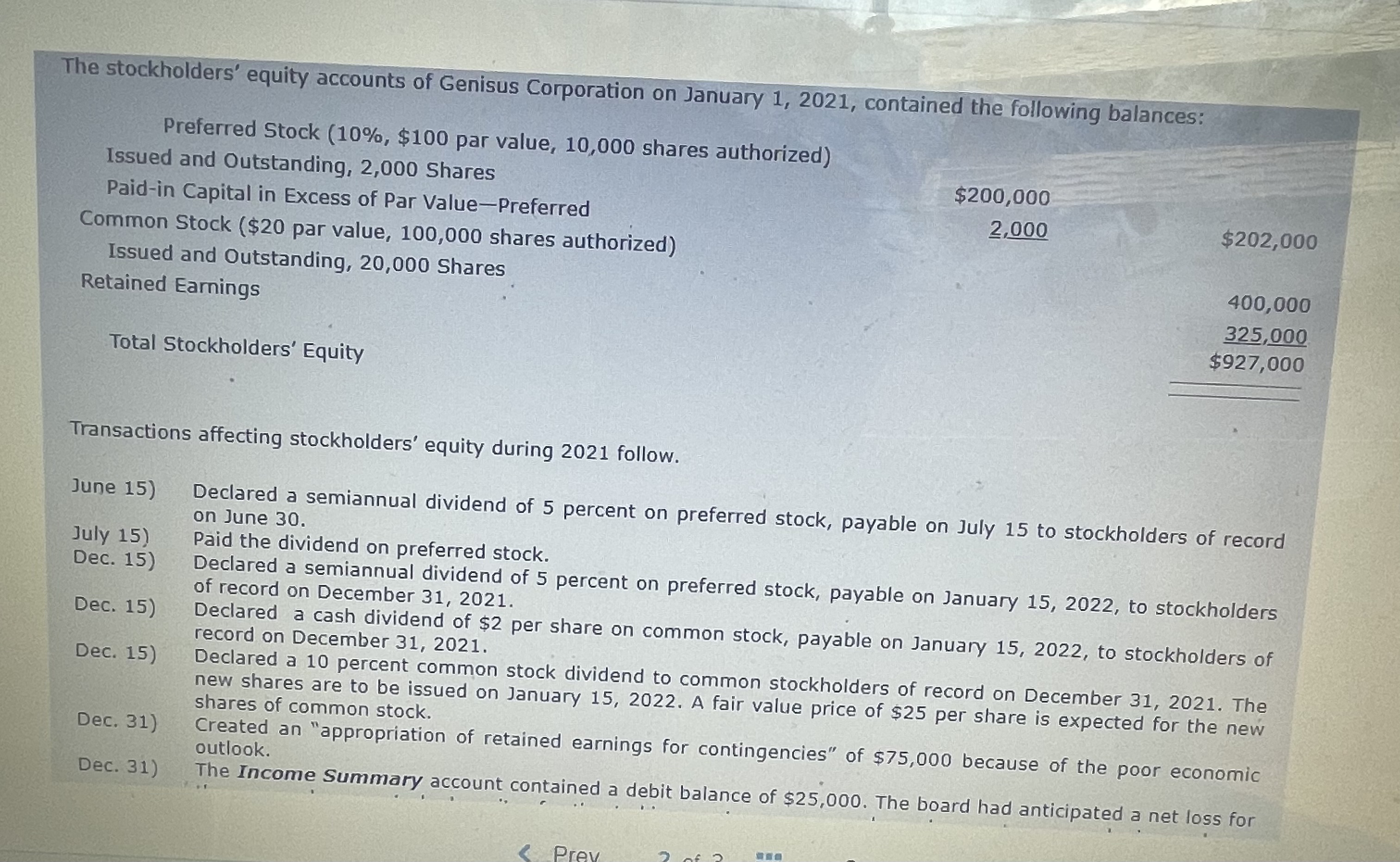

Dec. 15) Declared a cash dividend of $2 per share on common stock, payable on January 15,2022 , to stockholders of record on December 31, 2021. Dec. 15) Declared a 10 percent common stock dividend to common stockholders of record on December 31, 2021. The new shares are to be issued on January 15, 2022. A fair value price of $25 per share is expected for the new Dec. 31) Created an "appropriation of retained earnings for contingencies" of $75,000 because of the poor economic outlook. Dec. 31) The Income Summary account contained a debit balance of $25,000. The board had anticipated a net loss for the year and no quarterly deposits of estimated income taxes were made, so income taxes may be ignored. Show less 13% of available points - Select the accounts to be included in the Stockholders' Equity section of the balance sheet of the corporation. "Iallsacuons affecting stockholders' equity during 2021 follow. June 15) Declared a semiannual dividend of 5 percent on preferred stock, payable on July 15 to stockholders of record on June 30. Paid the dividend on preferred stock. Dec. 15) Declared a semiannual dividend of 5 percent on preferred stock, payable on January 15, 2022, to stockholders of record on December 31, 2021. Dec. 15) Declared a cash dividend of $2 per share on common stock, payable on January 15,2022 , to stockholders of record on December 31, 2021. Dec. 15) Declared a 10 percent common stock dividend to common stockholders of record on December 31, 2021. The new shares are to be issued on January 15,2022 . A fair value price of $25 per share is expected for the new shares of common stock. Created an "appropriation Dec. 31) Created - earnings for contingencies" of $75,000 because of the poor economic account contained a debit balance of $25,000. The board had anticipated a net loss for Dec. 15) Declared a cash dividend of $2 per share on common stock, payable on January 15,2022 , to stockholders of record on December 31, 2021. Dec. 15) Declared a 10 percent common stock dividend to common stockholders of record on December 31, 2021. The new shares are to be issued on January 15, 2022. A fair value price of $25 per share is expected for the new Dec. 31) Created an "appropriation of retained earnings for contingencies" of $75,000 because of the poor economic outlook. Dec. 31) The Income Summary account contained a debit balance of $25,000. The board had anticipated a net loss for the year and no quarterly deposits of estimated income taxes were made, so income taxes may be ignored. Show less 13% of available points - Select the accounts to be included in the Stockholders' Equity section of the balance sheet of the corporation. "Iallsacuons affecting stockholders' equity during 2021 follow. June 15) Declared a semiannual dividend of 5 percent on preferred stock, payable on July 15 to stockholders of record on June 30. Paid the dividend on preferred stock. Dec. 15) Declared a semiannual dividend of 5 percent on preferred stock, payable on January 15, 2022, to stockholders of record on December 31, 2021. Dec. 15) Declared a cash dividend of $2 per share on common stock, payable on January 15,2022 , to stockholders of record on December 31, 2021. Dec. 15) Declared a 10 percent common stock dividend to common stockholders of record on December 31, 2021. The new shares are to be issued on January 15,2022 . A fair value price of $25 per share is expected for the new shares of common stock. Created an "appropriation Dec. 31) Created - earnings for contingencies" of $75,000 because of the poor economic account contained a debit balance of $25,000. The board had anticipated a net loss for