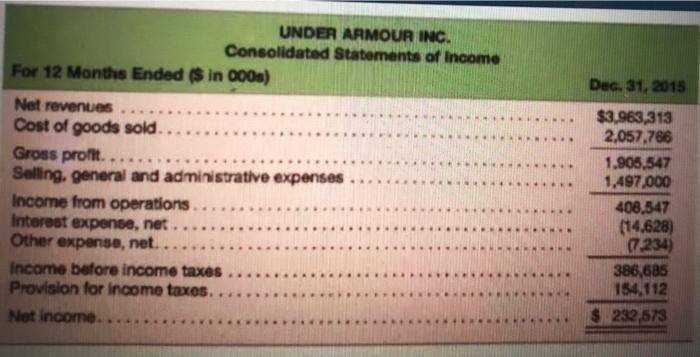

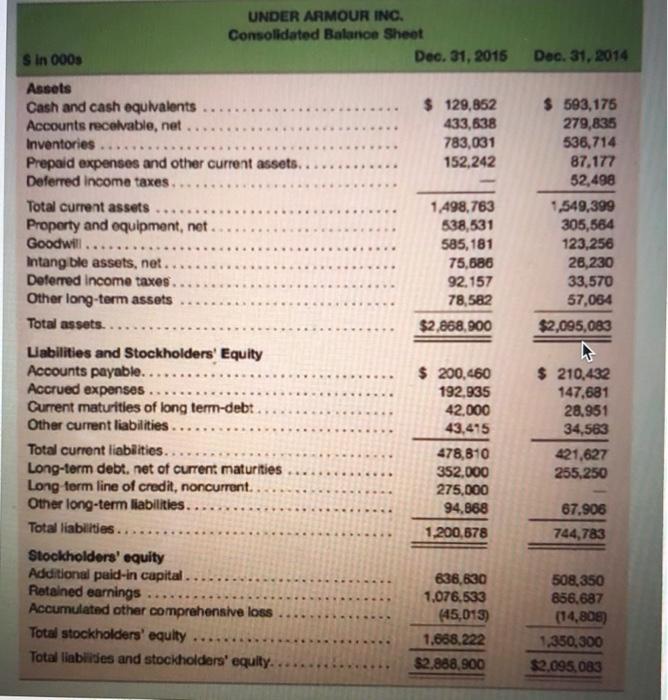

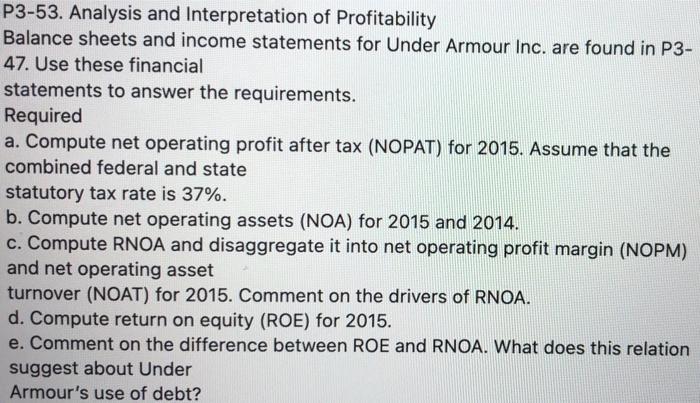

Dec. 31, 2015 UNDER ARMOUR INC. Consolidated Statements of income For 12 Months Ended $ in 000s) Net revenues Cost of goods sold Gross profit. Selling, general and administrative expenses Income from operations ..... Interest expense, net. Other experise, net.. Incame before income taxes Provision for income taxes. Net income. $3,963,313 2,057,786 1.905,547 1,497.000 408,547 (14,628) (7.234) 386,625 154,112 $ 232,573 UNDER ARMOUR INC. Consolidated Balance Sheet Dec 31, 2016 Dec 31, 2014 Sin 000s $ 129,852 433,638 783,031 152,242 - 1.498,763 538,531 585,181 75,686 92.157 78,582 $2,868,900 $ 593,176 279,835 536,714 87,177 52,498 1,549,399 305,564 123,256 26,230 33,570 57,064 $2,095,083 Assets Cash and cash equivalents Accounts receivable, net Inventories Prepaid expenses and other current assets. Deferred Income taxes... Total current assets Property and equipment, net Goodwill.. Intang ble assets, net Deferred Income taxes Other long-term assets Total assets.. Liabilities and Stockholders' Equity Accounts payable.. Accrued expenses ... Current maturities of long term-debt Other current liabilities. Total current liabilities.. Long-term debt, net of current maturities Long term line of credit, noncurrent. Other long-term liabilities. Total liabilities. Stockholders' equity Additional paid-in capital. Retained earnings Accumulated other comprehensive loss Total stockholders' equity Total liabilities and stockholders' equity. $ 200,460 192,935 42.000 43,475 478,810 352.000 275.000 94,868 1.200,678 $ 210,432 147,681 28.951 34,563 421,627 255,250 67.906 744,783 636,630 1,076,533 (45,013) 1.658.222 $2.888.900 508,350 856.687 (14,808) 1.350,300 $2.095,083 P3-53. Analysis and Interpretation of Profitability Balance sheets and income statements for Under Armour Inc. are found in P3- 47. Use these financial statements to answer the requirements. Required a. Compute net operating profit after tax (NOPAT) for 2015. Assume that the combined federal and state statutory tax rate is 37%. b. Compute net operating assets (NOA) for 2015 and 2014. c. Compute RNOA and disaggregate it into net operating profit margin (NOPM) and net operating asset turnover (NOAT) for 2015. Comment on the drivers of RNOA. d. Compute return on equity (ROE) for 2015. e. Comment on the difference between ROE and RNOA. What does this relation suggest about Under Armour's use of debt