Answered step by step

Verified Expert Solution

Question

1 Approved Answer

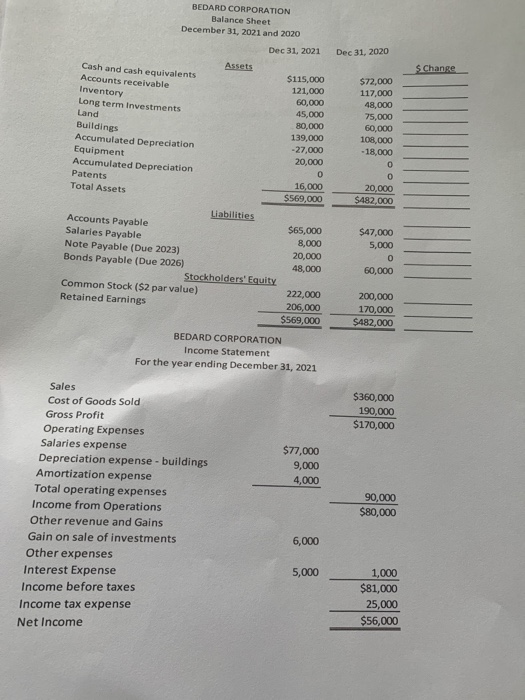

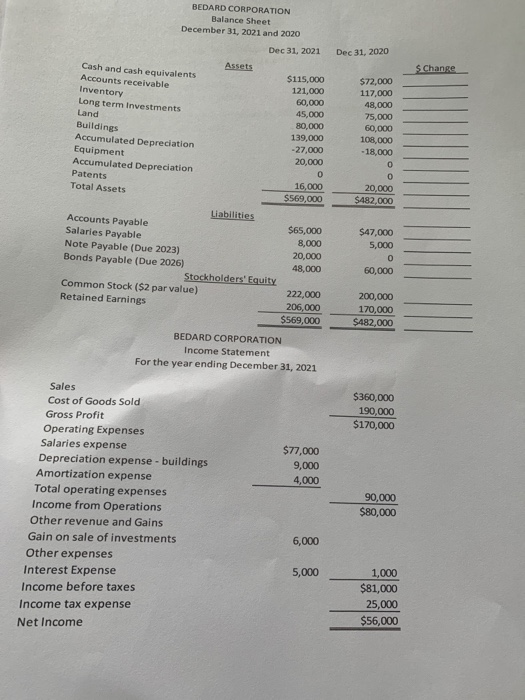

Dec 31, 2020 $ Change BEDARD CORPORATION Balance Sheet December 31, 2021 and 2020 Dec 31, 2021 Assets Cash and cash equivalents $115,000 Accounts receivable

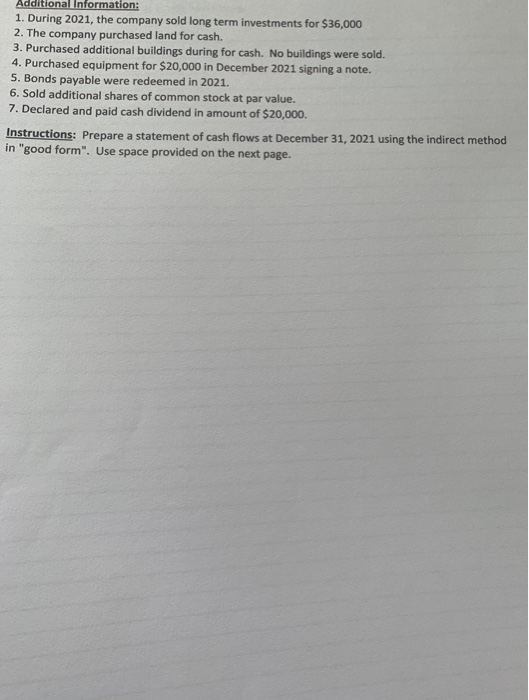

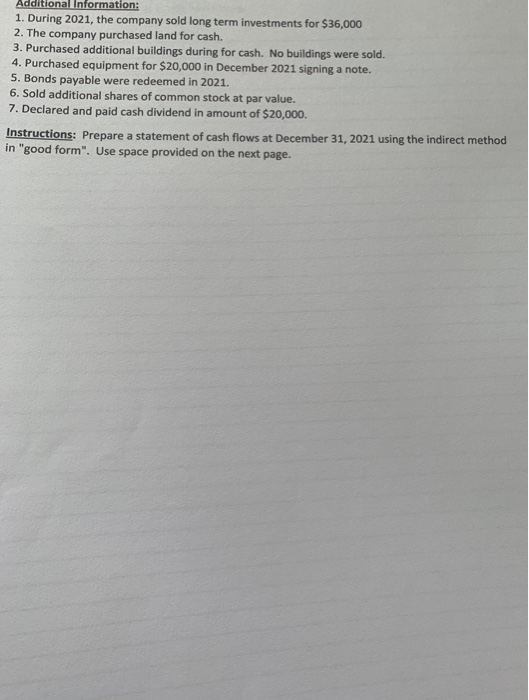

Dec 31, 2020 $ Change BEDARD CORPORATION Balance Sheet December 31, 2021 and 2020 Dec 31, 2021 Assets Cash and cash equivalents $115,000 Accounts receivable 121,000 Inventory 60,000 Long term Investments 45,000 Land 80,000 139,000 Accumulated Depreciation -27,000 Equipment 20,000 Accumulated Depreciation Patents 16,000 Total Assets $569,000 $72,000 117,000 48,000 75,000 60,000 108,000 -18,000 Buildings 20,000 $482.000 Liabilities Accounts Payable Salaries Payable Note Payable (Due 2023) Bonds Payable (Due 2026) Stockholders' Equity Common Stock ($2 par value) Retained Earnings $65,000 8,000 20,000 48,000 $47,000 5,000 0 60,000 222,000 206,000 200,000 170,000 $482,000 $569,000 BEDARD CORPORATION Income Statement For the year ending December 31, 2021 $360,000 190,000 $170,000 $77,000 9,000 4,000 Sales Cost of Goods Sold Gross Profit Operating Expenses Salaries expense Depreciation expense -buildings Amortization expense Total operating expenses Income from Operations Other revenue and Gains Gain on sale of investments Other expenses Interest Expense Income before taxes Income tax expense Net Income 90,000 $80,000 6,000 5,000 1,000 $81,000 25,000 $56,000 Additional Information: 1. During 2021, the company sold long term investments for $36,000 2. The company purchased land for cash. 3. Purchased additional buildings during for cash. No buildings were sold. 4. Purchased equipment for $20,000 in December 2021 signing a note. 5. Bonds payable were redeemed in 2021. 6. Sold additional shares of common stock at par value. 7. Declared and paid cash dividend in amount of $20,000. Instructions: Prepare a statement of cash flows at December 31, 2021 using the indirect method in "good form". Use space provided on the next page

Dec 31, 2020 $ Change BEDARD CORPORATION Balance Sheet December 31, 2021 and 2020 Dec 31, 2021 Assets Cash and cash equivalents $115,000 Accounts receivable 121,000 Inventory 60,000 Long term Investments 45,000 Land 80,000 139,000 Accumulated Depreciation -27,000 Equipment 20,000 Accumulated Depreciation Patents 16,000 Total Assets $569,000 $72,000 117,000 48,000 75,000 60,000 108,000 -18,000 Buildings 20,000 $482.000 Liabilities Accounts Payable Salaries Payable Note Payable (Due 2023) Bonds Payable (Due 2026) Stockholders' Equity Common Stock ($2 par value) Retained Earnings $65,000 8,000 20,000 48,000 $47,000 5,000 0 60,000 222,000 206,000 200,000 170,000 $482,000 $569,000 BEDARD CORPORATION Income Statement For the year ending December 31, 2021 $360,000 190,000 $170,000 $77,000 9,000 4,000 Sales Cost of Goods Sold Gross Profit Operating Expenses Salaries expense Depreciation expense -buildings Amortization expense Total operating expenses Income from Operations Other revenue and Gains Gain on sale of investments Other expenses Interest Expense Income before taxes Income tax expense Net Income 90,000 $80,000 6,000 5,000 1,000 $81,000 25,000 $56,000 Additional Information: 1. During 2021, the company sold long term investments for $36,000 2. The company purchased land for cash. 3. Purchased additional buildings during for cash. No buildings were sold. 4. Purchased equipment for $20,000 in December 2021 signing a note. 5. Bonds payable were redeemed in 2021. 6. Sold additional shares of common stock at par value. 7. Declared and paid cash dividend in amount of $20,000. Instructions: Prepare a statement of cash flows at December 31, 2021 using the indirect method in "good form". Use space provided on the next page

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started