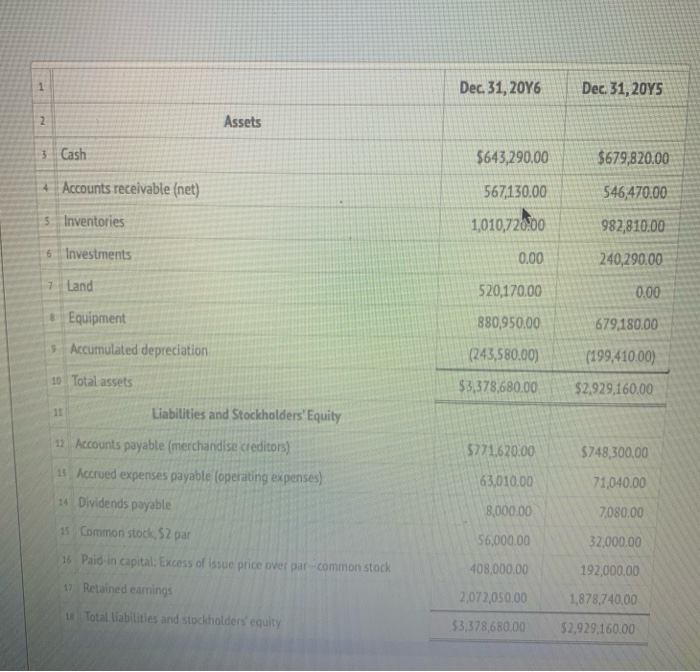

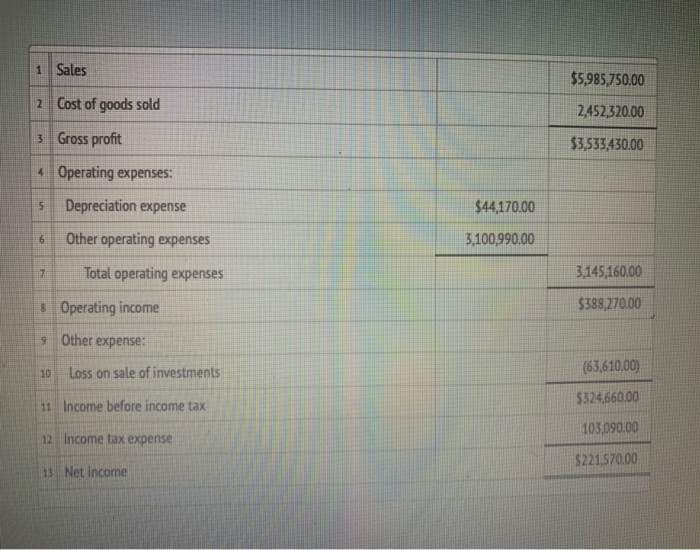

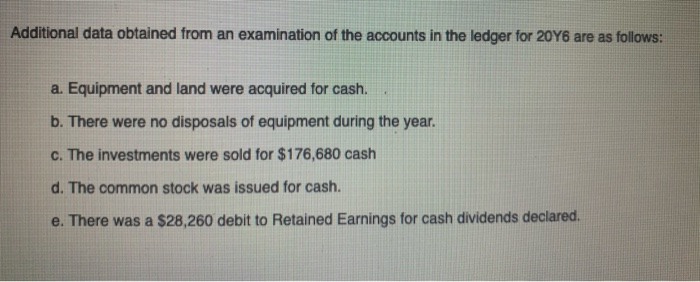

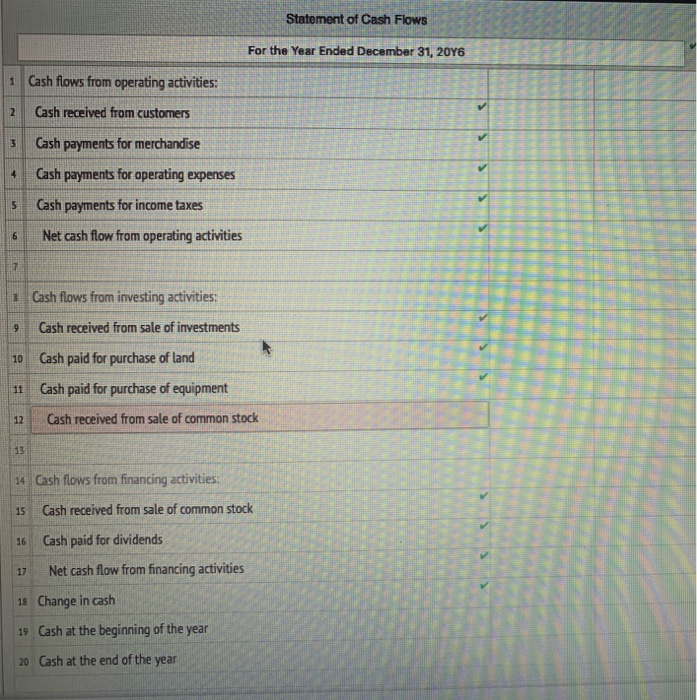

Dec. 31, 2046 Dec 31, 2045 Assets 3 Cash $643,290.00 $679,820.00 + Accounts receivable (net) 546,470.00 567,130.00 1,010,720.00 Inventories 982,810.00 6 Investments 0.00 240,290.00 7 Land 0.00 8 Equipment 679,180.00 520,170.00 880,950.00 (243,580.00) $3,378,680.00 9. Accumulated depreciation (199,410.00) $2,929,160.00 5271,620.00 $748,300,00 10 Total assets Liabilities and Stockholders' Equity 12 Accounts payable (merchandise creditors) 15 Accrued expenses payable (operating expenses) 14 Dividends payable 15 Common stock, 52 par 16 Paid-in capital: Excess of issue price over par-common stock 17 Retained earnings 71,040,00 63,010.00 8,000.00 56,000.00 408,000.00 2,072,050.00 $3,378,680.00 7,080.00 32,000.00 192,000.00 1,878,740,00 $2,929,160.00 11 Total liabilities and stockholders' equity Sales 2 Cost of goods sold $5,985,750.00 2,452,320.00 $3,533,430.00 3 Gross profit Operating expenses: Depreciation expense $44,170.00 Other operating expenses 3,100,990.00 Total operating expenses 3,145,160.00 $388,270.00 Operating income 9 Other expense: 10 Loss on sale of investments (63,610.00) | 11 Income before income tax 12 Income tax expense $324,660.00 103,090.00 $221,570.00 13 Net income Additional data obtained from an examination of the accounts in the ledger for 20Y6 are as follows: a. Equipment and land were acquired for cash. b. There were no disposals of equipment during the year. c. The investments were sold for $176,680 cash d. The common stock was issued for cash. e. There was a $28,260 debit to Retained Earnings for cash dividends declared. Statement of Cash Flows S For the Year Ended December 31, 2046 Cash flows from operating activities: Cash received from customers Cash payments for merchandise Cash payments for operating expenses Cash payments for income taxes Net cash flow from operating activities & 10 11 Cash flows from investing activities: Cash received from sale of investments Cash paid for purchase of land Cash paid for purchase of equipment Cash received from sale of common stock 14 15 16 17 Cash flows from financing activities: Cash received from sale of common stock Cash paid for dividends Net cash flow from financing activities 18 Change in cash 19 Cash at the beginning of the year 20 Cash at the end of the year