Answered step by step

Verified Expert Solution

Question

1 Approved Answer

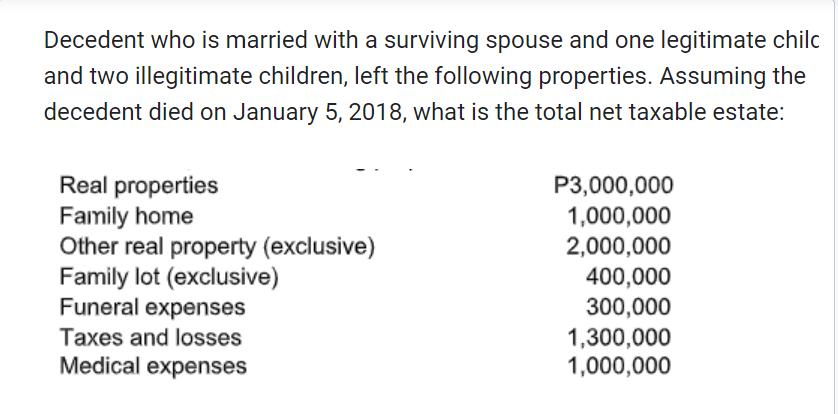

Decedent who is married with a surviving spouse and one legitimate chilc and two illegitimate children, left the following properties. Assuming the decedent died

Decedent who is married with a surviving spouse and one legitimate chilc and two illegitimate children, left the following properties. Assuming the decedent died on January 5, 2018, what is the total net taxable estate: Real properties Family home Other real property (exclusive) Family lot (exclusive) Funeral expenses Taxes and losses Medical expenses P3,000,000 1,000,000 2,000,000 400,000 300,000 1,300,000 1,000,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the total net taxable estate we need to consider the deductions allowed by the Philippi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started