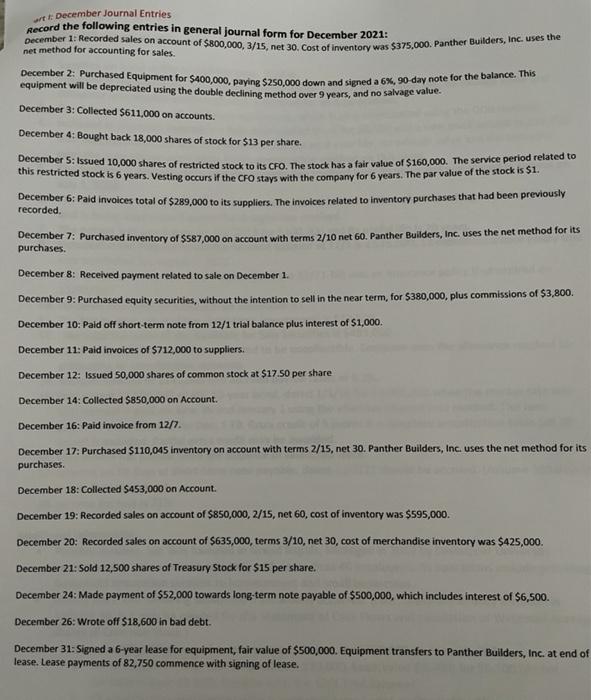

December 1: Recorded sales on account of $800,000, 3/15, net 30. Cost of inventory was $375.000. Panther Builders, Inc. uses the December 5: Issued 10,000 shares of restricted stock to its CFO. The stock has a fair value of $160,000. The service period related to artt December Journal Entries Record the following entries in general journal form for December 2021: method for accounting for sales December 2: Purchased Equipment for S400,000, paying $250,000 down and signed a 6%, 90 day note for the balance. This equipment will be depreciated using the double declining method over 9 years, and no salvage value. December 3: Collected $611,000 on accounts. December 4: Bought back 18,000 shares of stock for $13 per share. this restricted stock is 6 years. Vesting occurs if the CFO stays with the company for 6 years. The par value of the stock is $1. December 6: Paid Invoices total of $289,000 to its suppliers. The invoices related to inventory purchases that had been previously recorded December 7: Purchased inventory of $587,000 on account with terms 2/10 net 60. Panther Builders, Inc. uses the net method for its purchases. December 8: Received payment related to sale on December 1. December 9: Purchased equity Securities, without the intention to sell in the near term, for $380,000, plus commissions of $3,800. December 10: Paid off short-term note from 12/1 trial balance plus interest of $1,000. December 11: Paid invoices of $712,000 to suppliers. December 12: Issued 50,000 shares of common stock at $17.50 per share December 14: Collected $850,000 on Account December 16: Paid invoice from 12/7. December 17: Purchased $110,045 inventory on account with terms 2/15, net 30. Panther Builders, Inc. uses the net method for its purchases. December 18: Collected $453,000 on Account December 19: Recorded sales on account of $850,000, 2/15, net 60, cost of inventory was $595,000 December 20: Recorded sales on account of $635,000, terms 3/10, net 30, cost of merchandise inventory was $425,000. December 21: Sold 12,500 shares of Treasury Stock for $15 per share. December 24: Made payment of $52,000 towards long-term note payable of $500,000, which includes interest of $6,500. December 26: Wrote off $18,600 in bad debt. December 31: Signed a 6-year lease for equipment, fair value of $500,000. Equipment transfers to Panther Builders, Inc. at end of lease. Lease payments of 82,750 commence with signing of lease