Question

December 14 A special payroll needs to be completed to process Russell's final paycheck made payable to the Estate of Virginia A. Russell. This check

December 14

A special payroll needs to be completed to process Russell's final paycheck made payable to the Estate of Virginia A. Russell.

This check covers Russell's work for the weeks ending December 5 and 12 ($1,134.00) plus her accrued vacation pay ($1,260.00). Do not show the vacation hours in the Time Record columns on the payroll register, but include them in the Regular Earnings column.

Russell's final biweekly pay is subject to FICA, FUTA, and SUTA. This final pay is not subject to FIT, SIT, or CIT. Since Russell's cumulative earnings have surpassed the taxable earnings figures for FUTA and SUTA, there will not be any unemployment tax on the employer.

The deduction for group insurance is $14.70 [($49,000/$1,000) $.30].

Make a notation of Russell's death on the Payroll Register and her Employee's Earnings Record.

all the entries for the special pay; post to the General Ledger accounts and Employees' Earnings Records.

complete:

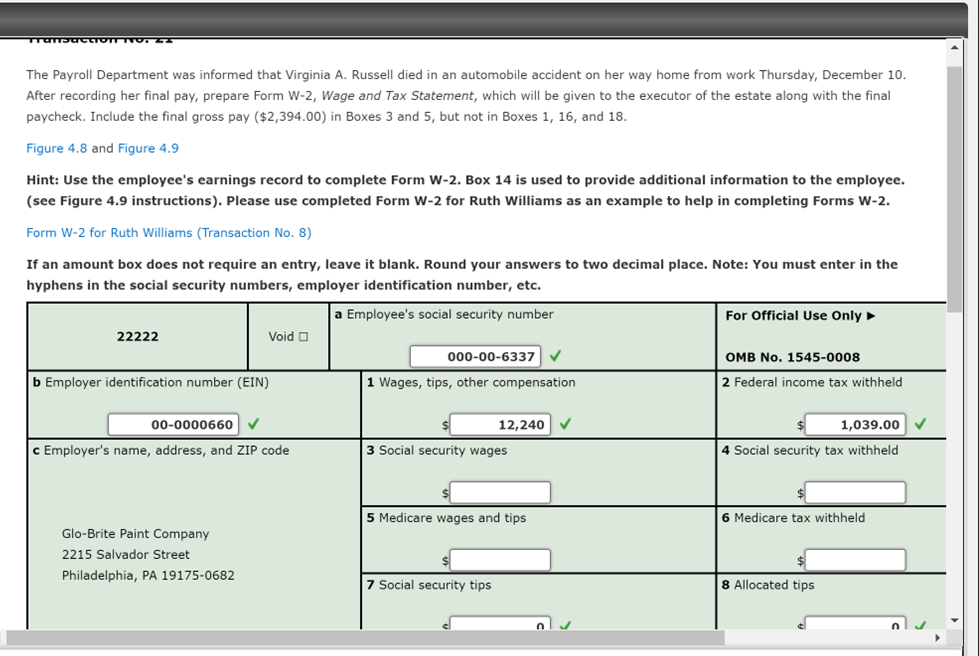

Form W-2 (Transaction No. 21): Include the final gross pay in Boxes 3 and 5, but not in Boxes 1, 16, and 18. This Form W-2 will be given to the executor of the estate along with the final paycheck. Russell's address is 8004 Dowling Road, Philadelphia, PA 19135-9001.

The Payroll Department was informed that Virginia A. Russell died in an automobile accident on her way home from work Thursday, December 10. After recording her final pay, prepare Form W-2, Wage and Tax Statement, which will be given to the executor of the estate along with the final paycheck. Include the final gross pay ($2,394.00) in Boxes 3 and 5 , but not in Boxes 1, 16, and 18 . Figure 4.8 and Figure 4.9 Hint: Use the employee's earnings record to complete Form W-2. Box 14 is used to provide additional information to the employee. (see Figure 4.9 instructions). Please use completed Form W-2 for Ruth Williams as an example to help in completing Forms W-2. Form W-2 for Ruth Williams (Transaction No. 8) If an amount box does not require an entry, leave it blank. Round your answers to two decimal place. Note: You must enter in the hyphens in the social security numbers, employer identification number, etc

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started